I feel like I’m driving in a gasoline truck at a 100 mph and towards an brick wall, says Brian Kelly. And Ben Bernanke just lit a match. I can’t help but worry that this ends badly. – Fast Money's Brian Kelly

I also remain skeptical, adds Steve Cortes. The unanimous opinion sees to be the market can not go lower and I find it reminiscent of the rhetoric we heard right before the tech bubble burst.I want to know what the Fed sees that’s so dire that it’s required them to take drastic steps, muses Guy Adami. I guess it doesn’t matter because the market just wants to go higher. But the market action has the feeling to me of a blow-off top. I don’t know when it ends, but I suspect it ends extraordinarily badly.

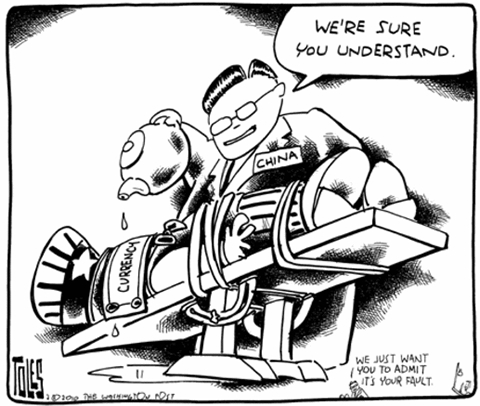

[Pic (left), credit: Elaine Supkis Culture of Life News]

David Stockman sums things up very nicely, saying:

Today the Fed is scared to death that the boys and girls and robots on Wall Street are going to have a hissy fit. And therefore these programs, one after another, are simply designed to somehow pacify the stock market, and hoping to keep the stock indexes going up, and that somehow that will fool the people into thinking they are wealthier and they will spend money.

The people aren't buying that. Main Street is not stupid enough to believe that engineered rallies as a result of QE2 stimulus are making them wealthier and so they should go out and buy another Coach bag. This is really crazy stuff that I can't say enough negative about…The Fed is telling a lot of lies to the market… it is telling all the politicians on Capitol Hill you can issue unlimited debt cause it doesn't cost anything.

We have $9 trillion of marketable debt. Upwards of 70% of that has maturities of 5 years or less down to 90 days. All of those maturities are 1% down to 10 basis points. So from the point of view of Congress, the cost of carrying the debt is essentially free. When you tell politicians they can issue $100 billion of debt a month for free, how do you expect them to do the right thing, and ask their constituents to sacrifice… I think the Fed is injecting high grade monetary heroin into the financial system of the world, and one of these days it is going to kill the patient."

Well, one thing we know about betting on a junkie that just got some heroin – they are going to get high! That's the easy bet and we took that earlier in the week for a quick 200% on the FAS spread and we're done with that as XLF hit $15 yesterday and FAS went over $25, up over 10% in 24 hours from Wednesday's pick.

Well, one thing we know about betting on a junkie that just got some heroin – they are going to get high! That's the easy bet and we took that earlier in the week for a quick 200% on the FAS spread and we're done with that as XLF hit $15 yesterday and FAS went over $25, up over 10% in 24 hours from Wednesday's pick.

I know that the trade was designed to make 1,334% but that was if we wait until January – after making 100% on day one and 100% on day too – forgive us if waiting 90 more days just to make 1,100% more seems a little tedious and we are still preferring to get back to cash early and often (per the above remarks!). Of course there are many other great leveraged trades, that was just an example, as I do still try to play Robin Hood and throw out the occasional trade or two to the masses but we've already moved on to XLF and UYG spreads in Member Chat and we will be making other plays next week to keep us ahead of the inflation game.

I said yesterday, I feel much less bad about taking advantage of our dysfunctional markets after the election – the little people obviously WANT to be screwed over, they want to the top 1% to own 70% of the nation's wealth while they go home to watch Fox news tell them what a great country this is. As I wrote several years ago, it's the opposite of Robin Hood, it's the Dooh Nibor Economy but it's apparently the economy the American people are comfortable with so who am I to fight the will of the people?

We're gearing up to play the inflation game at PSW and it's a very exciting game to play (as you can see from that little FAS spread). We can magnify relatively small moves in the market to create great trading opportunities almost daily and inflation is like putting a gigantic safety net under everything we do – it's just fantastic. On behalf of the top 1%, I want to thank the bottom 99% for voting to "extend and pretend " rather than stopping the ongoing transfer of wealth that has now far eclipsed even the economic atrocities that led up to the Great Depression.

We're gearing up to play the inflation game at PSW and it's a very exciting game to play (as you can see from that little FAS spread). We can magnify relatively small moves in the market to create great trading opportunities almost daily and inflation is like putting a gigantic safety net under everything we do – it's just fantastic. On behalf of the top 1%, I want to thank the bottom 99% for voting to "extend and pretend " rather than stopping the ongoing transfer of wealth that has now far eclipsed even the economic atrocities that led up to the Great Depression.

The big joke of the day is, clearly all this emergency Quantitative Easing was not necessary. We've been saying this for months but how else can the Fed tax the poor of this nation 10% of their total wealth in order for us to make 200% in 2 days trading on the banking sector? 151,000 jobs were added in today's Non-Farm Payroll Report vs 60,000 predicted by the economists Bernanke used to justify his debasement of our currency.

I already pointed out yesterday that inflation is out of control and the CPI is a total joke, also used by Ben to justify his extraordinary actions. "With all due respect, U.S. policy is clueless," Germany's finance minister said this morning. Pleading with the U.S. to take a global leadership role, Wolfgang Schaeuble believes there is no shortage of liquidity: "To say let's pump more into the market is not going to solve their problems."

Clueless, reckless, dangerous, damning, doomed, fatally flawed… Whatever. Our job as investors is simply to survive and thrive on the chaos. In chat yesterday, we were discussing some simple hedges to make 200% a year if we have 20% inflation and trades like that are good as we don't need to over-commit our assets because we are still wary of currency-led shocks to the system as we expect the dollar to bounce off that 76 mark (and we still like UUP at $22 with the November $22 calls at just .18 at yesterday's close as NO ONE believes the dollar will bounce, so a good contrarian play).

Despite crude supplies at 14% over the 5-year average, oil hit our Fed-induced $87.50 upside target yesterday and that puts the USO November $36 puts in play at .35, also a play on a dollar recovery as well as a sell-off of crude into the contract rollover period in 2 weeks.

“The markets have taken off like bottle rockets,” said Richard Soultanian, co-president of NUS Consulting Group, a Park Ridge, New Jersey-based energy procurement adviser. “The Fed action is going to create commodity inflation. A weak dollar is providing impetus to all the commodity trades.”

Aside from our own Federal Reserve screwing over the people by ramping up commodity prices, the oil industry is back in business (since we just voted out the possibility of more regulatory oversight) and the reason we had a draw in gasoline inventories the past two weeks had nothing to do with demand (still at 5-year lows) and everything to do with a 70% drop in gasoline imports for October. Actual consumption last week was just 9.03Mb per day, the lowest level in 3 weeks as prices squeeze those poor bastards in the bottom 90% off the roads entirely…

Things are certainly getting interesting. China said the U.S. Federal Reserve needs to explain this week’s decision to purchase bonds to pump money into the world’s biggest economy or risk undermining the global recovery. “Many countries are worried about the impact of the policy on their economies,” Vice Foreign Minister Cui Tiankai said at a press briefing in Beijing today. “It would be appropriate for someone to step forward and give us an explanation, otherwise international confidence in the recovery and growth of the global economy might be hurt.”

Things are certainly getting interesting. China said the U.S. Federal Reserve needs to explain this week’s decision to purchase bonds to pump money into the world’s biggest economy or risk undermining the global recovery. “Many countries are worried about the impact of the policy on their economies,” Vice Foreign Minister Cui Tiankai said at a press briefing in Beijing today. “It would be appropriate for someone to step forward and give us an explanation, otherwise international confidence in the recovery and growth of the global economy might be hurt.”

Cui’s remarks echo concerns raised across Asia as countries brace themselves for stronger currencies and possible asset- price inflation. German Finance Minister Wolfgang Schaeuble yesterday said the U.S. was creating problems for the world and the subject would be raised during next week’s Group of 20 leaders’ summit in Seoul.

We should be testing that critical 1,220 mark on the S&P and the percentage play is to short them into the weekend but we'll have to play that by ear in Member Chat as we still have Pending Home Sales at 12:30 and Bernanke Speaks in Jacksonville at 2pm and at 3pm we get the Consumer Credit numbers, which begin to matter as holiday shopping season is upon us.

Have a great weekend,

– Phil