Smoke on the water – and fire in the sky.

Smoke on the water – and fire in the sky.

That’s the images we’re getting from Fukushima. As Deep Purple said at their legendary Japan concert, they "burned the place to the ground" and "When it all was over, they had to find another place." That pretty much sums things up in Japan this morning as fires rage at 2 of the 6 nuclear reactors on site and none of the 4 problem reactors under control as of yet. I did not realize until yesterday that, although this is about the same as 3-Mile Island – 3-Mile Island had just two reactors and only one broke down – this is much, much worse than that.

550,000 people have already had to find another place as Japan evacuates a wide zone around the plant (and how would you feel if you were living one block away from that zone? If they are forced to widen the evacuation area, about 2M people could quickly be displaced and over 100,000 Japanese soldiers are in the disaster zone, attempting to help out with the relief effort but also standing ready to mobilize a major evacuation if necessary. People in Tokyo did not have to wait and many have already headed south or out of the country completely to avoid possible radiation fallout. Many foreign corporations are recalling workers, businesses are at half-staff and panic buying of food and water is causing shortages in one of the World’s most civilized cities. Think about that…

Also think about why the Nikkei went UP 5.6% last night – retracing 1/3 of the losses since the earthquake. Are we getting hysterical interpretations of events over here or is it perhaps simply that those people who stayed in Tokyo to trade are, by definition – the optimists! I was interviewed by BNN yesterday and they were "shocked" that we were buying yesterday – especially that we were buying HIT ($47 entry), GE ($19.20 entry) and SHAW ($31.50 entry on Monday).

Also think about why the Nikkei went UP 5.6% last night – retracing 1/3 of the losses since the earthquake. Are we getting hysterical interpretations of events over here or is it perhaps simply that those people who stayed in Tokyo to trade are, by definition – the optimists! I was interviewed by BNN yesterday and they were "shocked" that we were buying yesterday – especially that we were buying HIT ($47 entry), GE ($19.20 entry) and SHAW ($31.50 entry on Monday).

Too early they said. I see it differently. It seems to me that if this goes badly and the sentiment runs to decommissioning existing plants – that’s going to be a lot of work for these guys. If there is a push for alternate energy – that’s good for GE and HIT. If there is a push to put newer, safer plants on-line to replace older models – that’s great for SHAW and also GE and HIT. So many ways to win on this trade – why not?

Of course we are using hedged entries with option strategies, etc. but, if we’re not going to buy when things get cheap – when will we buy? We used that logic well last year with plays on MEE (mine collapse) as well as BP, RIG and HAL. When major blue-chip like companies sell off – it is possible to make a rational assessment of their true valuation compared to the maximum expected damage from the incident and pick an entry point. It’s easier, of course, when you use our strategy for buying stocks at a 15-20% discount – as that gives you a nice, extra cushion – just in case. As William Shatner tells us – you can’t argue with a big deal!

I have to remind people of this in every market panic but it is worth repeating. If you KNOW you want a stock and you intend to make it part of your retirement virtual portfolio and it drops 20% with the market and then you can give yourself an additional 20% discount using our buy/write strategy – WHY WOULD YOU NOT BUY IT? Fear is the only answer. Unless something has fundamentally changed with your stock that will make it earn less than you thought it was going to – why would your valuation change?

I have to remind people of this in every market panic but it is worth repeating. If you KNOW you want a stock and you intend to make it part of your retirement virtual portfolio and it drops 20% with the market and then you can give yourself an additional 20% discount using our buy/write strategy – WHY WOULD YOU NOT BUY IT? Fear is the only answer. Unless something has fundamentally changed with your stock that will make it earn less than you thought it was going to – why would your valuation change?

If a pair of Levis that you know you like is $50 but you have two pairs (other stocks) and don’t really need another – you might "like" them but not, as my daughter would say: "like LIKE" them. When they drop to $45, you may start to think about it and, at $40, you will start to get interested but at $30 – a price we haven’t been offered since 1995 – you will be excited to buy them. Why? Because you KNOW the value of a pair of jeans. Because you KNOW you want a pair of jeans and you KNOW that you can make good use of them for many years so it is almost a no-brainer decision for you to buy them for 40% off.

Why is it that the average investor has a firmer idea of what his next $50 clothing purchase should be than his next $5,000 stock purchase?

One reason is because you tend to buy the same or similar clothes over a long period of time so you become an "expert" in the value and pricing of clothes. Think about that next time you flip from stock to stock based on whatever is hot at the moment. A lot of our most successful Members are "faithful" following the same stocks or sectors year after year – where they are comfortable buying low and selling high because they KNOW what low and high should be from EXPERIENCE.

One reason is because you tend to buy the same or similar clothes over a long period of time so you become an "expert" in the value and pricing of clothes. Think about that next time you flip from stock to stock based on whatever is hot at the moment. A lot of our most successful Members are "faithful" following the same stocks or sectors year after year – where they are comfortable buying low and selling high because they KNOW what low and high should be from EXPERIENCE.

It always amazes me that the same CEO who will negotiate for weeks to save 1% on $1M worth of supplies will then turn around and buy $100,000 worth of whatever stock Cramer tells him to at whatever price it opens the next morning. That’s crazy right? Perhaps that’s why they call the show "Mad Money" – they’re not targeting the rational investors for that medicine show.

If you go back and read our archives, you’ll see that we are now starting to look at many of the same stocks we looked at in March of 2009 for the same reasons we liked them back then. There are certain comfortable, familiar stocks that we have lots of experience with – that we are comfortable with, that we like to buy. That’s why we have our Buy Lists and Watch Lists for Members – there are certain stocks that we go to whenever there is a sale being thrown by the market – for whatever reason.

Not to be callous but bank failure, terrorist attack, earthquake, government shut-down, debt crisis, nuclear melt-down – it’s always SOMETHING, isn’t it. I often quote Members my favorite line from Men in Black where Tommy Lee Jones says:

There’s always an Arquillian Battle Cruiser, or a Corillian Death Ray, or an intergalactic plague that is about to wipe out all life on this miserable little planet, and the only way these people can get on with their happy lives is that they DO NOT KNOW ABOUT IT!

The markets are like that – there’s always something to worry about and we’ve been in ignore mode for quite some time in our "Meatball Market" where "It just didn’t matter." Well, now something happens and things start to matter, which is what we expected to happen last week. We didn’t know it was going to be an earthquake and a nuclear crisis but we did know that inflation was out of control, Libya was in civil war, stocks were overpriced, oil was $105, various countries were having food riots…

The markets are like that – there’s always something to worry about and we’ve been in ignore mode for quite some time in our "Meatball Market" where "It just didn’t matter." Well, now something happens and things start to matter, which is what we expected to happen last week. We didn’t know it was going to be an earthquake and a nuclear crisis but we did know that inflation was out of control, Libya was in civil war, stocks were overpriced, oil was $105, various countries were having food riots…

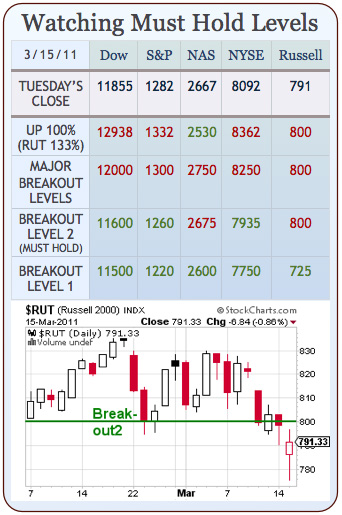

In short, all the stuff I have been whining about since we first went over our Major Breakout Levels without a pullback. Without consolidation, we don’t have support – it’s that simple. Now we’ve blown the whole year’s progress in a couple of days – POOF! – profits are gone for the "buy and hold" crowd and it’s time for us to get back in – our non-greedy exits rewarded by being offered a chance to get back in just a week later at prices we were happy to buy at in December.

The MSM, of course, is still pounding the fear drum and we’re certainly not ignoring the potential risks. We added several new disaster hedges in yesterday’s Member chat but that forms the BASE for our bullish plays. We expect support at our Breakout 2 levels and adding disaster hedges protects our buy-ins down well below the Breakout 1 Levels and, if those break – we simply add more hedges. That’s right – IT’S NOT COMPLICATED!

The Fed finally discovered inflation yesterday in their minutes but generally think it’s under control. That seems odd as the Feb Producer Price Index is up 1.6% this morning and that’s 166% HIGER than the 0.6% expected by the kind of "experts" the Fed relies on. Don’t worry though, that "core" PPI is up just 0.2% and THAT’s the one The Bernank likes to quote when he tells you how "under control" everything is.

The fresh disaster of the day is the February Housing Starts, which came in -22.5% at 479,000 vs. 570,000 expected by those fabulous economic experts and that’s down from a 596,000 pace last month. Permits, of course, are also off but only 8.2% at a 517,000 pace for the year. We expected this from reading the Beige Book but we’ll have to see how shocked our fellow investors are by this "news."

The fresh disaster of the day is the February Housing Starts, which came in -22.5% at 479,000 vs. 570,000 expected by those fabulous economic experts and that’s down from a 596,000 pace last month. Permits, of course, are also off but only 8.2% at a 517,000 pace for the year. We expected this from reading the Beige Book but we’ll have to see how shocked our fellow investors are by this "news."

Looking at the chart on the left – we have finally left denial and are clearly around the Panic/Capitulation part of the cycle. This is why we are scaling in carefully with hedged entries – now is not the time for heroics as you never know how far the markets can fall or how long Despondency can last. Once we get there though – it’s time to load up on our Dividend Payers (see Virtual Portfolio Archives) and, once those begin to lift – it’s time to get more aggressive again.

In the meantime – let’s be careful out there.

"The ice age is coming, the sun is zooming in

Engines stop running and the wheat is growing thin

A nuclear error, but I have no fear"