How do you kill the Dollar?

How do you kill the Dollar?

That's the question that was on everyone's mind last week (and you can review our Billions of Dollars of profitable trade ideas in the Weekly Wrap-Up, many of which will be useful again this week if we keep falling!) as the smallest indication of Dollar strength caused a Global equity meltdown. As Stock World Weekly has been pointing out all year and as evidenced by this 2-year chart of the Dow relative to UUP (Dollar index), essentially our entire 40% rally since last summer was at least augmented by QE2's 20% weakening of Dollar buying power.

If we give the market the benefit of the doubt and say there should be a 1:1 relationship between the Dollar losing buying power and the price of equities (which are priced in Dollars) rising, then we could assume that 20% of the rise in the market was "natural" while the other 20% was inflated due to the weak Dollar. BUT – you have to take into account the double boost that is given to commodity companies who get paid more for what they sell so that's tremendous over- PRICING of the energy, mining and agricultural sectors. Our exporters also greatly benefited from the strong Dollar and that benefit will reverse itself should the Dollar reassert it's strength.

Obviously, no one is ready for this. The weak Dollar was pretty much the only reason we had the pretense of a global recovery. It made is look like there was a demand for commodities (there was not), it made it look like there was a demand for American goods (there was not) and it made it look like we were paying our debts, which we were – but with discounted Dollars that were being created by the Federal reserve at a rate of over $50Bn per month.

In fact, the Fed has expanded their balance sheet (ie. printed money) by $2Tn since October of 2008. As you can see from the chart on the left (from the Cleveland Fed), there have been huge increases this year in "Long-Term Security Purchase" (T-Bills) as QE2's primary purpose was to keep our lending rate artificially low by faking a demand for the $140Bn a month of debt paper that is being issued by Treasury.

This chart just covers the first four months of the year and you can see Long-Term Security Purchases (in Red) grow from $700Bn to $1.3Bn in 5 months of QE2 (beginning in December). This has not been an issue of the Fed putting training wheels on the bike for us – this is the Fed drugging us, sitting us on the floor, playing a video of a bike ride and pretending we are ready to go on our own.

Clearly we are not ready at all! Just the threat of the removal of QE2 has caused the global economy to begin to wobble and we've fallen 7.5% in 30 days and we can't get up. The Dollar hasn't actually gone anywhere – it has simply stopped going down. We spiked to a low of 72.95 at the beginning of May and are now back to the 75 lines, that's up 2.5% from where we called a market top due, in fact, to the Dollar bottom call we made at the same time. Now we are, hopefully, about halfway through a correction IF they can get the Dollar to stop at the 77.50 line, which is the falling 200 dma. We discussed this last night in Member Chat so I won't go back over it all here but it's all very dependent on whether or not we can slow this descent of the Global Markets to stop them from breaking critical technical support (as I mentioned last Tuesday, S&P 1,266 is the single most important line that needs to hold).

Clearly we are not ready at all! Just the threat of the removal of QE2 has caused the global economy to begin to wobble and we've fallen 7.5% in 30 days and we can't get up. The Dollar hasn't actually gone anywhere – it has simply stopped going down. We spiked to a low of 72.95 at the beginning of May and are now back to the 75 lines, that's up 2.5% from where we called a market top due, in fact, to the Dollar bottom call we made at the same time. Now we are, hopefully, about halfway through a correction IF they can get the Dollar to stop at the 77.50 line, which is the falling 200 dma. We discussed this last night in Member Chat so I won't go back over it all here but it's all very dependent on whether or not we can slow this descent of the Global Markets to stop them from breaking critical technical support (as I mentioned last Tuesday, S&P 1,266 is the single most important line that needs to hold).

The entire financial sector threw a temper tantrum starting with JPM's Jaimie Dimon, who whined almost as much as Bernanke as he spun his little tale of banking woe if Uncle Ben should cut off his QE2 money and leave him at the hands of the evil regulators and their "rules" that might stop him and his pals from destroying the Global Economy (again). That sent XLF down to new lows and the financials are down over 10% since early April and we're now playing them for a bounce this week in to option expiration day on Friday. What Dr. Bernanke and Mr. Dimon both seem to forget is we used to regulate banks just fine under the Glass-Steagall, which worked well for almost 70 years until it was repealed and replaced by the much more Republican Gramm-Leach-Bliley Act that paved the way for a decade of Bankers Gone Wild.

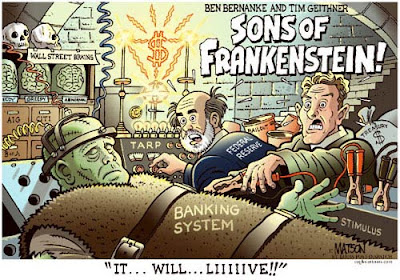

So here we are, 11 years after Gramm-Leach-Bliley paved the way for the destruction of the Global Economy and what are we going to do about it? We've created a monster and that monster is the heart of our economy – we can't kill it. We could have/should have let it die back in 2008 when the whole system was collapsing but, instead of spending $8Tn on unemployment and infrastructure (enough to give 150M US workers $53,333 each!), we gave it to the Banksters so that they could get back on their feet and, hopefully, eventually, trickle down some of their wealth on the rest of us.

So here we are, 11 years after Gramm-Leach-Bliley paved the way for the destruction of the Global Economy and what are we going to do about it? We've created a monster and that monster is the heart of our economy – we can't kill it. We could have/should have let it die back in 2008 when the whole system was collapsing but, instead of spending $8Tn on unemployment and infrastructure (enough to give 150M US workers $53,333 each!), we gave it to the Banksters so that they could get back on their feet and, hopefully, eventually, trickle down some of their wealth on the rest of us.

Of course it's stupid. It's also stupid that we have the World's lowest EFFECTIVE Corporate Tax Rate and that our top 400 households (who average $300M a year in income) pay an average of 16.6% in taxes while the average family earning over $1M a year pays an average of 22.8% in taxes – 33% LESS than families earning $50,000-250,000 a year! Our ENTIRE deficit is right there – in our lack of collections, not our excess of spending, which is in-line as a percentage of GDP with the rest of the World.

Keep in mind that the 11.2% per Million ($112,000) that a wealthy family doesn't pay, represents 11.2% MORE that 10 families earning $100,000 have to pay ($11,200) to balance out the revenues. This does not even take into account regressive taxes like Social Security, Medicare, Sales Taxes and Property Taxes – all of which disproportionately tax the poor as a percentage of their income. For people with fixed mortgages, rising property taxes are the number one reason families can no longer afford their "mortgage payment".

This was a very clever offshoot of the Reagan Revolution, where home ownership was encouraged under the Tax Reform Act of 1986 while, at the same time, the Government "de-centralized" and shoved a huge portion of the tax burden away from the Federal Government (where income is taxed progressively) and down to the Local Level, where regressive taxes were the norm. Over the past 24 years, this has shifted over $2Tn worth of tax payments from the top 1% to the bottom 90%.

Well, no use crying over spilled middle-class dreams, is there. What we have now is an economy that is almost entirely driven by Banking Interests so, if we want our markets to be strong, we need to do what is good for the banks. At the moment, that means keeping the Dollar as weak as possible and all the stops were pulled out this weekend, beginning with Jean-Clade Junker on Saturday, who lashed out at the US – calling our debt levels "disastrous." That managed to knock the Dollar down from Friday's 75.30 level back to the 75 mark in early EU trading and at 9:30 this morning we will hear from the Fed's Fred Lacker and then, at 7 pm, it's Fred Fisher's turn to give us an Economic Update.

On the other side of the pond, Bundesbank's Jens Weidmann says a Greek default would not destabilize the Euro saying: "If the commitments are not met, that cancels the basis for further funds from the aid package. This would be Greece’s decision, and the country then would have to bear the surely dramatic economic consequences of a default. I don’t think this would be sensible, and it would surely put partner countries in a difficult situation. But the euro would even in this case remain stable." Weidmann’s depiction of a default as a liveable outcome contrasts with warnings from fellow ECB officials Lorenzo Bini Smaghi and Christian Noyer, as well as European Union Economic and Monetary Affairs Commissioner Olli Rehn, who described it as a “Lehman Brothers catastrophe” last week – causing the Euro to hit new lows for the month.

Meanwhile, heading a little further East, China's June CPI will not hit a record high of 5%. According to the China Securities Journal, it is now likely to hit 6%. Meanwhile, our friends at the IBanks have boosted their bullish bets on Agriculture for the third consecutive week. If all goes "well", maybe we can shove China's food inflation high enough to push the CPI over 7% in July! It doesn't do any good to burst the oil bubble if all the money just moves into a food bubble. We made great money betting that just 369,000 oil futures contracts were unsustainable at $101+, now there are 759,974 net long Ag positions. This can get really, really ugly if they can't find some way to knock the Dollar back down.

Let's be careful out there.