In a gadda da vida, honey

Don't you know that I'm lovin' you

In a gadda da vida, baby

Don't you know that I'll always be trueOh, won't you come with me

And take my hand

Oh, won't you come with me

And walk this land

Please take my hand

That's all the lyrics there are in the 17 minute and 10 second song "In-A-Gadda-Da-Vida" by Iron Butterfly yet it sold 4M copies (the most ever for Atlantic Records at the time) and was on the charts, with a hit run for 140 weeks. 43 years later, it's "Iron Who?" and I challenge anyone reading this to name another song of theirs. Market rallies are kind of like that – once they get going, you often forget how they started and, after they end, you can only wonder what kind of drugs people were on when they were buying…

We have talked for years about the myth of China's "infinite expansion" that has been driving the global economy, particularly the commodity bubble. We've talked about the empty cities and shopping malls, the unused rail lines and airports, the bridges to nowhere, etc. that dot the Chinese landscape because it's easy to grow a $5Tn economy 10% a year if the Government spends $500Bn a year building things that no one needs. China's "boom" began with their preparations with the 2008 Olympics, for which they spent over $400Bn on infrastructure projects in preparation. China was "booming" and China became as addicted to infrastructure spending as the US ever was to oil. And who was pushing behind the scenes to encourage this madness – why GE, of course – China's pump-masters on CNBC!

Recently, local government debt has become a concern in China and, as recently as June, Standard Chartered had warned that debt would hit $2Tn Yuan ($308Bn) by 2012, which was likely to trigger a debt crisis in China. The report, authored by Fraser Howie, also the co-writer of a book entitled 'Red Capitalism,' which portrays a gloomy picture of China's 'fragile' financial system, said that banks could resort to fraud and false reporting on their balance sheets to cover up any losses arising out of lending to local governments. As a last resort, they might even be forced to seek capital injections, it noted.

According to data from the People's Bank of China, the central bank, there are more than 10,000 financing vehicles set up by local governments, with a total debt of 14.4 trillion Yuan ($2.22 Trillion), or 30 percent of the country's outstanding loans denominated in Yuan — much higher than Standard Chartered's estimate of 10 trillion Yuan ($540 Billion). Few stock analysts were alarmed by Standard Chartered's report: 20 of the 24 analysts tracking the China Construction Bank had a 'buy' or 'accumulate' rating on the stock; not one of them rated it as a 'sell.' Similar ratings were given to the Industrial and Commercial Bank of China's shares.

According to data from the People's Bank of China, the central bank, there are more than 10,000 financing vehicles set up by local governments, with a total debt of 14.4 trillion Yuan ($2.22 Trillion), or 30 percent of the country's outstanding loans denominated in Yuan — much higher than Standard Chartered's estimate of 10 trillion Yuan ($540 Billion). Few stock analysts were alarmed by Standard Chartered's report: 20 of the 24 analysts tracking the China Construction Bank had a 'buy' or 'accumulate' rating on the stock; not one of them rated it as a 'sell.' Similar ratings were given to the Industrial and Commercial Bank of China's shares.

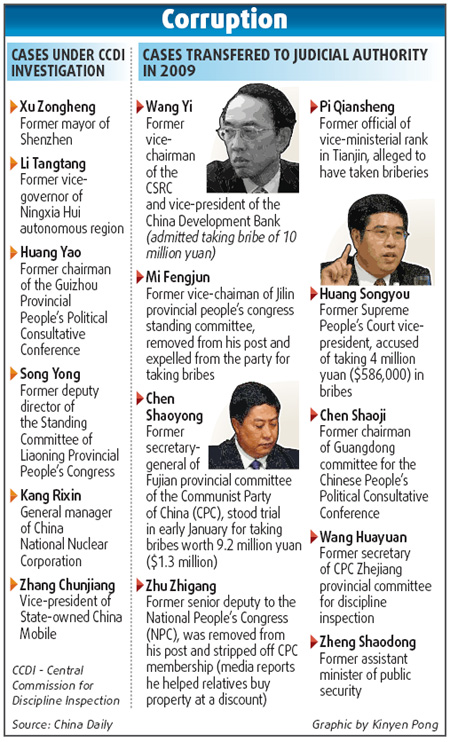

Now it has been confirmed by China's National Audit Office has found there is ALREADY $1.66Tn (10.72Tn Yuan) in local debt (20% of the GDP) and the report shows that 2,746 of the 2,800 municipalities audited are "at risk" of no being able to repay their loans. That's 98.1%! What's even more disturbing is that, just one year ago, the figure released was just 2.79Tn Yuan, just 26% of the new total. Did spending quadruple in one year (that would be bad) or were they lying then? That would then lead to the very important question – are they still lying?

Moody's is now leaning towards "still lying" and has identified AN ADDITIONAL (are you seeing a theme here?) 3.5 TRILLION Yuan ($540Bn) that did not show up in the NAO report. Moody's says that the potential scale of the problem loans at Chinese banks may be closer to its stress case than its base case, when considering the apparent absence of a clear master plan to deal with this issue. Moody's also views the credit outlook for the Chinese banking system as potentially turning to negative.

Moody's is now leaning towards "still lying" and has identified AN ADDITIONAL (are you seeing a theme here?) 3.5 TRILLION Yuan ($540Bn) that did not show up in the NAO report. Moody's says that the potential scale of the problem loans at Chinese banks may be closer to its stress case than its base case, when considering the apparent absence of a clear master plan to deal with this issue. Moody's also views the credit outlook for the Chinese banking system as potentially turning to negative.

"We assume that the majority of loans to local governments are of good quality, but based on our assessment of the loan classifications and risk characteristics, as provided by the NAO and other Chinese agencies, we conclude that the banks' exposure to local government borrowers is greater than we anticipated," says Yvonne Zhang, a Moody's Vice President and one of the authors of the report.

In other ratings agency news (and other national disasters in the making), S&P says Greece may be in "Selective Default" which means you can screw some of the people all of the time or all of the people some of the time BUT, if you screw all of the people, all of the time – NOW THAT'S DEFAULT! “Sentiment was undermined with those S&P comments,” said Jeremy Stretch, head of currency strategy at Canadian Imperial Bank of Commerce in London. “Markets are reluctant to aggressively sell the euro, though. We need to see what the other rating agencies are going to suggest.” Isn't that precious? Hope really does spring eternal…

Despite Greece being "fixed" (according to Mr. Stretch and the rose-colored glasses brigade), The cost of insuring against default on European sovereign and corporate debt rose, according to traders of credit-default swaps. The Markit iTraxx SovX Western Europe Index of swaps on 15 governments climbed 3 basis points to 221 at 12 p.m. in London. An increase signals deteriorating perceptions of credit quality. Swaps on Greece climbed 14 basis points to 1,875, according to CMA. Contracts on Spain jumped 6 basis points to 263, Portugal increased 5 to 755 and Ireland rose 4.5 to 732.5, while Italy was 4 higher at 182 and Belgium was up 3 at 146 so we're just barreling trough on to our next crisis – or do people REALLY think that Portugal and Ireland can afford to borrow money at 7.5%?

Of course, even though Greece is "fixed" – it still may become "unfixed" if Germany's Constitutional Court rules that Germany's participation in the $113Bn bailout violates their own constitution. This is, however, the third attempt to stop the bailouts: “The court has always been very critical on the European integration in its language — only to be rather conciliatory when it comes to the practical results,” said Axel Kaemmerer, a professor at Bucerius Law School in Hamburg. “The judges may lift their fingers to admonish the government about red lines that cannot be crossed, but in the end it won’t rain on its parade.”

We talked about Barron's bullish call on oil in the weekend post and Bloomberg reports I'm not the only one who is skeptical about commodities as Funds Slash Bullish Commodity Bets to One-Year Low on Slow Growth Outlook. Funds have reduced bullish bets on commodity prices to the lowest level in almost a year on speculation that slowing global growth will curb demand for metals, energy and grains. Speculators cut their net-long positions in 18 U.S. commodities by 15 percent to 958,309 futures and options contracts in the week ended June 28, government data compiled by Bloomberg show. That’s the lowest since the week ended July 13 last year, when oil was trading closer to $75, not $95! Also from the wayback machine, gold was $1,200 last summer, silver was $17.50 and copper was $3 so PLENTY of room for a commodity crash IF the Dollar wakes up.

Of course we're short oil (/CL in the futures) below the $96 line it looks to open today. They were spilling oil all over the place this weekend in an attempt to drive up prices and despite the fact that Asian and European traders never bought a barrel over $95.50 yesterday, the minute the NYMEX opened, those crooks ran the price right up to $96.50 and we hope they take it $97.50 so we can short it there but, if they fail $96 – that's fine too for our first entry as we enter into the next rollover cycle (more on that tomorrow).

Overall Consumer Prices in OECD nations are up 3.2% in May, 10% higher than April's 2.9% pace so inflationary pressures are accelerating rapidly – now at the fastest pace measures since right before the Global economy collapsed in 2008 and, right on cue, rice is now projected to rise 56% (number pulled out of someone's ass) as the Pro-Thaksin Party sweeps to power in Thai elections. The party that won parliamentary elections is expected to implement a policy to buy the crop from farmers above current rates. A Bloomberg survey last month, conducted during the campaign, suggested a gain to $750 per ton if Pheu Thai were to win. “It isn’t only Thai prices that will go up, the rest of the world will have to follow,” Mamadou Ciss, chief executive officer of Hermes Investments Pte, said from Geneva. With rice – fear of high prices often leads to high prices (remember all the idiots who were stockpiling it in 2008?). Unfortunately, rice is the staple of the World's 2Bn malnourished people and rice, more than anything else, can quickly lead to mass starvation.

We're already short (see last week's posts and this weekend's Stock World Weekly) – you be careful out there!