There are some things you can’t cover up with lipstick and powder.

There are some things you can’t cover up with lipstick and powder.

Don’t come any closer, don’t come any nearer

My vision of you can’t get any clearer

Oh, i just want to hear girls talk

I got a loaded imagination being fired by girls talk

I was complaining to Members yesterday that I was suffering from a rare case of information overload. The markets, indeed the entire planet seems to be at a critical juncture and really, we’re just trying to figure out what to do with our money – as well as what, if anything that money is worth (see "How Much is that Dollar in the Window"). In trying to divine the answer to life, the Universe and everything, I have been doing more than my usual share of reading and I will tell you it is downright scary how little people know about all of those subjects.

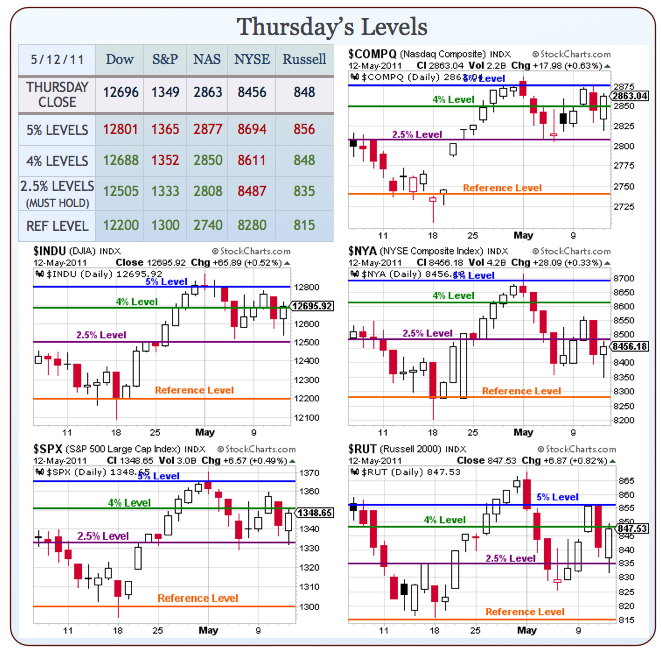

Fortunately, everyone else seems as clueless as we are as to what’s REALLY going on in the World and that put us all on a level playing field this week, which allowed us to have a week (so far, we’re crossing our fingers for a dip at 8:30 on a too hot CPI with too cool Real Earnings and then a lack of Consumer Confidence at 9:55) of perfect directional picks as the market has very kindly behaved itself inside our short-term range, which we adjusted for the Dollar beginning last Wednesday, when I set "New Watch Levels" which have now been turned into our very useful multi-chart, thanks to the team at Stock World Weekly (which can be delivered to you on Sunday Mornings for just $295/year):

The "reference level" line is essentially the same Major Breakout Level we targeted for our indexes last November. Our Members have been using these charts all year and we made minor adjustments to account for Dollar drift and it’s affect on the indexes. Unfortunately, these levels – unlike our major 5% levels – need to be adjusted any time there is a significant change in the Dollar, which has drifted between 73 and 76 since mid-March, when the Japan quake drove us beneath that line.

So, obviously, we’ve been using 74.50 (the mid-point) as our base and this morning the Dollar is at 75.21 after being smacked down from 75.83 at yesterday’s open. Usually a 0.62 drop in the dollar would yield a 1.25% rise in the market but we’re only getting 1/2 that pop so far, which indicates that there are still plenty of bears out there – perhaps covering their tracks with Dollar weakness. Yesterday, we noticed some particularly strange activity as, near the close, many Nasdaq names began racing to their 52-week highs. This seemed odd as the index itself was well off it’s highs but it turns out, that in the broader index – 110 Nasdaq stocks made 52-week highs yesterday, despite just a 0.33% rise in the index, which lagged the other majors.

So, obviously, we’ve been using 74.50 (the mid-point) as our base and this morning the Dollar is at 75.21 after being smacked down from 75.83 at yesterday’s open. Usually a 0.62 drop in the dollar would yield a 1.25% rise in the market but we’re only getting 1/2 that pop so far, which indicates that there are still plenty of bears out there – perhaps covering their tracks with Dollar weakness. Yesterday, we noticed some particularly strange activity as, near the close, many Nasdaq names began racing to their 52-week highs. This seemed odd as the index itself was well off it’s highs but it turns out, that in the broader index – 110 Nasdaq stocks made 52-week highs yesterday, despite just a 0.33% rise in the index, which lagged the other majors.

David Fry is calling it a "Zombie Rally." You may have noticed I’ve mentioned Dave a lot lately – that’s because he’s our "go-to" chart guy when things get technical. As Dave said:

It was a challenge for many to describe what caused today’s rally. Some said it was higher commodity prices while others ascribed it to a weaker dollar. This seems counterintuitive but we’re dealing with hot money now. Economic data sucked. Retail Sales missed estimates and most of the .5% increase was in food and energy, and adjusting for inflation it was basically a flat number. Jobless Claims fell from the previous high reading the previous week but still missed estimates. Even the silly “core” PPI missed estimates while rising. Cisco (CSCO, down 5%) reported much weaker than expected forward guidance and the Treasury bond auction was poorly received so finding bullish news was a challenge.

But, POMO kicked-in and after a few days of around $20 billion in freshly minted greenbacks, the Primary Dealers (dba, Da Boyz) know what to do with it. Minneapolis Fed President Kocherlakota stated he wanted a “more expansive” definition of “extended period”; but, more importantly added the Fed’s goal was higher stock prices. What a shock! Lastly, rumors were circulating the congress and president was homing in on a debt ceiling agreement. If it happens, read the fine print. So stocks came off an early morning decline to rally into the close. The primary reason seems the Fed wants to reflate asset prices, namely stocks. Is that part of their mandate? No it isn’t.

We had a good tutorial in last night’s Member chat about HOW the market is manipulated but the short story is – SO MANY WAYS – but our man Cramer lays it out for the little guys about how he used to screw over retail investors through lies and manipulation when he ran a hedge fund – thank goodness he doesn’t do that anymore and now just directly tells retail investors what to buy and sell, right?

I often say to Members, we don’t care IF the game is rigged, as long as we can figure out HOW the game is rigged and play along but that’s not entirely true – my Liberal side still gets very angry to see the rich and powerful trounce all over the little guys but, frankly, since the last election, I don’t have a lot of pity for the little guys – they have the Government, the Markets and the Economy they deserve and it’s a Government that is currently running headlong into a shutdown, with House Conservatives demanding the Deficit be cut in half with $381Bn in spending cuts before they will agree to raise the Debt Ceiling.

“The fast-approaching debt ceiling vote gives us an opportunity to make a bold statement to the American people about what direction we want our country to go,” says a letter from 176 Republicans. The conservative group asked its members to demand that the deficit be cut in half; that a ceiling be imposed on spending equal to 18 percent of gross domestic product; and that a balanced-budget amendment be added to the Constitution. Spending now stands at 24 percent of GDP. Because the Congressional Budget Office projects higher revenue will reduce next year’s deficit from $1.4 trillion to $1.08 trillion, RSC spokesman Brian Straessle said another $381 billion would have to be cut to reduce the deficit by half.

“The fast-approaching debt ceiling vote gives us an opportunity to make a bold statement to the American people about what direction we want our country to go,” says a letter from 176 Republicans. The conservative group asked its members to demand that the deficit be cut in half; that a ceiling be imposed on spending equal to 18 percent of gross domestic product; and that a balanced-budget amendment be added to the Constitution. Spending now stands at 24 percent of GDP. Because the Congressional Budget Office projects higher revenue will reduce next year’s deficit from $1.4 trillion to $1.08 trillion, RSC spokesman Brian Straessle said another $381 billion would have to be cut to reduce the deficit by half.

Treasury has pushed the deadline back to August 2nd before we actually begin shutting down Government services but local Governments don’t have anywhere near that long as they must make draconian cuts by the June 30th end of their fiscal year. Iowa will shut down on July 1st, Minnesota on May 23rd, Virgina schools are shutting down, North Carolina is running out of time… well, you get the idea. So we’re talking millions of people with jobs who think they may not get paid in the near future – not to mention companies that do work for the Government directly or have businesses in Government towns – what kind of spending mood do you think they will be in while this nonsense drags out?

Speaking of nonsense – it’s 8:30 and we got our CPI report and consumer prices are up a whopping 0.4% in April, with core CPI at 2%, up from 1% in March. Don’t worry though, because April Real Earnings were DOWN 0.3% and Average Weekly Earnings are down 1.7% in 6 months – isn’t that FANTASTIC – we (as we all own the means of production, right?) get to charge more AND pay our employees less to make it – what can possibly go wrong?

Speaking of nonsense – it’s 8:30 and we got our CPI report and consumer prices are up a whopping 0.4% in April, with core CPI at 2%, up from 1% in March. Don’t worry though, because April Real Earnings were DOWN 0.3% and Average Weekly Earnings are down 1.7% in 6 months – isn’t that FANTASTIC – we (as we all own the means of production, right?) get to charge more AND pay our employees less to make it – what can possibly go wrong?

Over the past 12 months, Dr. Ben’s "transitory" inflation is running 3.2%, now at the highest figure measured since October of 2008, when the economy had already collapsed under the weight of rising prices and stagnant wages. Well, happy days are hear again folks so let’s party like it’s 1999 or August 2008 at least….

The chart on the left (thanks Pharm!) shows another inflation gauge, the year-over-year change in net import prices. It too is heading back to those 2008 pre-crash highs led by the same oil that is, even as I write this, rallying on the "great" CPI report. Fortunately, 40% of the CPI is housing and housing was up just 0.1%, which nicely offset April’s 1.9% increase in the Utility Bills that go with those houses as well as the 3.3% increase in Gasoline (up 33% for the year) and the 0.5% increase in Home Food costs. Even people who live in their cars took a hit this month as new vehicles rose 0.7%, as the quake in Japan made it less necessary for dealers to offer a good price to their suckers customers.

It’s funny (because it’s not us) that the Real Average Weekly Earnings for American Citizens fell from $352.87 to $350.75, while the price of a tank of gas to drive to work went from $40 to $60. What the Government needs to do is stop helping these people – it’s the only way they’ll learn, right? Unfortunately, as Corporate America is soon to discover, what they are going to learn is to ask for better wages, organize and strike – that’s my prediction for 2011 – if not sooner…

Don’t forget we still have that Michigan Sentiment report coming in at 9:55 and "experts" are predicting that it will be UP to 70.5 from 69.8 last month. How that is supposed to happen with inflation chewing into earnings at a rate of close to 1% a month – I have no idea but, then again – I don’t hold myself to be an expert at these things (mostly because those guys are idiots). We did short the Nas into the close yesterday and, pre-markets, they were threatening to screw up my week of perfect calls but now we are getting a bit of a sell-off and we’ll see what the reaction to Michigan will be BUT – weak Consumer Spending means less demand for Dollars so we may not get a good move down if the Dollar fails to hole the critical 75.25 line.

We shall see what the day brings. Congrats to all our early morning futures players as we were able to take advantage of the Dollar declining to the 75 line at 4am, where my early morning call to Members was to short the Nasdaq Futures at 2,414 (now 2,404) and to short the Oil (/QM) futures at $100.50, now $99.50 so very nice, big moves on those and we can now go for the Dow Futures short off the 12,675 mark, with tight stops above it – assuming the Dow will play a little catch-up to the downside once the bell rings.

I think it’s going to be a perfect week after all!

Have a nice weekend,

– Phil