What if the World is flat?

It sure looks flat. You have to go to space to see that it's round, even in an airplane it looks pretty flat, doesn't it? Well, fiat currencies are like that too. We talk about Quantitative Easing as if the World is flat because Americans (who are trained to be self-centered to the point of Xenophobia from birth) don't think of their connections to other counties on this planet. To understand the American investor is to look at this map and understand that it is not a joke…

So investors in the US discuss Quantitative Easing as if we can simply devalue the dollar and every other country on Earth has no choice but to bend over and accept our worthless currency because they are lucky we even bother to trade with them. To most American's, it's still 1950 and we just won the war and Europe better kiss our ass and the rest of the World better fear us or they're NEXT. That pretty much sums up our next 50 years of diplomacy, doesn't it?

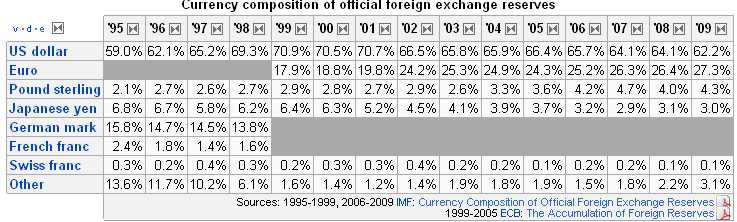

That is the mindset that now permeates investors attitudes towards our currency which is, in fact, the World's Reserve Currency. What does it mean to be the World's Reserve Currency? Well, nothing more than the fact that it is held in significant quantities by governments and institutions as part of their exchange reserves. That is what our government and the Fed are now taking advantage of by printing Trillions of additional dollars and devaluing our currency, which is currently 62% of the World's reserve holdings, although that is down from 71% in 1999 and 64% in 2008.

That's the problem the rest of the World faces as we race to devalue our own currency – they simply can't replace it fast enough to stop us. The only real alternative to the dollar is the Euro, which makes up 27.3% of the World's reserves, next is the Pound at 4.3%, followed by the Yen at 3%. Let's say, for argument's sake, there is an even $100Tn in the World. That means $62.2Tn of it is the US Dollar and $3Tn is the Japanese Yen. No matter how irresponsible you think the US is being with it's currency – you simply can't buy enough Yen to replace them. There are only $27.3Tn in Euros (and they don't look like a good bet, do they?) and $4.3Tn in Pounds. What has been happening? Well between 2008 and 2009 $1.9Tn was moved out of the Dollar (3%) and $900Bn went into the Euro (3.4%), $300Bn into the Pound (7.5%), the Yen LOST $100Bn (3.2%) and "Other" currencies picked up $800Bn (36%)!

A 36% increase in "Other" currencies, which flew from 2.2% of global reserves to 3.1%. Others are Rupees and Yuan/Renminbi and even Rubles as well as Aussie Dollars and Canadian Loonies but the sum total of ALL those currencies is just 3% of Global Reserves. It is tremendously destabilizing to those countries to have their currencies go up in value as it makes them all less competitive as exporters. That is the goal of the US at the moment – to create a monetary sink-hole of such mass and gravity that it begins to actually suck global trade dollars in – instead of spitting endless amounts of them out, as has been the norm for the past few decades.

Can creating a black currency hole really save our country, or do we risk being sucked in as well? Clearly the "Greenspan Model" we've been running has been nothing but destructive for America as we have exported 10% of our labor demand to China, who have accumulated $2.5 TRILLION dollars of our currency reserves while we have run up $9Tn of debt since Al Gore lost his election bid in 2000, despite getting the majority of the popular vote.

Can creating a black currency hole really save our country, or do we risk being sucked in as well? Clearly the "Greenspan Model" we've been running has been nothing but destructive for America as we have exported 10% of our labor demand to China, who have accumulated $2.5 TRILLION dollars of our currency reserves while we have run up $9Tn of debt since Al Gore lost his election bid in 2000, despite getting the majority of the popular vote.

Why bring up Gore? Well it was Gore who wanted to protect both jobs and our "lock box" but that lock box was raided and our Social Security SURPLUS was used to fund a decade of runaway Government spending that has gotten so extreme that we now need to borrow over $100Bn a month just to keep the lights on in this country. $100Bn is more than the ENTIRE GDP of all but 67 countries on this planet and that's what we need EVERY MONTH to keep up the pace of our spending. Annually, our $1.2Tn deficit is the ENTIRE GDP of all but 14 countries on Earth (about Canada or Spain's entire GDP).

Our monetary black hole has already sucked up all the money on Earth and that's why 72.1% of our Treasuries are now sold to ourselves – we've pushed the rest of the World past their limits and $4Tn of our debt has been dumped on the Social Security Trust since the "lock box" was raided and now we are devaluing our currency at a rate of 1.5% PER MONTH in order to keep up the illusion of solvency but we're really not fooling anyone BUT OURSELVES!

Our monetary black hole has already sucked up all the money on Earth and that's why 72.1% of our Treasuries are now sold to ourselves – we've pushed the rest of the World past their limits and $4Tn of our debt has been dumped on the Social Security Trust since the "lock box" was raided and now we are devaluing our currency at a rate of 1.5% PER MONTH in order to keep up the illusion of solvency but we're really not fooling anyone BUT OURSELVES!

It's US we owe the money to. Sure China has $2.5Tn of our debt and other countries have perhaps $8Tn more but the other $30Tn in the world are held by Americans and the Government's insane scheme to devalue our currency by 10% in order to borrow 10% more money is costing us $3Tn for every $1.5Tn we borrow. That's CRAZY!

Of course crazy isn't just our current policy – it seems to be what the voters aspire to as well. Unlike Europe, we do not have serious policy discussions about taxation and Government spending – instead we have two parties that totally disagree with each other on every issue other than maintaining the status quo which is destroying our nation day by day.

Of course crazy isn't just our current policy – it seems to be what the voters aspire to as well. Unlike Europe, we do not have serious policy discussions about taxation and Government spending – instead we have two parties that totally disagree with each other on every issue other than maintaining the status quo which is destroying our nation day by day.

The MSM is no better, with nothing but polarizing opinions as if the whole World is right or left with no room in the middle for rational thought. On Friday, I called Newt Gingrich an idiot and my patriotism was subsequently questioned – that's the way politics are played in America these days – the way they were played under Joe McCarthy in the 50s…

Unfortunately, the lunatics have clearly taken over this asylum and we continue to create dollars at the pace of about a dozen Bahamas per month. That's right, the entire annual GDP of the Bahamas is $9.3Bn and we drop 12 times that in debt load on a monthly basis, going 144 Bahamas deeper into debt every year! Our debt and deficit is now so massive, that we need to measure it in terms of the GDP of other nations because 1,500,000,000,000 is fairly inadequate to grasp the scope of our deficit spending. Suffice to say that it's more money than exists unattached on the planet Earth so, in order to go further into debt – we have to create more money.

As I mentioned, because other countries aren't as stupid as we imagine, we need to create 3 dollars in order to borrow 1. That gives us $1 more debt (out of 10) and $2 less value to our remaining pile. How long can that go on? One reason our currency creation is so inefficient is because the people we are giving the money to, the Banks, aren't willing to invest it in America either. They have their own debt holes to fill and most of the money we give them goes into a derivatives ($200Tn and rising) juggling scheme that makes them look solvent and masks their very, very questionable asset bases.

The banks take the money the Fed is dumping on them and speculate in commodities and foreign currencies and THEN they buy some TBills in order to keep the treadmill running. This forces asset bubbles in things like gold and oil but they too are a complete illusion because it's only the idiots with dollars that are buying them – the rest of the World stopped chasing shiny metals in June but the flat-Earthers in the US just didn't seem to get the message. Here's gold priced in Euros, which is DOWN 8% in 3 months!

The banks take the money the Fed is dumping on them and speculate in commodities and foreign currencies and THEN they buy some TBills in order to keep the treadmill running. This forces asset bubbles in things like gold and oil but they too are a complete illusion because it's only the idiots with dollars that are buying them – the rest of the World stopped chasing shiny metals in June but the flat-Earthers in the US just didn't seem to get the message. Here's gold priced in Euros, which is DOWN 8% in 3 months!

Our stock markets, of course, look just even worse – down 10% to the Euro in the last 3 months, but that won't stop the MSM from engaging in the Grand Dellusion that they are feeding to the voters this month – that everything is somehow going according to plan (what plan?) and happy days are just around the corner – as long as Americans can keep pretending the World is not round at all but a neat little square with our great nation on top and in the center.

Well, there's a lot to be said for getting out while you're on top – or at least while there are still enough people fooled into believing you are on top. As the Joker says in the "what plan?" link above – Nobody panics when things go according to plan, EVEN WHEN THE PLAN IS HORRIFYING!

That's what we have now, a horrifying plan to prop up the US Economy based on the belief that the US is the center of the universe and that the rest of the World will be fooled by our fiscal nonsense. As you can see from the gold chart and the S&P chart – we stopped fooling them a long time ago. What will happen when we can no longer fool ourselves?

For my take on the markets today, see the weekend's Member Chat but, as indicated above – it's a meaningless semi-holiday in America – a day the bulls can only pray will be quiet, because all my charting indicates that real activity is very likely to come to the downside this week.