Reminder: Sabrient is available to chat with Members, comments are found below each post.

DARK HORSE HEDGE – Sitting on the Dock of the Bay

By Scott at Sabrient and Ilene at Phil’s Stock World

So I'm just gonna sit on the dock of the bay

Watching the tide roll away

Ooo, I'm sittin' on the dock of the bay

Wastin' timeBy Otis Redding and Steve Cropper, On the Dock of the Bay

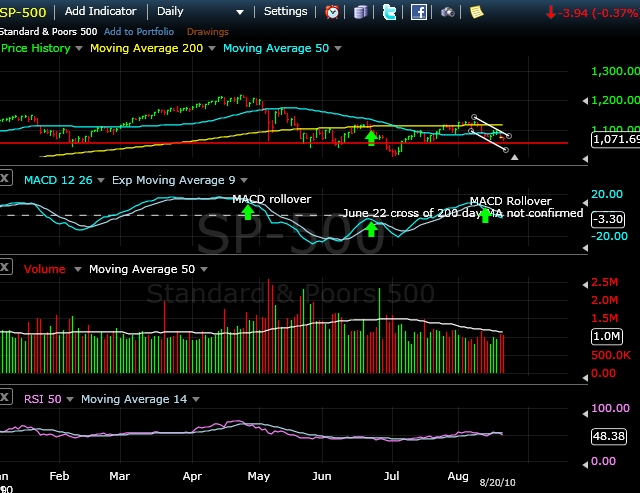

Heading into the week of August 23, 2010, the market is digesting another week of worse than expected data. The Philly Fed figure of -7.7 versus the expected +8 on Thursday, against a backdrop of 500,000 pink slips being handed out, was brutal. The data added fuel to the fire on our Road to Nowhere. When the dust settled on Friday after August options expired, the S&P 500 was sitting at 1071 and our market trend indicators were all pointing south. The MACD 12-26-9 has clearly crossed the bearish signal line at -3.3 and the RSI 14 day is back under 50 at 48.38 (chart below).

We covered many of the DHH Long positions by writing call options, which provided an advance net SHORT tilt in anticipation of the recent downward move in the market. Currently, our virtual DHH virtual portfolio is holding 8 SHORT positions (7.5% each) and 9 LONG (7.5% each). We covered our 9th Short position, HUSA, on Friday. After shorting a new stock on Monday morning, we will have the same number of Long and Short positions. The long positions are leveraged against the short positions which provides additional cash into our virtual equities account. Although we will have the same number of Longs and Shorts, we are tilted short because we sold calls against seven of the long positions. We also sold puts against three of these hedged Long positions, which makes them more bullish than bearish. However, we have the advantage of having sold premium for both the calls and puts.

At the open on Monday morning, we will add another SHORT position to replace HUSA.

Sell SHORT ComScore, Inc. (SCOR) at the open Monday, August 23, 2010

ComScore, Inc. (SCOR) provides a digital marketing intelligence platform that enables customers to make informed business decisions and implement digital business strategies. SCOR ranks #11 at the bottom of the Sabrient VCU rankings and it has a strong sell rating. The closing price on Friday of $18 gives SCOR a P/E of 130.

Generally we don't pay a lot of attention to insider selling because there are many reasons for selling that are unrelated to the company's business prospects. However SCOR catches our eye with 37 different automatic sales over the last 6 months from multiple officers of the company. These automated sales were at prices higher than the stock is trading today. Because the sales were automated, they will likely continue in the near future. This could be designed to be part of the executive compensation packages, but we don't view the practice of automated open market sells as particularly confidence-building. Institutional shares held have dropped 41% in the previous quarter adding to our feeling that SCOR is overvalued and that DHH should join them in the selling parade.

As always, we will continue to monitor market trends and make recommendations as we go.

Chart by FreeStockCharts.com

Insider selling table from Insider Cow: