The G-20 meeting convenes today and Cisco reported disappointing earnings and outlook that have sent the market down in the early goings. We have positions currently in CSUN, FSLR, CRME, and KKD. We are looking to exit CSUN for a 3% gain or higher at 4.84 or higher. FSLR has been a disappointment since entering at 140.40, and we will continue to hold but not much longer. We exited half of CRME yesterday after entering an Overnight Trade. The company announced late yesterday they would be pushing their earnings report back to the afternoon. That sort of news scares me, so I will be taking my position off completely at the open. The stock was up in after hours, so I hope to get a small gain for the second half. Finally, we got into KKD yesterday at 5.50, and we are looking for around 3% on that one.

The G-20 meeting convenes today and Cisco reported disappointing earnings and outlook that have sent the market down in the early goings. We have positions currently in CSUN, FSLR, CRME, and KKD. We are looking to exit CSUN for a 3% gain or higher at 4.84 or higher. FSLR has been a disappointment since entering at 140.40, and we will continue to hold but not much longer. We exited half of CRME yesterday after entering an Overnight Trade. The company announced late yesterday they would be pushing their earnings report back to the afternoon. That sort of news scares me, so I will be taking my position off completely at the open. The stock was up in after hours, so I hope to get a small gain for the second half. Finally, we got into KKD yesterday at 5.50, and we are looking for around 3% on that one.

We are fully booked in the Buy category, so here is a Short idea for today…

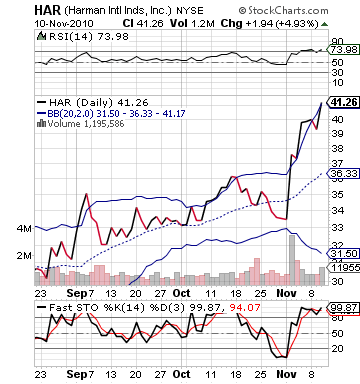

Short Sale of the Day: Harman International Inc. (HAR)

Analysis: Harman International has jumped just under 30% since the beginning of November. The company reported solid earnings last week with a surprise beat of close to 30% on EPS, and they beat revenue estimates. The company, however, did not kill earnings and had no major forecasting of any kind. The stock has moved like it was taking over the entire audio products industry, and it is slated to open another 4-5% higher again this morning.

The stock is extremely overvalued and overbought heading into today. It was already above its upper bollinger band, and with this morning’s major rocketing up, the stock is even more overvalued and is towering above its upper band. With the market slated to pullback to start the day and most everything else on the exchanges looking glum, it may be time for Harman to come back to reality.

upper band. With the market slated to pullback to start the day and most everything else on the exchanges looking glum, it may be time for Harman to come back to reality.

The company does appear solid, but a 30% movement in six trading days is really unsustainable. We should be able to get in at the open after a slight pop and take advantage of some profit-taking that definitely should start to take place. Demand for buying will be heavily outweighed by supply, which will start to drop the price. Once investors see their five day friend dropping on them, they will join in the ranks.

Get in early and watch Harman take a dive. At least we can feel good about a drop in one of our positions, since the other four will be taking it on the chin as well.

Entry: We want to get involved at 42.80 – 43.20.

Exit: We are looking to cover on 2-3% drop.

Stop Buy: 3% on top.

Good Investing,

David Ristau