Wheee, that was fun!

We're already back in our range after all that hand-wringing last week. I like to do these perspective charts once in a while even though I'm not much of a chart guy. It's funny how people lose their minds over what was clearly a minor dip so far – never even coming close to threatening our 5% rule, which is the only way we're likely to give up hope.

Our next big challenge is getting over the 1,088 Fibonacci line but after that we should have a clear shot to retaking 1,100. Nobody expects good jobs numbers today but more than 460,000 lay-offs in this morning's report will probably keep us on hold through tomorrow's NFP report at least. Notice how yesterday's fat-body candle was as big as any of our recent big drops – that means the bears are as freaked out about yesterday's action as the bulls were about the flash-crash and there's a lot of bears out there – crossing that 1,100 line this week could lead to a pretty good short-squeeze into the weekend.

As I had mentioned way back on May 5th, our expected downtrend along the 5% rule was 1,155, 1,114, 1,100, 1,073 and 1,045. Now we just have to work our way back up that ladder! Since earnings were not as exciting as we had hoped, our expected mid-point on the S&P has since dropped from 1,100 to 1,070, which alters (lowers) our expectations slightly but not too much from a long-term standpoint and there hasn't been a need to adjust our long-term positions as we hit our buy point on the nose at 1,045 and, of course, we have our hedges.

Speaking of hedges, on August 25th, with the S&P down at 1,045, we looked at Disaster Hedges that could make 500% if the market falls. The idea is to take 2% of your virtual portfolio value in a play that makes 10% if the market falls 5% or more as insurance. We do this so we DON'T have to panic out of positions at an inflection point.

Some people take them right off if we hold our levels and some people use our 1,070 and 10,200 lines (both passed yesterday, of course) as a signal to take them off and some don't mind the carrying cost of insurance but let's look at the damages if we had done nothing while the Dow jumped over 250 points yesterday: The DXD Jan $27/32 bull call spread was $1.60 and the October $27 puts were sold for $1.20 for net .40 on the $6 spread with 1,400% of upside if DXD hit $32 (it was $28.50 at the time and is now $27.20).

Some people take them right off if we hold our levels and some people use our 1,070 and 10,200 lines (both passed yesterday, of course) as a signal to take them off and some don't mind the carrying cost of insurance but let's look at the damages if we had done nothing while the Dow jumped over 250 points yesterday: The DXD Jan $27/32 bull call spread was $1.60 and the October $27 puts were sold for $1.20 for net .40 on the $6 spread with 1,400% of upside if DXD hit $32 (it was $28.50 at the time and is now $27.20).

So what are the damages on this "wrong-way" insurance play? The Jan $27 calls are now $3.30 and the Jan $32 calls are $2.10 so $1.20 on that spread and the Oct $27 puts are .75 so .45 on the total spread. It made a nickel – even though the market went way up! Meanwhile, the stocks we protected but didn't sell made 2-3% so VERY NICE. How is that possible? Because we mostly sold premium and selling premium is GOOD. At PSW we teach you to BE THE HOUSE and sell risk, don't buy it. We made money off people who were betting that DXD would fly to $32 and from people who thought it would drop below $27 and, since it has done neither, the time decay on the trade becomes our best friend and pays us a profit EVERY SINGLE DAY.

When you learn how to manage your virtual portfolio using this kind of leverage, you will also learn that we can take our hedge off with a nice profit because THERE IS ALWAYS ANOTHER ONE. As PT Barnum told us, there is a sucker born every minute and I will add "and those suckers buy options from us." When Barnum made his statement, there were only about 1Bn people in the World so, taking into account the population growth, there are now 8,640 brand new suckers born every single day and that's why I can happily tell you our "secret" system for hedging – just like I have been telling people about our 3am Yen trade for over 2 years now and STILL it works almost every day.

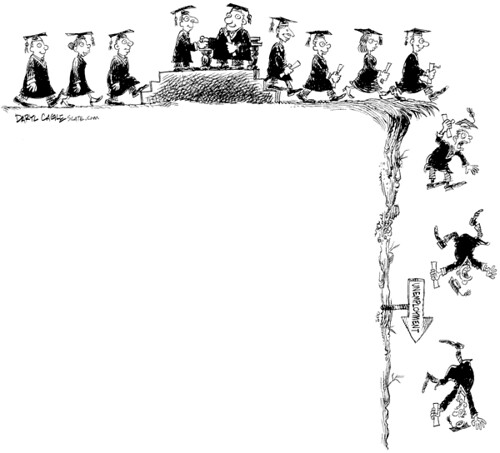

Everything else is just timing and we just try to be right a little more often than we're wrong to stay ahead of the markets. It's 9am now and the Unemployment Report came in at 472,000 jobs lost last week. That's 0.3% of the workforce (1 in 300) getting a pink slip in a week. 52 more of those and you have a 1 in 6 chance of losing your job in the next year – not so bad really. The problem is getting another one, not losing the ones we have.

Everything else is just timing and we just try to be right a little more often than we're wrong to stay ahead of the markets. It's 9am now and the Unemployment Report came in at 472,000 jobs lost last week. That's 0.3% of the workforce (1 in 300) getting a pink slip in a week. 52 more of those and you have a 1 in 6 chance of losing your job in the next year – not so bad really. The problem is getting another one, not losing the ones we have.

Hopefully, the Government will wake up and start spending some money to create jobs. As jobs have a 1.8x multiplier effect on the economy and since the government is spending about 0.4x to sustain each unemployed person anyway – it is irrational not to spend money to create jobs. Spending 0.6x more than they are spending now to sustain the unemployed is a +2.2x return for each job created. This is not complicated folks, all the rhetoric is nothing but political BS by people who want government handouts (defense contracts, tax breaks, bailouts) to go to them rather than the people who actually need it, even though it is CLEARLY better for America to put our people back to work. Let's stop the madness, please!

The American consumers (the ones who have jobs, anyway) are doing their best to chip in – if you give them jobs, the will spend, and turn into customers for others – this is a simple concept, isn't it? August same-store sales are coming in better than expected in the early going, with companies like COST, LTD and BKE beating modest expectations. COST posted a 5% rise in same-store sales when a 3.6% gain was expected. The retailer's international operations were up 11%, compared with a 6% rise in the U.S. Limited Brands, which owned Victoria's Secret and Bath & Body Works, posted a 10% rise in same-store sales when a 7.3% gain was projected. All told, the 30 retailers tracked by Thomson Reuters are expected to post same-store sales growth of 2.5% for August, after a 2.9% drop last year and a 2.7% rise in July.

One very encouraging report this morning is Productivity falling 1.8%, more than expected. That has driven Unit Labor costs up 1.1% in Q2 and that is bad for corporate profits but good for America as it means they have finally squeezed everything they could out of the existing workforce and now they MUST begin to hire – providing buisiness picks up, of course. We'll get an idea of whether business is picking up with July Factory Orders at 10 and any positive move there will keep the markets happy. We will also see Pending Home Sales but those are expected down 1% and it will be hard to be disappointed by housing data at this point.

Tomorrow it's all about Non-Farm Payrolls. Are we creating any jobs at all? If not, then it's up to the Government to do so – THAT'S WHAT GOVERNMENTS ARE FOR! Remember the bible story where Joseph tells Pharaoh to save grain in times of plenty so the Pharaoh's Government can feed the people in times of famine? How do you think they got the grain? TAXES? That's right, it's in the friggin' bible – taxes are the way wise men manage the economy and the government collects taxes in times of plenty and then REDISTRIBUTES THE WEALTH in times of need. What amazes me is how this country seems to have gotten that backwards as the last Administration cut taxes when things were good and now the Conservatives refuse to redistribute the wealth in times of need – this is something we've been taught is wrong since the first sermon we heard when we were children – how has this nation gone so far off course?