10% – That's how much we've gained in the markets over the past 12 months.

10% – That's how much we've gained in the markets over the past 12 months.

9.6% – That's the annual rate of inflation using the original CPI methodology – before it was altered to hide the true impact of inflation. Why would our government do this? Well A) They don't want to look incompetent (more so), B) They don't want workers asking for raises, C) They don't want Bond buyers to ask for higher rates to compensate for declining Dollar buying power and, most importantly D) They don't wan to give cost of living increases to millions of Government workers and, much more importantly, tens of millions of seniors who are collecting Social Security.

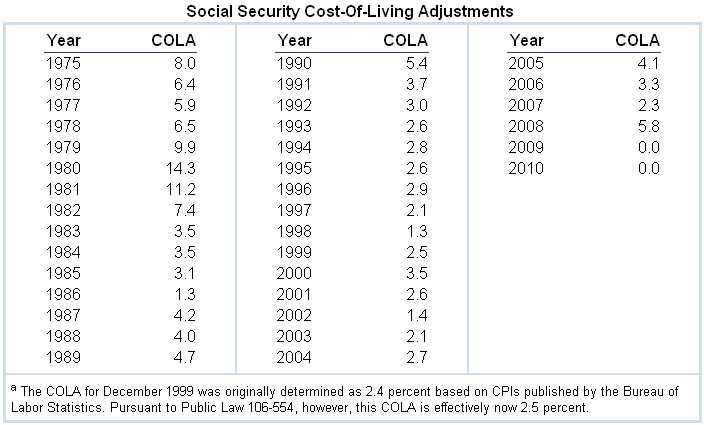

Since 2008, Social Security benefits have been frozen, with no cost of living allowance. Next to Defense (28.5%), Social Security payments (20%) are the Government's biggest outlay (it is also their 2nd biggest inflow (32% of revenues) but don't let that logic stop the people who want to break the system). Our Social Security outflows are currently $600Bn and inflows are $900Bn – that's not the problem – it's Medicare & Medicaid at $550Bn that is getting out of control quickly (which is why Health Care Reform was a logical top priority to tackle the long-term deficit projections, just like it was supposed to be in 1992, when we spent just $200Bn on Medicaid).

Of course the entire thing can be fixed in 5 minutes by simply eliminating the income cap on contributions above the $106,800 line. This would, of course, have no affect at all on people earning less than $106,800 and a person earning $213,600 would pay 3% more total taxes and that amount would top out at 6% for people making upwards of $1M per year – a small price to pay to keep Grandma from eating cat food or, even worse, moving back in!

Of course the entire thing can be fixed in 5 minutes by simply eliminating the income cap on contributions above the $106,800 line. This would, of course, have no affect at all on people earning less than $106,800 and a person earning $213,600 would pay 3% more total taxes and that amount would top out at 6% for people making upwards of $1M per year – a small price to pay to keep Grandma from eating cat food or, even worse, moving back in!

It seems to me that people who "only" earn $213,600 a year will end up paying a lot more than 3% of their income ($6,408) to support Mom, Dad and the various In-Laws if they do let SS fail or cut back benefits but, for some reason – Obama and company do not seem to be able to articulate this fairly obvious point to baby boomers.

The kids don't want their parents to count on them and the parents don't want to have to count on their kids for support and it is not yet legal to either hunt old people for sport or to eat the poor ones (the so-called "Cheney Plan") so SOMEONE is going to have to support old people. Will it be you or will it be your Government? 3% is suddenly sounding quite reasonable, isn't it?

The kids don't want their parents to count on them and the parents don't want to have to count on their kids for support and it is not yet legal to either hunt old people for sport or to eat the poor ones (the so-called "Cheney Plan") so SOMEONE is going to have to support old people. Will it be you or will it be your Government? 3% is suddenly sounding quite reasonable, isn't it?

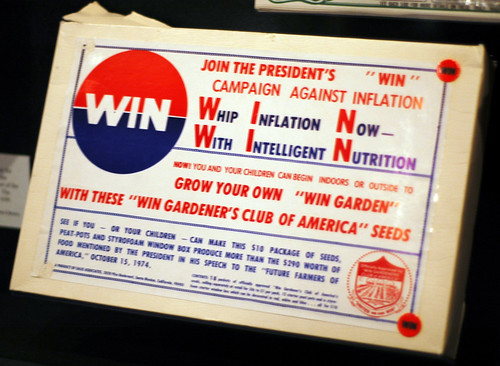

Meanwhile, as we approach year 20 of kicking the can down the road – the Government has taken to falsifying data in order to avoid their obligations of increasing SS benefits to keep up with inflation. For most of the 20th century, Social Security payments afforded the average American enough money to retire in dignity and well it should as a person earning (using today's averages) $40,000 a year and contributing $2,400 a year matched by $2,400 from their employer for 40 years should, at 6% compounded interest, have $787,428.88 in their retirement account.

$787,000 at 6% a year is $47,220 a year – that's about equal to the contributer's average salary over 40 years, which is what the system was designed to do. The system works perfectly – it's the raiding of the lock box over the past 20 years that has destroyed it. This began under Bush the First, when the first of the CPI shenanigans was initiated and suddenly annual adjustments to payments dropped by 50% over the next decade. This is how we strip our retirees of their dignity and rob them of their savings, year by year – so the Government can pretend it has more money than it does:

Obama made a good speech yesterday but, as I said, why can't they make the point that these "savings" are really trade-offs. Our lack of support for balancing SS with higher taxes 20 years ago and our lack of getting Health Care under control is now costing our nation over $2Tn a year in higher payments and the problem is still snowballing and will cost $4Tn a year in 10 years and $8Tn a year (half our current GDP) in 20 years. This is not really YOUR problem if you are wealthy and can simply relocate to a more stable nation but it will really, really suck for the people we will leave behind (yes, I will be out the door too if this country can't get serious and deal with it's collection problems).

Moving on now. It's 8:30 and guess what, even MORE people are losing their jobs. Quelle suprise, right? A whopping 412,000 pink slips were handed out in March, up 5% from February and 27,000 more than expected by those fabulous expert prognosticators. Despite ultra-low labor costs, the PPI jumped 0.7% in March and even the core PPI was up 50%, from 2% to 3% – almost crossing over to a level that even crazy Benny can't deny.

Chinese inflation is clearly on the rise with food inflation clocking in at 7.2% in 2010 and getting WORSE in 2011. The supply of cheap labor is drying up and Multi-National companies – the SAME ONES that tell you that it's been a tough year and they have no raises or bonuses this year – gave their Chinese workers an AVERAGE increase of 8.4% to keep up with inflation in 2010.

Chinese inflation is clearly on the rise with food inflation clocking in at 7.2% in 2010 and getting WORSE in 2011. The supply of cheap labor is drying up and Multi-National companies – the SAME ONES that tell you that it's been a tough year and they have no raises or bonuses this year – gave their Chinese workers an AVERAGE increase of 8.4% to keep up with inflation in 2010.

Overall inflation in China is at a 5.5% pace in March, up from 4.6% in December and it would be much, much higher except the Chinese took a page out of our Government's playbook and reduced the weighting of food in their official CPI by 24%. THAT's how official inflation in China was reduced from 10.3% in January to 5.5% in February and March – who says Government can't solve problems?

Brian Coulton, an emerging markets strategist at LGIM, believes that Beijing is not on top of inflation – expected to come in at 5.5pc for March – which threatens a more painful tightening process to rein in prices than many expect. "This means rising risk to the country's macroeconomic stability and of growth falling from the current 10pc a year to 4pc or 5pc." Mr Coulton said. Are we prepared for the consequences of a 50% pullback in China's growth?

On Goldman watch this morning, it's a slow day. Apparently they mislead their clients and Congress on Collateralized Debt Obligligations, misleading their own client/investors – creating (allegedly Lloyd!) conflicts of interest as the company built short positions before the U.S. housing market collapsed. I guess it is subject to interpretation as their Hudson Mezzanine Funding 2006-1 stated (allegedly!) that Goldman Sachs told investors its interests were aligned with theirs while the firm held 100 percent of the short side. So it's the EXACT opposite – just like GS alumni, Cramer, if you do the EXACT opposite of what they say you can do very, very well so it's only the suckers who listen to them who get screwed (allegedly). Senator Carl Levin is, not surprisingly, a little pissed:

On Goldman watch this morning, it's a slow day. Apparently they mislead their clients and Congress on Collateralized Debt Obligligations, misleading their own client/investors – creating (allegedly Lloyd!) conflicts of interest as the company built short positions before the U.S. housing market collapsed. I guess it is subject to interpretation as their Hudson Mezzanine Funding 2006-1 stated (allegedly!) that Goldman Sachs told investors its interests were aligned with theirs while the firm held 100 percent of the short side. So it's the EXACT opposite – just like GS alumni, Cramer, if you do the EXACT opposite of what they say you can do very, very well so it's only the suckers who listen to them who get screwed (allegedly). Senator Carl Levin is, not surprisingly, a little pissed:

“In my judgment, Goldman clearly misled their clients and they misled the Congress. Our investigation found a financial snake pit rife with greed, conflicts of interest, and wrongdoing,”

Come on Carl – that's not news – it's their mission statement!

The Senate Report also outlines how GS Traders (allegedly) tried to manipulate the derivatives market in 2007, "manipulating prices of derivatives linked to subprime home loans in May 2007 for their own benefit," according to a U.S. Senate report. Company documents show traders led by Michael J. Swenson sought to encourage a “short squeeze” by putting artificially low prices on derivatives that would gain in value as mortgage securities fell, according to the report yesterday by the Permanent Subcommittee on Investigations. The idea, abandoned after market conditions worsened, was to drive holders of such credit-default swaps to sell and help Goldman Sachs traders buy at reduced prices, according to the report. “We began to encourage this squeeze, with plans of getting very short again,” Deeb Salem, a trader in the structured product group, said in a 2007 self-evaluation excerpted in the report. Swenson, Salem’s supervisor, sent e-mails in May 2007 urging traders to offer prices that will “cause maximum pain” and “have people totally demoralized.”

This is the same logic that is used in the TradeBot programs we play against every day. We love the fake moves that squeeze out the retail crowd and we are happy to jump on board the train as it reverses – right at the point where most traders are capitulating their positions so I thank the Senate for providing us a nice addendum to our usual trading materials – it's not a conspiracy theory when they prosecute the conspirators, right?

In other Gang of 12 action, DB is also under investigation for also dumping bad CDOs on their clients with the head of the marketing team EMailing in regards to the $1.1Bn package they were pushing on the same clients who PAY THEM for advice: "Keep your fingers crossed but I think we will price this just before the market falls off a cliff." Er, allegedly!

This is no different than the tactics that are used every day by Cramer, Goldman (allegedly) and the rest of the Gang of 12 and their MSM lackeys. OPEN is a buy at 175 times earnings? PCLN is a bargain at 50 times earnings, NFLX at 80 times earnings? Come on people, that is just nonsense!

Still it's nonsense we need to learn to live with. Remember the robo-signers? We said "Oh that is such blatantly obvious fraud they are certainly going to get it now." Well that jokes on us… The Office of the Comptroller of the Currency, the Federal Reserve and the Office of Thrift Supervision announced a settlement yesterday with the 14 largest U.S. mortgage servicers including Bank of America, Citibank, HSBC, JPMorgan Chase, MetLife Bank, PNC, U.S. Bank, and Wells Fargo. The settlement doesn’t fine the banks for any of the wrongdoing but instead lists ways they need to improve their mortgage and foreclosure proceedings.

I am not kidding! It's a Bankster World – we're just living in it.