Hey all. Hope you had a fantastic weekend. I am extremely sick and was trying to catch up on some zzz’s this morning. I have a Play of the Week on the way in which we want to get involved. As for our current positions, we only have one open right now. We are involved with Lennar Corp. as a Medium Term Short Sale. The stock got down to some small gains from our averaged entry of 14.64, but it has swung back up to about a 1% loss for us today. We are continuing to hold. Since we made the pick, we have had two days in the green, which have made it hard for this to be a winner.

open right now. We are involved with Lennar Corp. as a Medium Term Short Sale. The stock got down to some small gains from our averaged entry of 14.64, but it has swung back up to about a 1% loss for us today. We are continuing to hold. Since we made the pick, we have had two days in the green, which have made it hard for this to be a winner.

Let’s get into this week’s Play of the Week…(market timing indicator to the right)

Play of the Week: Savient Pharmaceuticals Inc. (SVNT)

Analysis: This recommendation was tipped to me in house, and I have to thank Cslanson2 for this one. Savient Pharmaceuticals, tomorrow, will be receiving the announcement of whether or not they are receiving FDA approval for their drug called Krystexxa. The drug was approved once before, but Savient had to change their manufacturing of the drug and now must get reapproved.

The reapproval seems like it should be able to happen. The original drug got a 14-1 approval, and the company just needs to be able to prove that the newly manufactured drug can produce the same results. They had a year to prove that to the FDA  and now will receive word of approval or disapproval either this evening, tomorrow, or tomorrow evening. While the FDA is anything but a sure thing, Savient could be ready for some major movement upon approval. The stock has a nice run up into the announcement tomorrow, and the stock has moved a nice 5% over the past two weeks.

and now will receive word of approval or disapproval either this evening, tomorrow, or tomorrow evening. While the FDA is anything but a sure thing, Savient could be ready for some major movement upon approval. The stock has a nice run up into the announcement tomorrow, and the stock has moved a nice 5% over the past two weeks.

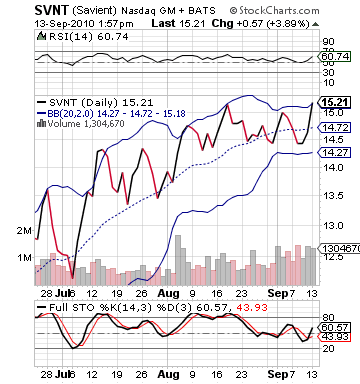

If the drug does get approval, it would be a very nice week for SVNT. The stock is in a breakout scheme. The stock has seen its bollinger bands shrink, and the stock has just hit its upper bollinger band. How high it could breakout is definitely a question. A testing of the 17-18 range is definitely possible for this one, but it all depends upon approval.

Krystexxa is a series of drugs and injections that is used to help with chronic gout. Gout is a crystallization of uric acid in nerves and joints that is extremely painful. The drug is an injection that is taken every two weeks. There are around 50,000 chronic gout sufferers. The pool of possible consumers therefore is small compared to typical drugs, so the longterm benefits are strong but not as strong as other drugs. That is why a huge gain may not be in order compared to a gain that could give us at least 5-6%.

The technicals on the stock are sort of mute besides the narrowing bands. The stock appears overvalued on RSI with its recent movement, but it is fundamentally justified. Further, those bands will spread apart very quickly after approval and a giant leap. The stochastics, interestingly, show only a slight overbought trend, which would tend to suggest that a lot of buyers are still on the sidelines and don’t want to take the risk. These long termers are what will add a lot of demand to the mix and help drive the stock price upwards.

giant leap. The stochastics, interestingly, show only a slight overbought trend, which would tend to suggest that a lot of buyers are still on the sidelines and don’t want to take the risk. These long termers are what will add a lot of demand to the mix and help drive the stock price upwards.

We want to take the risk and get in today because the company seems to have a very strong shot at being able to get approved. To get approval the company only needed to address production issues, and if they did that, then they should see approval. I cannot imagine the company could not complete this task.

Entry: We are looking to enter SVNT at 15.05 – 15.20.

Exit: We are looking to exit SVNT on a 4-6% gain or sell off if company does not get FDA approval.

Stop Loss: 5% on bottom.

Good Investing,

David Ristau