TGIF! Hope everyone had a good week. It has been another seemingly successful week with The Oxen Report. We end this week with the sad news of Heidi Klum’s departure from Victoria’s Secret. In fact, Limited is trading down 3% this morning in honor of her. Yesterday, we got out of Worthington Industries at the open for a solid 6% gain. Additionally, we opened a new position in a Midterm Trade in Mosaic Co. (MOS). Mosaic looks poised for a rise on what could be its potentially best quarter of all-time. We entered the stock at 58.35, and we are looking to exit at a minimum of a 3% gain or 60.10. The stock is looking to open in the mid-59s.

TGIF! Hope everyone had a good week. It has been another seemingly successful week with The Oxen Report. We end this week with the sad news of Heidi Klum’s departure from Victoria’s Secret. In fact, Limited is trading down 3% this morning in honor of her. Yesterday, we got out of Worthington Industries at the open for a solid 6% gain. Additionally, we opened a new position in a Midterm Trade in Mosaic Co. (MOS). Mosaic looks poised for a rise on what could be its potentially best quarter of all-time. We entered the stock at 58.35, and we are looking to exit at a minimum of a 3% gain or 60.10. The stock is looking to open in the mid-59s.

Let’s get into today’s plays…

Buy Pick of the Day: Direxion Daily Financial Bull 3x ETF (FAS)

Analysis: After the market took a couple days to stub its toes, things are looking quite positive to end the week. Personal spending and personal income were higher than expected, and the market is set up to rally. A number of stocks and ETFs have given up some of their gains and overvaluations, and they are in a position to move back up. One sector that probably took one of the biggest hits over the past couple days was the financial sector. Over the past few sessions, Direxion’s Daily Financial Bull ETF has given up nearly 5%.

Today, though, things are looking quite different. The positive economic news and great day in China is setting the markets to open higher, but they should continue to move higher from there. The positive news was the first in several days, and it should help propel the markets. Even without good news, the red days were soft, and many ended with rallies into the green or saw.png) some rally throughout the day.

some rally throughout the day.

In addition to the strong market, the financial industry got positive news that foreclosures are slowing, and the government successfully sold $2.25 billion worth of Citi (C) stock. Most of the money center banks and regional banks are all in the green to start the day, and they look ready to help lead the market higher.

A final positive sign is that futures continue to creep a bit higher but not too high. The Dow is set to open around 50 points in the green, which is a very solid amount. Not too much but enough to get the market over the hump. FAS, technically, looks very solid. It has upward movement to its upper bollinger band up to around 24, and it is not overbought or overvalued.

Get in early!

Entry: We are looking to enter at 21.60 – 21.80.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

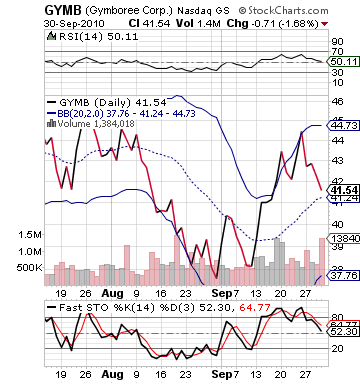

Short Sale of the Day: Gymboree Corp. (GYMB)

Analysis: 22% rise!?!?!? How did we miss this? Gymboree Corp. (GYMB) announced in after hours that they were seeking to find a company to acquire them, and the stock has shot up ever since. Despite the news being quite positive and adding value to the stock, 22-23% may be a bit excessive for this company. The rise takes the stock well out of its  band range, and those that are taking it higher will definitely take gains. Many of those involved want to hold this one for a bit, but a lot of others are just traders.

band range, and those that are taking it higher will definitely take gains. Many of those involved want to hold this one for a bit, but a lot of others are just traders.

I think that supply is going to outweigh demand at some point on this crest. Finding that spot is key. It most likely will pop another 1-2% from the opening price, so we are trying to narrow in on what that will be. It seems like in pre-market it has met resistance above 51.00 and dropped down below it each time hitting it. So, that may be a resistance level of some kind for us. 22% no good but 23% definitely.

While the news is spectacular, I just do not think that it can make 23% without facing some heavy selling pressure, and I am pretty confident that it will meet pressure after a pop to start the day.

Watch this one closely at the open!

Entry: We are looking to enter at 51.20 – 51.70.

Exit: We are looking to cover for a 2-3% gain.

Stop Loss: 3% on bottom.