Profile: Skechers USA Inc., founded in 1992, is a footwear retail company that designs, develops, and distributes their own shoes under the Skechers brand name. The company offers shoes in the casual, athletic, slip-on, fashion, and working line. The company distributes its shoes to department stores, specialty stores, boutiques, and other retailers. Additionally, the company operates ninety concept stores, 92 factory outlet stores, and 37 warehouse outlet stores. The company has  international presence in Asia and Europe. The company is headquartered in Manhattan Beach, CA.

international presence in Asia and Europe. The company is headquartered in Manhattan Beach, CA.

Thesis

With its recent success of the Shape-Up toning shoes, Skechers USA Inc. (SKX) has reentered the footwear picture as a company that has some potential. The company is set to have its best FY in 2010 among the wildly popular shoes that are supposed to help individuals lose weight while they walk. The shoes are designed with a sole that is curved that makes standing and walking more strenuous than a normal flat sole. With how busy Americans are, the line has become wildly popular as an alternative to exercise or an auxiliary to a work out routine.

In one year, the stock has increased, to date, 30% and as much as 160% in the 52-week period. The reason behind the success is Skechers is about to have its best FY to date. The company is projected to earn just over $2 billion while in 2009 the company earned $1.4 billion in revenue. Yet with all this success, the long term potential of the company comes into question.

For one, are the Shape-Ups or toning shoe category a long term option. Speculation that the actual ability of the shoes was not quite up to the marketing that toning shoes companies have been releasing has recently been confirmed. NPR did a report on the shoes and pointed out that two studies done by the American Council on Exercise have both proved that the toning shoes add no additional benefit of a regular shoe. If the shoes lose legitimacy in their claim to actually be more beneficial than a regular shoe, Skechers would definitely lose a key angle that is acting to its advantage. One positive point on the shoes is that the American Podiatric Medical Association has commented that the shoes have significant value and are great for the health of the foot.

beneficial than a regular shoe, Skechers would definitely lose a key angle that is acting to its advantage. One positive point on the shoes is that the American Podiatric Medical Association has commented that the shoes have significant value and are great for the health of the foot.

Skechers comments that they have received 12,000 positive reviews of their shoes and have conducted extensive research on the issue. When it comes down to it, the real review is the consumer. Do they feel like they are improving? Even if it is all mental, it is good for Skechers. So far, it appears the answer is yes.

Even if the company can maintain its advantage as a viable alternative to regular shoes, we must remember the cyclical nature of shoes. At one point, no one would have ever thought that Crocs would ever run awry with popularity. Style and sense of mind changes in the American consumer. The Shape Ups much like any other fashion trend are just that a trend. Whether or not Skechers can leverage this opportunity to create a solid niche and brand recognition is still to be seen.

One positive is that the company is introducing new lines that are more aesthetically pleasing and are more advanced than the first model. The production of new lines and creating lines that continue to be more pleasing to the eye are crucial to the success of Skechers’ Shape-Ups. The fad, though, lasting much past 2012 will be definitely tough to manage. The company will need to leverage this opportunity into helping the brand image in order to maintain its success. Otherwise it will lose P/E and valuation past 2012 and not be able to maintain stock prices at their current and future levels.

Additionally, the company is getting the athletic world behind it. Already Joe Montana has been a spokesperson for the shoe. Upcoming, Kareem Abdul-Jabbar, Wayne Gretzky, Evander Holyfield, and Karl Malone are all supposed to become .png) spokesmen for the company. Adding legitimacy through veterans like these men is definitely a great positive for the company. If they could add some more female spokespersons then the company would definitely helps its marketing scheme.

spokesmen for the company. Adding legitimacy through veterans like these men is definitely a great positive for the company. If they could add some more female spokespersons then the company would definitely helps its marketing scheme.

Financially, the company poses some initial risks when digging into the balance sheet, income statement, and cash flow statement. the company has not in the past been consistent in producing free cash flow and has never dealt with such high amounts of orders and popularity. Some fears are whether the company will be able to have as strong of inventory turnover and deal with such drastically larger amounts of shipments. Looking at a growing company, one key metric is that we want to see accounts receivable and inventory staying close to sales. In the past year, the company has seen its A/R grow 57% and its inventory grow 14%. The company’s sales have risen 60%. One issue that I see is that the company is taking on too much A/R and not increasing its inventory great enough to match its A/R. If the company cannot up its inventory, there is fear they will face order cancellations.

One positive is that the company has increased its gross margins each year for the past three years to the current TTM, increasing from 41% to 47%. The company also is very well off in the financial health categories. The company has less than 2% of its liabilities as long-term debt. The company’s net debt is a positive because they have more cash on hand than short-term and long-term debt. Inventory turnover has increased from 2009 to the TTM, which is not a good sign of efficiency.

The company also faces risk from its mounting competition. The company has been helped by the fact that Nike has decided not to enter the picture. Reebok is already marketing their own shape up, and Adidas is supposed to be designing their own type of toner. Skechers has been able to gain the brand recognition with toning shoes, but the competition coming from established brands like Reebox and Adidas could slim down sales to a point. The company has built a small economic moat with the shoe, but that moat could dry up very fast if these shoes lose value or popularity.

The risks are definitely high with Skechers. The company has financial isses on the balance sheet, low free cash flow, stiff competition, a cyclical success, and mounting issues of whether their shoes are even beneficial. The company definitely has some potential, but the highs the company saw earlier in 2010 could be the height of this phase of success for Skechers.

Valuation

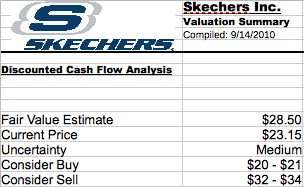

The Oxen Group’s fair value estimate for Skechers is $28.50 per share based on a discounted cash-flow analysis. The company has seen in the past year, but the future ability for sustained growth versus a cyclical high are very real for Skechers. The risk of the company seem to outweigh speculative nature of the company, and unless the stock can move back another 10-15% from its current levels, it does not present a significant play. The company should see growth in operating income through 2011, but after that point, much more growth presents significant hurdles. Estimated available cash flow starts at $82 million for this year and ends at $49 million in 2015. The company has a WACC at 8.0%.

company has seen in the past year, but the future ability for sustained growth versus a cyclical high are very real for Skechers. The risk of the company seem to outweigh speculative nature of the company, and unless the stock can move back another 10-15% from its current levels, it does not present a significant play. The company should see growth in operating income through 2011, but after that point, much more growth presents significant hurdles. Estimated available cash flow starts at $82 million for this year and ends at $49 million in 2015. The company has a WACC at 8.0%.

The stock is a buy in the range of $20 – $21 and a sell in the range of $32 – $34.

Risk

Risk is medium to medium-high with Skechers. The company, in the last year has been able to gain its fifteen minutes as a leader in the toning footwear industry. The question and risk comes from the fact that no one knows if toning shoes are the next Crocs or the next Birkenstock. The company has risk associated with its financial statements and will need to do a better job of building inventory to match A/R. Additionally, the company has not diversified itself well enough into foreign markets.