Here we go again!

Here we go again!

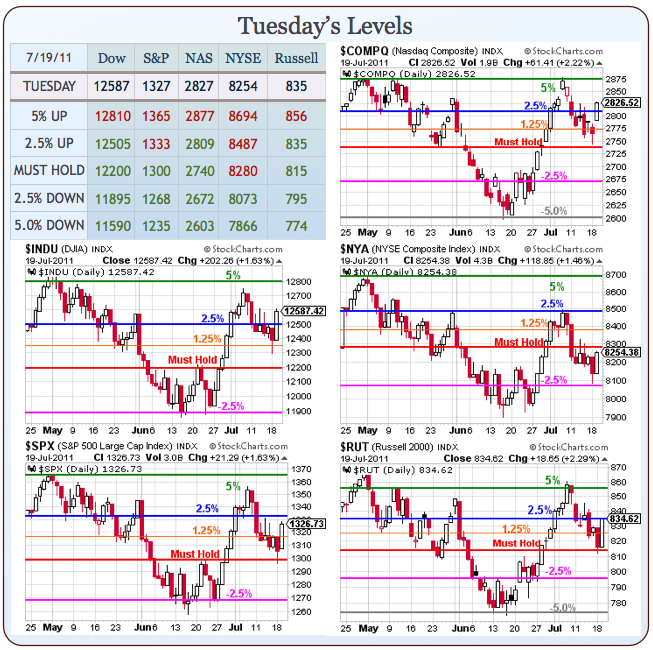

We blew right though our expected bullish levels of Dow 12,500, S&P 1,317, Nasdaq 2,775 and Russell 825 but failed to make 8,300 on the NYSE so, as usual, our biggest and most difficult to manipulate index is holding us back – flashing a warning sign while the other indices scream for us to "party on." Fortunately, as I mentioned in yesterday’s morning post, we had already gone aggressively bullish with the SPY Aug $128/131 bull call spread at $1.83, selling the Sept $120 puts for $1.57 and that net .26 spread is already net $1.86 – up 615% since I posted the trade idea at 12:53 in Monday’s Member Chat.

It’s good to have a few aggressive trades like this to take advantage of market bounces. Before that we had taken the SSO Aug $51/53 bull call spread at $1.05, selling the Sept $44 puts for $1.07 for a net .02 credit at 10:46 in Member Chat (the SPY play was for late-comers who missed out on SSO). The Aug $51/53 spread finished the day yesterday at $1.35 but the real win comes from the short $44 puts, which fell to .70 so the .02 net credit is now a .65 net credit for .67 total profit, up 3,350% in less than 48 hours. See, options are fun!

The only other trade ideas from Monday were a long-term bullish play on RIMM (selling 2013 $22.50 puts for $4.20) a long futures play on the Russell Futures (/TF) off the 810 line (now 835) and I reiterated our bearish spread on CMG as I felt they would disappoint on earnings (they did). Yesterday we picked up a long-term longs on GLW, RYAAY and WFR, half covered our FAS longs (iffy so far), took a poke at shorting the DIA that worked for a quick 10%, shorted oil with a DUG spread (futures too scary) and picked up another short spread on CMG – selling 3 Aug $330 calls for $16 ($4,800) against 2 long Dec $360 calls at $18 ($3,600) for a net $1,200 credit – those should be nice winners this morning!

In the afternoon we flipped more bearish and picked up 10 SPY weekly $133 puts at $1.15 ($1,150 of our virtual dollars) for our $25,000 Virtual Portfolio and those are probably going to hurt this morning as the Dollar has been jammed down to 75.05 in pre-market trading and that’s down almost 1% from yesterday’s high but, since we’re only getting a .5% rise in the indexes – I’d have to say we’re right to be bearish and we will be pressing that bet into any rally that doesn’t take us over that critical 1,333 mark on the S&P.

In the afternoon we flipped more bearish and picked up 10 SPY weekly $133 puts at $1.15 ($1,150 of our virtual dollars) for our $25,000 Virtual Portfolio and those are probably going to hurt this morning as the Dollar has been jammed down to 75.05 in pre-market trading and that’s down almost 1% from yesterday’s high but, since we’re only getting a .5% rise in the indexes – I’d have to say we’re right to be bearish and we will be pressing that bet into any rally that doesn’t take us over that critical 1,333 mark on the S&P.

We’re also going to be very excited to be shorting oil this morning (/CL in the Futures) as we play it below the $99 line but, maybe with inventories at 10:30 and the weak dollar – we’ll have a chance to short the $100 line again! You can "fix" Europe all you want and raise our debt ceiling to infinity and beyond but that still won’t make $4 per gallon gasoline affordable to beleaguered consumers…

Speaking of Europe and disasters we seem to be ignoring – Greek 2-year notes shot up to 40% this morning. That’s right, if you are brave enough to lend Greece money for 2 years, they will pay you 80% interest on your money (if, of course, you get ANY of it back). Now how screwed up do things have to be in Europe for millions of potential investors to pass on 20%, 25%, 30%, 35% and now 40% annual interest on a Member Nation of the EU that is supposedly "fixed." ARE YOU PEOPLE FRIGGIN’ COMATOSE?!?

40% (Forty Percent)! 40%. 40%. Sorry but it’s 40%. Who gives you 40% interest? Nobody, right? Do you know why? Because, generally, long before anyone is in a position to offer 40% interest – they are TOTALLY BANKRUPT! There are no functioning businesses paying 40% interest on money. There are no functioning countries paying 40% interest on money – IT’S NOT POSSIBLE. WAKE UP PEOPLE – WAKE UP!!! Think McFly:

Even AAPL, who made $7.31 BILLION last quarter on $28.57Bn in sales CAN’T afford to borrow money at 40% because that’s "just" a 25% profit margin for them so they would be falling behind 15% a year on the loan at 40% interest. At 40% interest compounded over 7 years, $10,000 loaned to Greece becomes $105,413.50 – AM I GETTING MY POINT ACROSS??? What the Hell is wrong with investors that they are not concerned about this? This isn’t some minor African nation or some Asian Kleptocracy – this is the World’s 32nd largest economy ($305Bn) as well as the World’s oldest Democracy (yeah, that system’s working out great, isn’t it?).

If you have access to the capital markets, you can borrow $100M from your favorite Central Banks at 2.5% or less and lever that cash 8 times and buy $800M worth of Greek 2-year notes at 40% and collect $320M a year in interest. That’s paying your Central Bank loan back the whole $102.5M in year one and having $217.5M to put in the bank (may as well lever up again, right?) and collecting another $400M next year and getting your $800M back ($100M of cash) so you net a profit of $717.5M in 48 months on $100M borrowed. THAT is how rich people make money! Who needs options or futures when you have this gig?

That’s the game that’s going on now and that’s the same game the Investment Banks were playing with BSC and LEH in 2008 – they "KNEW" they were going to get bailed out so they kept lending them money at ever-increasing interest rates – even though those rates were obviously unsustainable. Once the hyenas were done picking the bones clean off of one victim, they would start rumors and cause runs on the next bank, knowing that, ultimately, the Government would end up throwing the American people Trillions of Dollars into debt rather than let a wealthy bond speculator take a loss. That was a definite with ex-Goldman CEO, Hank Paulson as Secretary of State – his friends were saved and his enemies were ground into dust.

Now we have the EU crisis and DSK was removed on the eve of the meeting that was going to bail them out (May 15th) and now Christine Lagarde has taken his place at the IMF and rates are 15% HIGHER (60% of 25%) than they were in mid-May. The Dow was at 12,500 on May 15th as well and we fell to 11,862 (5%) over the next 30 days as Greece was alternately "fixed" and then "not fixed" on a pretty-much daily basis. If you take a step back and look at the above chart – it would seem Greece is not actually fixed, right?

Ignoring the situation in Greece is like ignoring cancer because "it’s only in one lung" – not smart! And it’s not only one lung, is it? It’s Ireland paying 13.42% for a 10-year, Spain at 5.99%, Portugal 12.65%, Greece 18.11%, Italy 5.64%… If the US were paying 6% interest on our debt, the interest payments alone would be $1Tn a year. You could cut Government Spending to zero and we’d still double our deficit in 12 years. At 13.42% for 10 years, Ireland must pay back $3.5Bn for each Billion it borrows – that would be like the US paying back $52.8Tn by 2021 on our $15Tn debt – assuming we had an otherwise balanced budget! This isn’t a small problem – it’s a catastrophic one and it’s getting worse and worse every day yet this market is UP over 5% in the past month – as if there wasn’t a care in the World.

Ignoring the situation in Greece is like ignoring cancer because "it’s only in one lung" – not smart! And it’s not only one lung, is it? It’s Ireland paying 13.42% for a 10-year, Spain at 5.99%, Portugal 12.65%, Greece 18.11%, Italy 5.64%… If the US were paying 6% interest on our debt, the interest payments alone would be $1Tn a year. You could cut Government Spending to zero and we’d still double our deficit in 12 years. At 13.42% for 10 years, Ireland must pay back $3.5Bn for each Billion it borrows – that would be like the US paying back $52.8Tn by 2021 on our $15Tn debt – assuming we had an otherwise balanced budget! This isn’t a small problem – it’s a catastrophic one and it’s getting worse and worse every day yet this market is UP over 5% in the past month – as if there wasn’t a care in the World.

Greece was first "fixed" last May and the global markets collapsed anyway. Ireland was "fixed" on Thanksgiving last year and we had a nice Santa Clause rally that topped out a Dow 12,400 in February before we fell back to 11,555 in March. Now we’re back around our famous 2.5% levels of Dow 12,500 and S&P 1,333 and it makes sense the Dow is driving higher on earnings as the large-cap Industrials that do more business outside the US than inside it have been benefiting from a cheap (weak) Dollar on the exchange rates and that’s inflating their sales and profit figures (as long as you ignore the fact that it’s all transitory currency gains).

Take IBM for example, Total Global Service Revenue Grew 10.1% last quarter but, measured in constant currency, that number is actually 2%. Since American investors are completely oblivious to currency fluctuations (which explains why they let themselves get raped by the Fed as they repeatedly devalue the Dollar to prop up the markets), IBM jumped up 5% in yesterday’s trading anyway as the headlines were, in fact, excellent-looking and, as Fernando has taught us – It is better to look good than to feel good – and IBM LOOKS marvelous! Also boosting IBM’s looks were share repurchases, which added 18 cents to profits (5.8%) which, according to Zacks, "fully offset weak margins in the quarter."

Are you freakin’ kidding me?