Did you have fun when Japan crashed the markets?

Did you have fun when Japan crashed the markets?

How about when the S&P knocked us down last week? If not, then you probably weren’t hedged and you weren’t hedged because you don’t buy your protection when it’s low, which is when the market is high. I’ve said enough about us being in a channel and I’ve made enough titles of posts "1,333 or Bust," referring to the line the S&P has to hold (for more than a day!) in order to give us a properly bullish sign and I’ve said that there isn’t enough money in the World to support what is now $112 per barrel oil so I’m not going to bother – that’s why we have archives…

I laid out a case for Members last night as to why earnings are deceiving as we are hearing a lot from multi-nationals early in earnings season and they get some pretty big benefits from the exchange rate, which is running 14% better than last year. I strongly advise all Members to read my example on YUM brands as well as look over the charts and other stuff I’m not going to bother repeating here.

What I will repeat here is what I said in conclusion, which is:

I look at stuff like this (the Dollar’s effect on earnings) and think "surely I can’t be the only person who sees this" but I can’t find anyone else discussing it. I just don’t see how there can’t be quite a few fund people who know full well that this is all BS but, if so – what is the logic that keeps them playing the game? I guess, like us – they are worried about losing out to inflation so they can’t really stay away but we are currently ignoring a staggering amount of bad news at a complacency level we haven’t seen since 2007 (VIX under 15).

Is it really possible that anyone can look at the market and say that they feel there is less risk in the market now than there was in 2005-7. Of course NOW we know that they were idiots but THEN people felt very safe buying anything that wasn’t nailed down. I guess that’s the answer – only in hindsight does the behavior we are observing right now seem idiotic. While it’s happening it’s called "trading the trend."

Is it really possible that anyone can look at the market and say that they feel there is less risk in the market now than there was in 2005-7. Of course NOW we know that they were idiots but THEN people felt very safe buying anything that wasn’t nailed down. I guess that’s the answer – only in hindsight does the behavior we are observing right now seem idiotic. While it’s happening it’s called "trading the trend." Although we did break 13,900 on a desperate pump into the close I warned members (and I hate to be a Chicken Little but sometimes the sky actually IS falling!): " This is not a rally, this is limping halfway back to our 14,200 high from a sharp and relentless drop to 13,600. The big drop came 10/19 at 13,900 (to 13,550) after a protracted sell-off from 14,200 on the 10th. So here we are on the 31st at 13,930 (and boy was that finish forced!) acting like everything is great. After the last Fed blast (9/18) we drifted flat along 13,800 for a week so it’s all going to be about next week’s action. Today is meaningless."

Last night I gave my overview of the economy, which was kind of scary, but not as scary as the 100.1% rise in foreclosures since last year. 446,726 homes are currently in some form of foreclosure and that’s up 33% from Q2. Since we know, thanks to Mr. Sparkle, that ARMs will be resetting at an alARMing rate for the next few years, it is easy to imagine that 33% gain driving foreclosures up from the current level of 1/196 homes (was 1/400 last year) to 1 in 150, 1 in 100, maybe even 1 in 50 homes. Will that matter? At 33% a quarter we could get there in just 18 months. Party on mainstream media!

The above-mentioned overview was what I called my "Spooky Federal Wrap-Up," in which I warned that, if you deconstructed what was, at the time, a 3.9% GDP number, that was boosted by Federal tampering, a weak dollar and that "3% of our 3.9% GDP growth coming from sources of dubious benefit." That line is what prodded me to check the archives – because I knew I had a similar feeling in 2007 to the one I have now for similar reasons. It’s deja-vu all over again and look what happened to the markets pretty much the day after my October 31st warning in 2007!

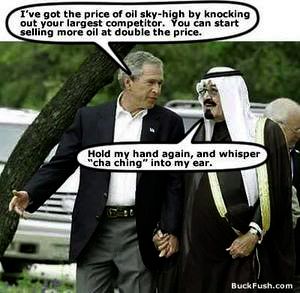

At the time, the MSM was non-stop positive as the markets rallied but the Dollar was testing the 75 mark, 5 points away from completing the 50-point collapse (40%) from the highs at 120 in 2000-2002. The strong Dollar was, of course, terrible for OPEC as they got far less of them (20 at the time) for a barrel of oil but, by happy coincidence, King Fahd’s kissing buddy George got elected President of the United States and that led to a bunch of very lucky breaks for OPEC including 3 planes full of Saudis crashing into US buildings which caused George to declare war on Iraq and destroy their production capacity which fueled commodity speculation just months after the rules on speculation had been revised to allow massive speculation by people who had no actual interest in the commodities.

At the time, the MSM was non-stop positive as the markets rallied but the Dollar was testing the 75 mark, 5 points away from completing the 50-point collapse (40%) from the highs at 120 in 2000-2002. The strong Dollar was, of course, terrible for OPEC as they got far less of them (20 at the time) for a barrel of oil but, by happy coincidence, King Fahd’s kissing buddy George got elected President of the United States and that led to a bunch of very lucky breaks for OPEC including 3 planes full of Saudis crashing into US buildings which caused George to declare war on Iraq and destroy their production capacity which fueled commodity speculation just months after the rules on speculation had been revised to allow massive speculation by people who had no actual interest in the commodities.

Those happy coincidences were followed by a massive increase in Government spending (2 wars, homeland security, pork) that was coupled with a massive decrease in Government collections due to tax cuts and, at the EXACT same time, the Fed began relentlessly driving rates down from 6.5% when Bush took office all the way down to 1% by the middle of 2003. That coupled with more relaxed regulations on lending and lower reserve requirements from banks sent the money supply flying and led to the massive inflationary bubble market that I finally became sick of on October 31st, 2007.

Now we have a background as to what happened last time. The question now is – is this time different? So far, I don’t think so. Other than not jamming his tongue down the throats of Saudi princes, Obama has been no better than Bush at handling the oil situation and Congress has done nothing to reign in the rampant speculation in the commodities markets and things are now MORE out of control than they were in 2007. While we don’t yet know WHAT will be the straw that breaks the market camel’s back, I can simply repeat my Halloween warning of 2007:

Who knows what other horrors will reveal themselves as the year winds down but the real Halloween slasher event is what’s been done to the dollar, which hit new record lows as the Fed worked hard to appease everyone and ended up pleasing no one.

Add to that the monstrous yen carry trade, that’s been flooding the global economy with speculative money all decade and we have one of those scenes by the lake where all the kids are having a wild make-out party while a killer (that could be almost anything in our fragile economy) observes from the woods, circling closer and waiting to strike. Just like any classic horror flick, several people (MER, CFC, C… ) have to actually fall victim before any of the other kids even notice there’s a problem. Then they call the cops (Paulson and Bernanke) who look at all the blood and the severed body parts and then say: "Oh, it’s probably just some kids on dope." Usually, it’s a long time before anyone takes the psycho killerseriously, and by then it’s way too late!

That’s right, I named MER, CFC and C as potential catastrophes a year before the collapse. Oil was "only" $95 a barrel at the time and housing had barely turned down but I’m not the guy in the horror film who keeps telling the people it’s still safe to go in the water (or whatever) – no, I’m the loud guy in the movie theater who says "Oh no girl, do NOT go in that house!" You may hate that guy but you KNOW he’s right….

So, what are we gonna do about it? As promised, we can protect ourselves with some nice, leveraged plays to take advantage of a POSSIBLE collapse in the markets:

So, what are we gonna do about it? As promised, we can protect ourselves with some nice, leveraged plays to take advantage of a POSSIBLE collapse in the markets:

SDS is still my favorite index hedge and the June $20/22 bull call spread is just .69 and is currently .72 in the money at $20.72 so all it takes is for the S&P to finish below 1,333 and you should be able to get out even. We can improve the odds on that by selling SPY May $126 puts for .46 to turn this into a .23 spread so a risk of $230 in cash pays $2,000 (+769%) if the S&P falls. On the put side, SPY $126 is S&P 1,260, which is 5.4% lower than it is now – this can happen, of course but the nice thing about offsetting with SPY is you can’t lose both bets.

For those of you with PM accounts, you can get .65 for the short SPX May 1,095s, which is a whopping 17.8% below the current price and, if you think the S&P will go lower than that by May expirations then you should be at the ammo store and not worrying about the markets!

We actually don’t expect the S&P to fail 1,200 on a pullback and you can sell SPX May 1,200 puts for $2 and that pays for 3 SDS spreads at .69 ($2.07) for net 0.07 on $6 worth of spreads which pay almost 100 to one if the S&P falls between 2.5% and 10%.

Another fun way to offset a hedge is to think about what stocks you would REALLY love to buy if they get cheaper and then sell puts at around the price you are willing to pay. This works very well if you are brave around earnings season and look for oversold stocks like TEVA this morning, which took a hit on BIIB’s MS drug getting good results. TEVA May $42.50 puts should be .60+ this morning.

A few other suggestions to raise cash:

A few other suggestions to raise cash:

- XLF June $16 puts can be sold for .50.

- TBT June $34 puts can be sold for .55

- TM June $72.50 puts can be sold for $1.25

- RIMM Jan $45 puts can be sold for $3

- AAPL Jan $250 puts can be sold for $6

- GOOG Jan $450 puts can be sold for $18.50

As I said, anything you REALLY want to own at the net strike is a fine way to raise capital to offset your bearish hedges. So, now that we have some cash to play with, what else makes a good hedge?

EDZ makes a nice cover on a longer-term collapse in the BRICs. This would likely be caused by a rising dollar and/or a commodity collapse or simply their own economies imploding due to inflation. The Oct $14/18 bull call spread is $1.80, so offsetting that with TM June $72.50 puts at $1.25 is net .55 on the $4 spread with 627% of upside if EDZ moves up 9%. TM makes a good offset because if the BRICs stay solid, they should have good sales so your real insurance risk is just the .55 cash you commit to the trade.

TZA is interesting as we think small caps may be the first to feel the bite of inflation and you can get a big money spread fairly cheaply. This is far more speculative than SDS but the Jan $30/50 bull call spread is $4.75 and I love selling the AAPL calls against those for a net $1.25 CREDIT on the $20 spread that’s starting out $4.60 in the money. The short story on this spread is, if AAPL holds $250, you make $1.25 no matter what the Russell does. If the Russell falls 15%, you should collect $2,000 for every AAPL put you sell (and collect net $125 on). Isn’t hedging fun?!?

So that’s my post for the pre-holiday weekend. I thought it was important enough to ignore the market BS this morning. As the great Han Solo once said: "I have a bad feeling about this" and, sometimes, you just have to go with the force you feel…

Have a good weekend,

– Phil