Happy Thursday to all. The market is looking interesting today. We have some solid drop in the unemployment claims that was below expectations. Yet, the market is not reacting heavily to it. That may be because of the rise yesterday, and also, we have pending home sales at 10 AM that may actually drop year-over-year. Additionally, retail sales came out looking pretty well in the month of August. Today, it may be a show me what you got sort of day with the market not moving in either direction too strongly. Yesterday, we did not enter any new positions and got out of an Overnight Trade in Donaldson Company (DCI) for no gain at 2.20. The big story, yesterday, was our August results were in for our virtual portfolios. We had a 5% gain in the Buy Virtual Portfolio and a 10% gain in the Short Sale Virtual Portfolio. Both virtual portfolios continue to improve with a 62% improvement for the year on the Buy and 21% improvement on the Short. You can read the full story and check out the statistics here.

Happy Thursday to all. The market is looking interesting today. We have some solid drop in the unemployment claims that was below expectations. Yet, the market is not reacting heavily to it. That may be because of the rise yesterday, and also, we have pending home sales at 10 AM that may actually drop year-over-year. Additionally, retail sales came out looking pretty well in the month of August. Today, it may be a show me what you got sort of day with the market not moving in either direction too strongly. Yesterday, we did not enter any new positions and got out of an Overnight Trade in Donaldson Company (DCI) for no gain at 2.20. The big story, yesterday, was our August results were in for our virtual portfolios. We had a 5% gain in the Buy Virtual Portfolio and a 10% gain in the Short Sale Virtual Portfolio. Both virtual portfolios continue to improve with a 62% improvement for the year on the Buy and 21% improvement on the Short. You can read the full story and check out the statistics here.

Let’s get into some plays…

Buy of the Day: Limited Brands Inc. (LTD)

Analysis: August retail sales are actually the gem of the morning so far. Retailers across the country are reporting very solid gains for the final month of the summer and the back to school season. Most retailers positive gains were spurred by discounting, but it was of the best positive economic data points we have seen in quite some time. One company that may have been the golden goose among the flock was Limited Brands Inc. (LTD). The company reported same-store sales in August rose a solid 10%. Expectations were that sales would rise just over 7%.

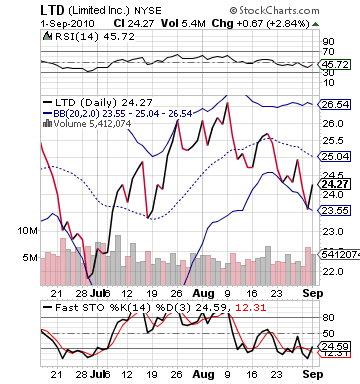

Limited has been one of the strong recoveries in the retail sector along with some of the top of the line names. The company saw significant growth in Q2 of 2010 with a solid quarter from its flagship Victoria’s Secret line. The story appears to be continuing into August. Recently, though, LTD has taken quite a hit to its share price. Since announcing their earnings on August 19th, the company has seen a 7% drop in share price and is sitting right at its lower bollinger band.

Today’s news of retail and unemployment claims appears to be giving the market a small gain. Futures were down before the unemployment claims and same-store sales reports. Now, futures are sitting up slightly in the green and continue to gain. The real test of whether the day will end green or red is based on pending home sales at 10 AM. I am hoping that the retail sales and retail companies can become somewhat adverse to these numbers. Limited should be able to make some strong movement upwards on financials and technicals.

Technically, LTD is in a perfect position to rise. The stock is just off its lower bollinger band and sitting below its 50-day moving average. It only needs to gain fifteen to twenty cents to break through that barrier. From there, it has tons of room to the upside. Fast stochastics are in the oversold category, but they are separating and look ready to move higher, and the stock has a very low valuation on RSI. With today’s very solid news, the outlook is bright on LTD.

We want to get involved right at the start.

Entry: We are looking to enter the stock at 24.30 – 24.50.

Exit: We are looking to exit LTD for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: KB Homes Inc. (KBH)

Analysis: KB Homes has been quite a nice stock as of late. In the past week and a half, the stock has put on 15% in gains. The company has risen ever since learning that existing home sales had fallen 27% in July. The stock got a boost from some great news out of Toll Brothers’ earnings report for their latest quarter and the fact that home prices are  rising. Additionally, the stock received news yesterday that they ended their SEC investigation into the company with no punishment. This sent stocks soaring 11% yesterday. Overall, it has been a great week and a half for the stock.

rising. Additionally, the stock received news yesterday that they ended their SEC investigation into the company with no punishment. This sent stocks soaring 11% yesterday. Overall, it has been a great week and a half for the stock.

That will all probably end today. I am not bullish at all on pending home sales at 10 AM today. The estimates are for a neutral reading from one year ago – no gain or loss in pending home sales. This is up from a -2.60% loss one month ago. I don’t think a positive reading will occur. I am not sure it will matter too greatly because I think a 2-3% gain can be expected within the first thirty minutes of trading this morning. I think that the home sector has had a great run over the past two weeks of trading, but it is a false rise. This is a market that is still very far from any truly exciting news.

The false run up should end today, and the technicals point to KBH to lead the way. The stock broke into its upper bollinger band yesterday and has actually become overbought. It is the first time since the end of July that the stock has consistent overbought results. The stock is also now over 50 on RSI. Basically, the gains have been made, and this stock is a trader’s delight. A short squeeze occurred yesterday, and traders will take gains today. Short interest will start again today. I think we see a small pop to start the morning followed by a dry up in demand and oversupply of sell orders, dropping the price.

Get in after a small rise.

Entry: We are looking to enter at 11.50 – 11.60.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau