Profile

Paychex Inc. (PAYX) is involved in the outsourcing of payrolls. The company focuses on outsourcing payroll for small to medium-sized businesses that have around fifth to 100 employees. The company was founded in 1971 in Rochester, New York, and it was grown in 1979 by consolidating 17 payroll processors. The company services over 550,000 clients. The company is the second largest payroll outsourcing firm behind Automatic Data Processing Inc. (ADP).

Thesis

Paychex Inc. (PAYX) is an attractive longterm position for several reasons. The company is a leader in a fairly uncompetitive industry with a wide economic moat that is created by the company’s significant competitive advantage and top notch brand image. The company has a low cost of doing business. Further, Paychex has one of the swellest dividends one could hope for that gives a yield above 4% and has little risk of being threatened.

Paychex’s economic moat begins with heavy costs of entering the business but low costs of operation. The cost of switching payroll processors and high scalability gives the firm a significant advantage of any firm entering the industry. Additionally, Paychex has the respect of forty years of doing business that have allowed it to grow and keep customers. Small businesses also are less likely to take on new businesses since margins are less significant and heavy costs are avoided.

Paychex benefits its investors most significantly through its ability to have a very low cost of business. The company’s free cash flow is significant each year. They have had FCF over $500 million for the past four year. The latest FY, which ended in May 2010, saw the company earning $550 million in FCF and obtaining a FCF margin of 27%. A rate of 10-12% is considered healthy. That heavy dose of FCF is pumped back into business developments and investors through the dividend. The company, currently, operates a dividend of $1.24 per share for a yield of 4.5%. With such a significant FCF margin, the dividend seems very safe, and it allows investors to sop up some significant dividend payments while waiting for the company to grow.

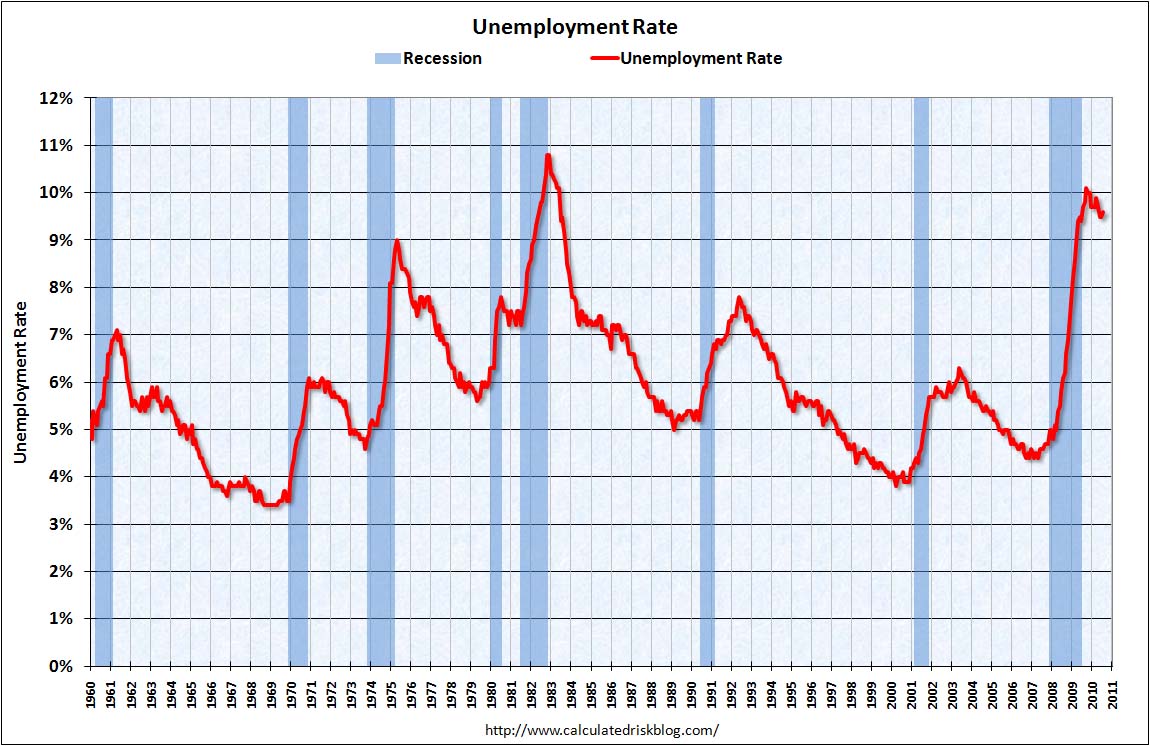

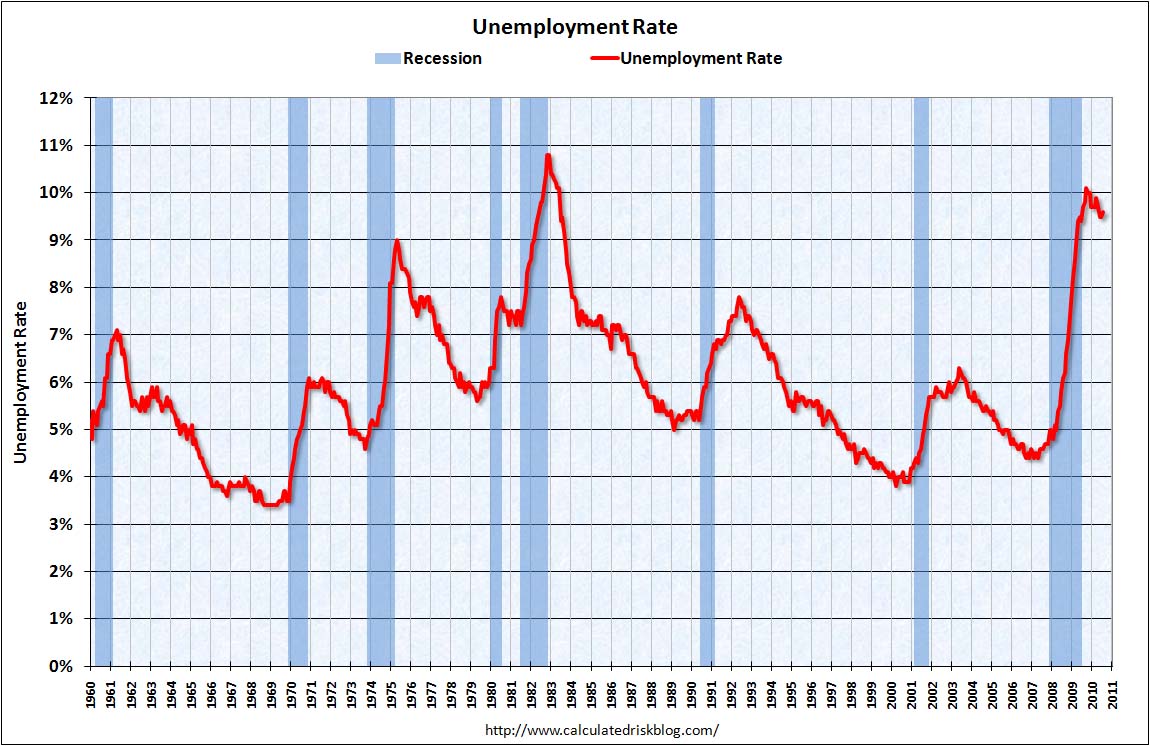

The question with Paychex is can it grow. The company has seen no growth since 2008. The company continues to lose business. In its latest quarter, the company saw another 12% of business drop out the bottom on its paycheck business. The company has battled some of its loss here with gains in its human resources outsourcing business that is expected to grow 10-12% in the coming year. Yet, the company needs its core business to return if the company wants to see growth. That core business will not grow until employment starts to perk up and new businesses are created.

Employment has shown slow but steady inclines. Recent numbers of jobless claims have been stuck around the 450,000 weekly additions level. The current unemployment rate is stuck at 9.5%, and it appears that it will bounce around this level for the remainder of this year and into 2011. Most employment analysts suggest that normal employment might not return until 2012 or even 2013. The small growth in employment will continue to plague Paychex’s ability to get back to the type of 15%+

sales growth it was seeing moving into 2008. The company has branched out with its human resources division, but this is still tied to employment.

One thing that we can stay confident about is that employment will come back. The private sector this year is adding more jobs than they are cutting. It is not at an alarming rate, but it is something. Many companies have piled up a large stash of cash and cash equivalents, which should be able to easily wielded to create new jobs and expand companies the second demand kicks into the economy.

Positive signs from the company that things are slowly getting better came when Paychex recently reinstated its salary increases and announced it will be raising its sales force by 2% next year. As they see bankruptcies declining and small businesses continuing to hire back, Paychex will continue to gain its foothold. In its latest quarter, the company also saw its check per client increase 1.2%. It was only the second increase the company had seen since Q3 of FY 2007.

On the financial side, Paychex has very strong margins even compared to similar companies. In the TTM, the company’s gross margin was at 67%, and its operating margin was solid at 32%. These are very strong margins for any company. In a low cost industry, higher margins should be expected. Automatic Data Processing (ADP) and DST Systems (DST), two of PAYX’s top competitors, turned in gross margins and operating margins at 52% and 22% and 20% and 16%, respectively. Paychex is a definite step above its competition in margins, which shows a better revenue stream and lower costs.

Another very positive sign from the company that future growth is on the way comes from PAYX’s ROIC. In the TTM, the

company has seen its ROIC move upwards from 9.83% in FY 2010 to 35%. A high ROIC and growing ROIC is a great sign of financial health.

Finally, Paychex is a company that makes a great deal of money by sitting on money. When money is in float, the company is able to make a great deal of interest. With fed rates and interest rates so low, the float is not able to make much interest. This can not go on forever. At some point, the Fed will raise rates and interest rates will increase. It is only a matter of time till this float begins to increase. The company makes about 10% of its income off floating money. This float also allows the company to battle inflation.

While the story on Paychex looks bright, the company does face some issues. They recently lost their CEO Jonathan Judge, who has been with the company for the past six years. The company just named a new CEO in Martin Mucci. It will be interesting to see how well Mucci can do at the helm. He has been with the company since 2002. Prior to his position at CEO, Mucci was VP of Operations. Judge, though, was crucial to the company’s success story and its heavy growth in the past five years.

If employment or interest rates rise, Paychex is going to see a very nice rise. Until then, you can settle for a solid yield.

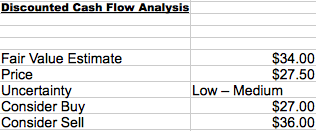

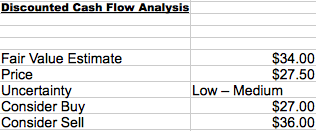

Valuation

My fair value estimate for Paychex is $35 per share based on discounted cash-flow analysis. The company has seen a  dip in its ability to grow its revenue as of late. The company will struggle to continue to grow revenue into 2011, and it should be no more than 4-5%. Breaking into 2012 – 2014, the company should begin to start an upwards trend in growth. With little competition and a high economic moat, the company does not face stiff competition and should maintain their current status.

dip in its ability to grow its revenue as of late. The company will struggle to continue to grow revenue into 2011, and it should be no more than 4-5%. Breaking into 2012 – 2014, the company should begin to start an upwards trend in growth. With little competition and a high economic moat, the company does not face stiff competition and should maintain their current status.

The company is a Buy below $27 and Sell above $36.

Risk

Risk is low with Paychex. The company will maintain very well, but they do face the issue of a slow but sustained growth for the time being. They will continue to do well as long as a recovery is sustained. In the long term, Paychex represents an opportunity for a very sustainable and safe company moving forward.

Good Investing,

David Ristau

sales growth it was seeing moving into 2008. The company has branched out with its human resources division, but this is still tied to employment.

sales growth it was seeing moving into 2008. The company has branched out with its human resources division, but this is still tied to employment. company has seen its ROIC move upwards from 9.83% in FY 2010 to 35%. A high ROIC and growing ROIC is a great sign of financial health.

company has seen its ROIC move upwards from 9.83% in FY 2010 to 35%. A high ROIC and growing ROIC is a great sign of financial health. dip in its ability to grow its revenue as of late. The company will struggle to continue to grow revenue into 2011, and it should be no more than 4-5%. Breaking into 2012 – 2014, the company should begin to start an upwards trend in growth. With little competition and a high economic moat, the company does not face stiff competition and should maintain their current status.

dip in its ability to grow its revenue as of late. The company will struggle to continue to grow revenue into 2011, and it should be no more than 4-5%. Breaking into 2012 – 2014, the company should begin to start an upwards trend in growth. With little competition and a high economic moat, the company does not face stiff competition and should maintain their current status.