We’re done with our week – good luck to the rest of you!

We’re done with our week – good luck to the rest of you!

Yesterday we flipped bullish at the bottom and went double long on FAS (ultra-long financials) at 10:10 in Member Chat and we went long on XOM, Gasoline, QLD and TNA within the next hour. In fact, since I had released the morning post for publication on Seeking Alpha – I even made sure to comment in their chat at 11:20 that we had flipped long – as the morning post was bearish and I didn’t want people reading it to be confused. That went out on our Facebook site (be sure to follow us PLEASE) and on StockTwits (where I still don’t have 100 followers even though I have over 6,000 on Twitter, where I never "tweet" – go figure) and even on LinkedIn (which I have no use for) so DON’T blame me if you missed the rally – there’s only so much I can do…

In fact, early this morning, I sent out an Alert about a move in the futures that I didn’t think many of our Members would be awake to take advantage of – so I thought I’d be nice and we posted it on Seeking Alpha and I Tweeted and Linked and Face’d it as well. The trade idea was to play The Dow Futures up off the 12,000 line and the Russell Futures up off the 800 line. About an hour later we had Russell 805 (up $500 per contract) and Dow 12,050 (up $250 per contract) and I called it a day in Member chat at 5:22. In Member Chat, we also worked in a nice oil trade that made another 83 cents on two legs ($830 per contract) but we were done with it all at 5:22 as the Dollar began to recover.

You can read all about the action in that morning Alert so I won’t get back into it. It’s exactly what I said, Greece is not really fixed and the whole run-up was nothing more than retail traders getting fooled by misleading newspaper headlines written by a Billionaire whose holdings are mainly in Euros. He got very, very rich(er) while all the suckers who pay to read his paper lost their asses – that’s the way of the World isn’t it? Don’t complain – you keep voting for it…

Now it’s 8am and we’re waiting for the GDP Report at 8:30 as well as Durable Goods so the per-markets are, sensibly, backing off again. We’re not crazy enough to bet the outcome: The GDP is the third and final estimate of the second quarter and is widely expected to come in at 1.8%. Durable Goods, however, were -3.6% in April and they are expected to rebound to about 2% in May but I’m not sure that’s going to happen – MAYBE the headline but not ex-Transportation, which is what really matters. Bad news has suddenly become bad for the market as QE2 winds down and this may be a tough one to shrug off – we’ll see in a few minutes but, while we wait – let’s check the news:

- The Economist argues again for a 3rd way in dealing with Greece: an orderly restructuring marking down the country’s debt by 50%. This would bring Greece’s debt/GDP level down to 80%, from where the country could hope to grow again. Yes, banks would have to take an immediate hit, but nothing their capital position can’t handle.

- The after-hours slide in Micron (MU) shares just gets worse after its dismal earnings report, setting up trouble in the chip sector tomorrow. "The PC environment is weak, at this point, and hard for us to call too much further out in the future," sales VP Mark Adams says on the conference call. After stumbling 21% in three months, shares after hours were down 12%.

- Crude is now -0.2% at $90.80 after giving up gains of as much as 1.5% following yesterday’s 4.6% slump due to the IEA’s decision to release 60M barrels of oil reserves. Prices had risen on concerns about the ability to respond to supply disruptions in future.

- JPMorgan (JPM) gives up on over 1,000 debt-collection lawsuits it had filed in five states as it tried to recover soured credit-card loans from borrowers. JPM refuses to comment, saying it considers "our collections strategy to be proprietary."

- Another member of the ruling PASOK party hints he may vote against the fiscal reform plan necessary for continued EU/IMF funding for Greece, telling Bloomberg a ‘no’ vote is "the direction I am leaning." Combined with other defections, this would bring the PASOK majority down to 3.

- Trading in Italian bank stocks has been suspended following steep drops after Moody’s put them on negative outlook. Unicredit -8%. Other European lenders are dropping as well. Premarket: STD -2.7%,BBVA -3.1%, DB -2%, CS -1.4%.

- Has Chinese Premier Wen Jiabao given risk markets a big green light? Writing in the FT, he says China’s battle against inflation has worked, with price levels expected to "drop steadily" from here. A key market worry – tight money and a slowdown in China – may have just been lifted. Asian markets and commodities are up sharply. Non-paywall summary here.

Wow, lots of conflicting events on the table. I think no matter what the reports are, we head higher. Oil should be playable up over the $91 line today and gold off the $1,520 line, especially with Ron Paul holding hearings on "The Gold Reserve Transparency Act of 2011", which directs the Treasury Department to "conduct a full assay, inventory, and audit of federal gold reserves, including an analysis of the sufficiency of the measures taken for their security."

Wow, lots of conflicting events on the table. I think no matter what the reports are, we head higher. Oil should be playable up over the $91 line today and gold off the $1,520 line, especially with Ron Paul holding hearings on "The Gold Reserve Transparency Act of 2011", which directs the Treasury Department to "conduct a full assay, inventory, and audit of federal gold reserves, including an analysis of the sufficiency of the measures taken for their security."

"For far too long, the U.S. government has been less than transparent in releasing information relating to its gold holdings," Paul said in his opening statement, explaining that this lack of information has only created questions and given rise to theories like the bars of gold in Fort Knox are "actually gold-plated tungsten." "No one from Congress has been allowed to view the gold at Fort Knox in nearly 40 years," Paul stated.

Ron Paul is great. He’s like that semi-senile grandfather you have that says all kinds of bat-shit crazy things but you love the guy and, once in a while – you kind of wonder if he’s actually got a good point. Ideally, I’d like to see a huge run-up in gold if the pass the audit bill because – if they don’t find "gold-plated tungsten" in Fort Knox, gold is going to make on fantastic short as this kind of idiotic nonsense is about 1/3 of current $1,500 price. Even without an audit, our target for a gold pullback is $1,250, maybe even $1,100 once the Dollar moves up but WITH and audit – they might lose $1,000 as some of the loony hoarders wake up and smell the bullion.

8:30 Update: GDP came in at 1.9%, right about in line but the GDP Price Index came in hot at 2% but don’t worry because Corporate Profits are up 7.8% and that’s up 34% from the original estimate of 5.8% – ISN’T THAT FANTASTIC? The inflation is being rammed down the consumers throats and our wonderful Corporate Masters are able to use it to IMPROVE their margins (mainly by laying off 400,000 Americans a week and reducing the size and quality of the products they sell) so it’s BUYBUYBUY as long as the Dollar stays below the dreaded 76 line (preferably below 75.75) but that is, unfortunately up to Europe – who are still a friggin’ mess!

8:30 Update: GDP came in at 1.9%, right about in line but the GDP Price Index came in hot at 2% but don’t worry because Corporate Profits are up 7.8% and that’s up 34% from the original estimate of 5.8% – ISN’T THAT FANTASTIC? The inflation is being rammed down the consumers throats and our wonderful Corporate Masters are able to use it to IMPROVE their margins (mainly by laying off 400,000 Americans a week and reducing the size and quality of the products they sell) so it’s BUYBUYBUY as long as the Dollar stays below the dreaded 76 line (preferably below 75.75) but that is, unfortunately up to Europe – who are still a friggin’ mess!

Durable goods came in at a solid 1.9% but just 0.6% ex-Transport but that’s a damned site better than -3.6% and don’t forget, this is May and is already counted in the Q2 Final GDP so who really cares anymore, it’s all about looking ahead now. So, going back to Europe, the German IFO business sentiment index unexpectedly rose for the first time in 4 months in June, coming in at 114.5 vs. a forecast 113.5. Hans-Warner Sinn, President of the IFO, maintains the economy is continuing "a robust upswing."

BOE Governor, Mervyn King is working it across the pond, saying: "The direct exposure to Greece of U.K. banks is really remarkably small," which is Central Banker speak for "the indirect exposure is catastrophic" but at least he’s trying. "I’m not sure the sovereign debt crisis and what happened to Lehman Brothers have much in common," said the Governor – let’s hope he doesn’t find out the hard way because I seem to remember Lehman saying the same thing about Bear Stearns about a week before they went under.

As for us – we don’t care! We had a great week, got to cash and we’re just cruising into the weekend. With any luck we’ll be mission accomplished on our $25,000 Virtual Portfolio next week (or at least by the end of the month), which was our $10,000 Virtual Portfolio last year – and we can cash it out with $50,000 virtual dollars so we can start from scratch and let new Members catch up with all fresh trades and a goal of doubling up over the next 6 months in our very, VERY aggressive virtual portfolio.

As for us – we don’t care! We had a great week, got to cash and we’re just cruising into the weekend. With any luck we’ll be mission accomplished on our $25,000 Virtual Portfolio next week (or at least by the end of the month), which was our $10,000 Virtual Portfolio last year – and we can cash it out with $50,000 virtual dollars so we can start from scratch and let new Members catch up with all fresh trades and a goal of doubling up over the next 6 months in our very, VERY aggressive virtual portfolio.

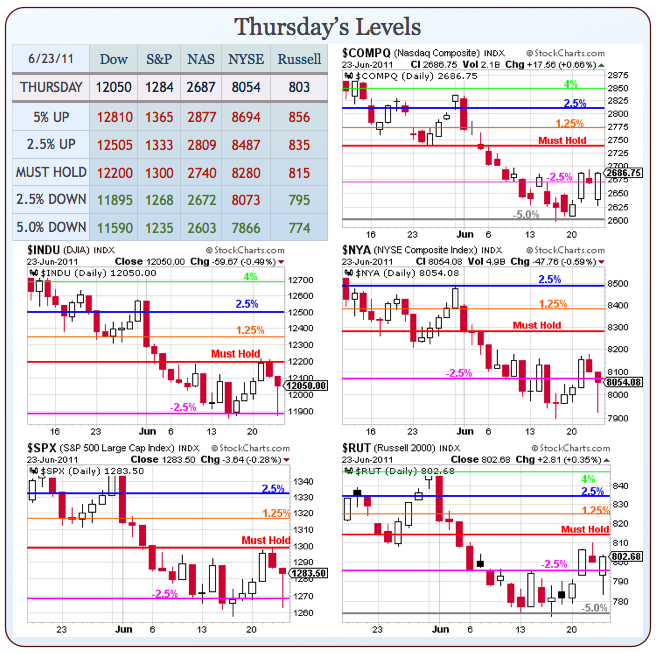

Meanwhile, we’ll be watching our Big Chart levels and look how well they have been behaving! Both the Dow and the S&P ran right down to our 2.5% lines yesterday and held them very nicely while the RUT popped right back over their 2.5% line along with the Nasdaq and we’re waiting for the NYSE to stop being a drag (as usual) and confirm our theory that next week is going to be fun with a mega-pump into end of month window dressing.

As I’m writing this (9:20) gasoline (/RB in the Futures) is back at $2.82, where we had a great long play yesterday. Gasoline contracts can be violent movers and the contracts are, oddly, $4.20 for each .0001 move so VERY nasty if you get them wrong ($420 per penny!) but lots of fun when they go right and gasoline is so often pumped up into the weekend, it just seems like a nice trade idea for the morning. The Dollar is currently at 75.89 so no play if it’s over 75.90 but I think they are just pumping the Dollar up pre-market so they can take it down at the bell and create some buying excitement at the open.

As I said to Members yesterday, sometimes the manipulation is so blatant that I am ashamed to participate in this market but, other times – it’s a really fun way to make a living -especially if you don’t take it too seriously…

Have a great weekend,

– Phil