Wheeeeeeee – that was fun yesterday!

Wheeeeeeee – that was fun yesterday!

We love a BS rally in the mornings, we got our double down on the USO puts as oil rose to $102.44 in frenzied (and totally BS) buying, which we expected in yesterday’s post – just not to that level of stupidity… I called for profit taking on the oil futures at 9:38 in Member chat and we got out right at the day’s low at $100.80 with a nice, quick .80 profit off the $101.60 line, which is $800 per contract.

We had the USO puts to make sure we didn’t miss out on a bigger down move and added some weekly puts that made a quick 20%, got out of those and kept the July puts (of course) but then oil went nuts and gave us a great short entry at the $102.25 line just after noon and from there we fell with little drama, all the way down to $101.30 at 2 and stopping out at $101.50 on the bounce was a very nice .75 gain ($750 per contract) and, with 270,000 open contracts, I hope everyone followed our strategy and stuck it to the speculators for a good $418M on the day!

Early this morning (5:30), we got another shot at a cross below $101.60 to short and got a nice .40 drop before stopping out at $100.25 for a quick .35 gain again (see the pattern) and now (8am) oil is down at $100.90 and we finally decided to take a poke at the long side (yes, I know, we are so ashamed to be participating) but all the better to flip short with on the silly pump job we expect into the open. If they want to take it lower (maybe back at our $100.60 line), we’ll be happy to stop out and go long again at lower strikes and, if they aren’t going to pump oil up into the weekend for a change – well, that’s what the July puts are for!

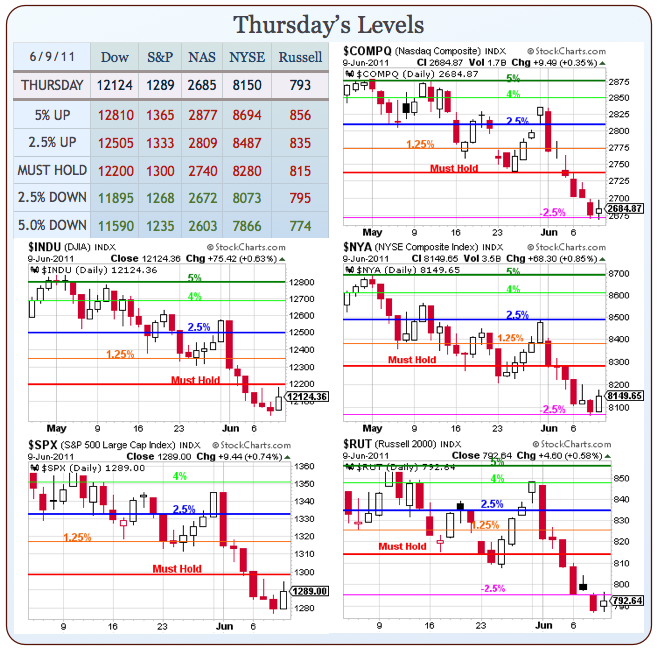

It was close but no cigar for the Russell yesterday as they tried to recapture that 795 level and that kept us from falling for the silly rally they tried to put up in the afternoon. Notice how well the Bots are behaving and following our pattern to a T. Unfortunately, it’s Friday and there’s too much danger of something very bad happening in Europe or Asia over the weekend that may boost the buck and send the markets crashing lower for us to be enthusiastic about bottom-fishing today. We’re already bearish and prepared for the next 2.5% drop and we’ll probably take an upside hedge or two into the weekend – just in case we pop back to Must Hold levels for expirations (next Friday) but if that’s all they can do by Friday, we’ll be shorting off that line again anyway.

It was close but no cigar for the Russell yesterday as they tried to recapture that 795 level and that kept us from falling for the silly rally they tried to put up in the afternoon. Notice how well the Bots are behaving and following our pattern to a T. Unfortunately, it’s Friday and there’s too much danger of something very bad happening in Europe or Asia over the weekend that may boost the buck and send the markets crashing lower for us to be enthusiastic about bottom-fishing today. We’re already bearish and prepared for the next 2.5% drop and we’ll probably take an upside hedge or two into the weekend – just in case we pop back to Must Hold levels for expirations (next Friday) but if that’s all they can do by Friday, we’ll be shorting off that line again anyway.

We already took a long on IWM over the RUT 785 line but, if you want some serious leverage, the IWM June $79/80 bull call spread is .50 and you can sell the $77 puts for .45 for net .10 on the $1 spread so 1,900% upside if IWM re-takes 80 (RUT 800) for next Friday’s options expirations. If the Russell falls below 770 (2%), you will then be assigned IWM as a long position at net $76.55, which is 2.5% down from here and our 10% line, where we would want to get bullish to protect our bearish plays in the very least so this is a hedge that should be a no-brainer for people who have shorts to protect.

See how easy it is to make 1,900% in a week? Don’t say I never gave you anything! We went short on gold at the $1,550 mark with a downside hedge but that one was more conservative, just looking for 300% at July expirations if gold fails to hold up. These are great hedges if you are a gold bug and don’t want to get out because you can, for example, take just $2,500 of a $155,000 position (100 ounces) to protect yourself at that $1,550 mark. If gold goes up, yes you lose the $2,500 but you make $2,500 if gold gets to $1,575 so you are paying for the insurance that gives you the comfort not to take a winner off the table (which is what sensible people SHOULD do). If gold does pull back, you make $15,000 on the hedge so you are protecting your gains down to $1,400 where you would stop out of your gold, cash the hedge and have kept all of your ill-gotten gain up to $1,550 even though you were too much of a dumb-ass to cash out on that silly spike.

So options are NOT all about taking risks – they are mainly about HEDGING your risks. The fact that they are misused and misunderstood by most people is sad but we do our best to teach people otherwise. On to news then:

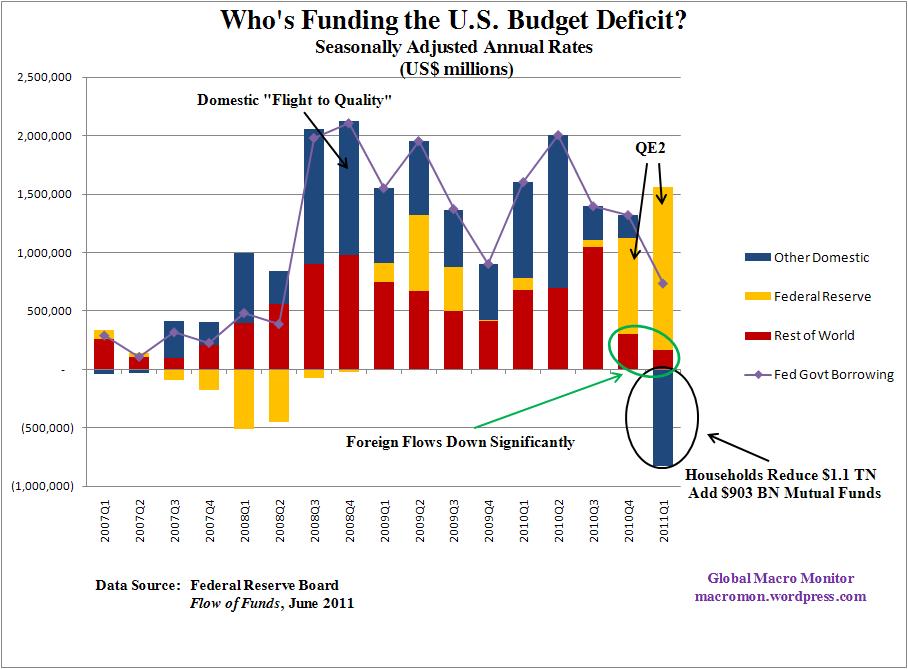

The Fed surpasses China as the largest holder of U.S. Treasuries, thanks to multiple QE operations. By the time QEII ends this month, the Fed will hold 16% of U.S. paper vs. 12% for the Chinese. Hopefully, the 3rd biggest holders – American households – will pick up the slack when the Fed steps away.

Incessant blustering about debt default by politicians will eventually erode faith in the dollar, but an actual default, even for one day, could lead to catastrophic consequences similar to what Argentina faced in 2002. Of course, the U.S. is helped by having the world’s reserve currency… for now.

I like that one! Very anti-Dollar and didn’t seem to do anything to depress it this morning. Now, perhaps this talk about not raising the debt ceiling is the only way the US will be able to save face by NOT issuing more TBills for a while since, without the Fed, there won’t be any buyers. It’s funny that we keep worrying about issuing more debt but if you want to see this economy collapse overnight, how about having a FAILED DEBT AUCTION?

I like that one! Very anti-Dollar and didn’t seem to do anything to depress it this morning. Now, perhaps this talk about not raising the debt ceiling is the only way the US will be able to save face by NOT issuing more TBills for a while since, without the Fed, there won’t be any buyers. It’s funny that we keep worrying about issuing more debt but if you want to see this economy collapse overnight, how about having a FAILED DEBT AUCTION?It’s hard to keep the dollar down at this point. UK Manufacturing fell the most in 30 months in April, dropping 1.5% in a single month. Attempts to brush it off as being caused by the wedding aren’t really flying and the FTSE is down 0.3% as of 9am. Saudi Arabia says they will bump up supply by 1.5M barrels a day to 10Mbd, another reason we will be selling into any BS rally in oil and loving our long-term short positions. If people sour on oil and other commodities, then they are forced to sell those shiny bits of metal and barrels of black goo in exchange for US DOLLARS. That then creates a DEMAND for US DOLLARS, which makes their value go up. Isn’t this all so convenient?

Another market that’s turning sour is Junk Bonds, as the weakening Global Economy makes investors finally realize what JUNK means. That sector fell 1% yesterday, the worst move in 3 months and that’s even more flight to Dollar safety so watch that 75 line on the Dollar today – if we break over that, the markets can drop to our 10% lines pretty fast and oil.. well, bye bye to that!

Have a great weekend and congrats to all our oil bears who helped us bust the speculators this week,

– Phil