It is not much of a Wonderful Wednesday as questions over the Fed’s buy back of Treasury bonds have started to mount. The news has overshadowed better than expected home sales and durable orders, as well as, strong earnings from Comcast and Office Depot. Our current positions have been hurt by the extremely weak day in the markets. Skechers, which we entered at 23.80 is down about 1.5%. My goal for this position is to exit half of it today and let half of it ride into earnings. The stock should bounce back to give us at least a break even or small gain before the close as I expect a nice afternoon lift. Yingli Green was actually up for us today, and we might have gotten all the gain I had expected today if it were not for the weak market. We got involved at 11.83, and we are looking to exit at around 12.18 and above.

It is not much of a Wonderful Wednesday as questions over the Fed’s buy back of Treasury bonds have started to mount. The news has overshadowed better than expected home sales and durable orders, as well as, strong earnings from Comcast and Office Depot. Our current positions have been hurt by the extremely weak day in the markets. Skechers, which we entered at 23.80 is down about 1.5%. My goal for this position is to exit half of it today and let half of it ride into earnings. The stock should bounce back to give us at least a break even or small gain before the close as I expect a nice afternoon lift. Yingli Green was actually up for us today, and we might have gotten all the gain I had expected today if it were not for the weak market. We got involved at 11.83, and we are looking to exit at around 12.18 and above.

Since the market has taken such a significant dip, an Overnight Trade looks very promising today. We may even be able to get involved with it and sell half or the whole position from our entry here if we can get an afternoon bounce…

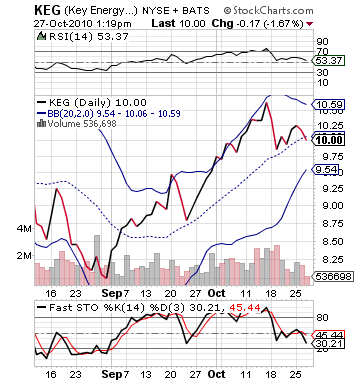

Overnight Trade of the Day: Key Energy Services Inc. (KEG)

Analysis: The oil and gas exploration business is one of the hottest businesses for this quarter. Companies are seeing  a surge of onshore drilling after the BP crisis and heavy influx of oil prices. Oil price have increased for Q3 YOY. 2009 prices in July – September ranged from $66 – $80 per barrel with an average price in the mid-70s. This year, prices have not fallen below 75 and are averaging out closer to $80 per barrel. The increase in prices has led to a raid on oil and gas exploration as companies are attempting to take advantage of higher demands for oil.

a surge of onshore drilling after the BP crisis and heavy influx of oil prices. Oil price have increased for Q3 YOY. 2009 prices in July – September ranged from $66 – $80 per barrel with an average price in the mid-70s. This year, prices have not fallen below 75 and are averaging out closer to $80 per barrel. The increase in prices has led to a raid on oil and gas exploration as companies are attempting to take advantage of higher demands for oil.

One such company that looks poised to benefit from the onshore drilling explosion is Key Energy Services (KEG). The company has a lot going for it moving into earnings. It has an industry that is looking very solid, a turn to profits, and its own reported rigging numbers that show a discrepancy between revenue and earnings estimates and what could actually be reported. Not to mention that the stock has current undervaluation that makes it even more attractive.

First, KEG is slated to reported an EPS of 0.02 vs. a loss at 0.20 per share one year ago. This will be the company’s first profit per share since 2008, and it should give a major boost the stock after reporting its first profitable quarter in two years. One of the crucial pieces of information that I look for in an Overnight Trade is something that can make a stock pop. Good earnings are wonderful, but if there is not a significant beat, turn to profit, or outstanding forecasting, it will not give the move we hope it will have.

are wonderful, but if there is not a significant beat, turn to profit, or outstanding forecasting, it will not give the move we hope it will have.

(Keg’s mining areas are in light blue)

Not only does KEG have the turn to profit expectations, but its industry is performing outstanding. Two of the companies closest business competitors are Complete Production Services (CPX) and Nabors (NBR). The companies both produced positive earnings surprises and rose heavily after earnings. CPX beat earnings per share estimates by 35%, and they saw a 32% rise in revenues YOY. Nabors was mostly the same. The company reported a revenue rise of 34%, and they saw a beat of earnings by 26%. Both companies commented that solid business onshore and high petroleum prices were helping them offset a natural gas hiatus.

KEG’s estimates, however, show only a 21% rise in revenue YOY, which affects its EPS estimates. Both appear to be quite undervalued. One of the ways to know this besides how well its industry as a whole has been underestimated is to take a look at the numbers. Key Energy Services saw total rig hours increase domestically (where it does 5x its international business) 28% with 418,052 US rig hours in Q3 2010 vs. 325,838 in 2009. International rigging hours stayed the same. That 28%  increase, however, is not shown in revenue results. CPX and NBR saw similar increases in their rigging hours, and their results show it.

increase, however, is not shown in revenue results. CPX and NBR saw similar increases in their rigging hours, and their results show it.

The current valuations are underestimations on KEG. With NBR and CPX’s numbers, one would expect KEG to have risen to levels where the earnings would be baked into the stock. Key Energy, however, is a bit under the radar, and it has not seen any rise. The stock is down almost 7% over the past week and a half. It has moved into a neutral RSI level near 50, and its stochastics show overselling. The stock has dropped into earnings despite the fact that close companies are showing show tremendous results.

Take if from KEG’s CEO:

Chairman, President, and CEO, Dick Alario, commented, "Activity trends in the U.S. remain favorable. Rig hours per working day in September were up moderately compared to August, and total rig hours for the third quarter 2010 were up 4% compared to the second quarter."

This one seems like a solid Overnight Trade with little downside and lots of upside.

Entry: We are looking to get involved at 9.95 – 10.05.

Exit: We are looking to exit tomorrow morning after earnings are announced this afternoon or in after hours.

Stop Loss: None.

Good Investing,

David Ristau