Wheeeeee, this is fun!

Wheeeeee, this is fun!

As I mentioned in yesterday's post, the move up in the markets was an excellent time to establish some disaster hedges because – well, that's what you do when you are heading into a potential economic disaster, isn't it?

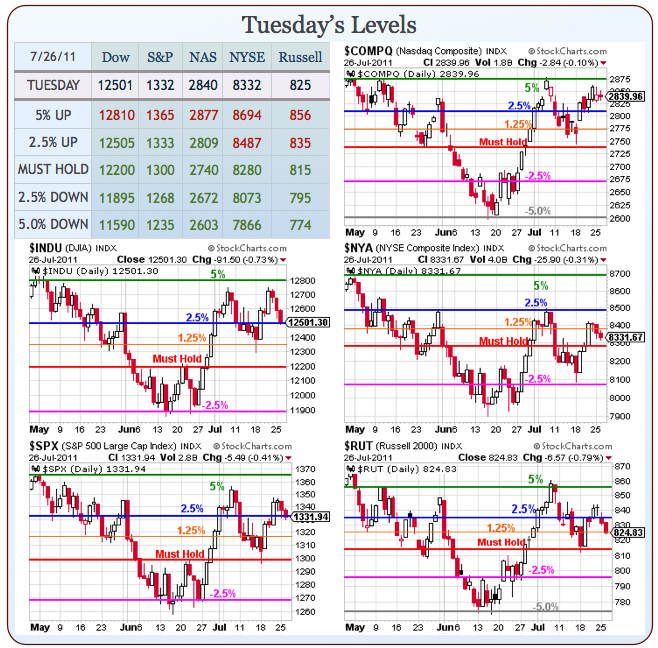

I've laid out my concerns since last week so now it's just time to sit back and enjoy the ride. In addition to the bearish bets I outlined in yesterday's morning post, we added a short play on copper futures (/HG) at $4.45 (reiterated in this morning's Alert to Members) and THREE (3) Disaster Hedges using SQQQ, TZA and EDZ – each of which return well over 1,000% should the markets falter and, if those 2.5% lines fail on the Dow and the S&P today – faltering is going to be pretty likely.

Of course we don't go 100% bearish and we picked up a very nice 42% winner day-trading oil up (USO), of all things. After we cashed out our winning short trades on the Futures at the $98 line, we got a nice ride back to $100.50 where we shorted again and now we're back to $98.50 this morning so – wheeeeeee! Gotta love that oil scam, right? Another long we took was a protective bullish spread on IWM – just in case our "leaders" actually "fix" the debt ceiling but that's not looking very likely this morning with Boehner's ridiculous plan being so poorly contrived that he is now unable to get his own party behind it.

That is, of course, the "plan" that President Obama said he will veto and that the Senate has already said no way to but, like a child throwing a temper tantrum, Boehner has decided that the Republican Controlled House of Representatives will now spend 72 hours working on this non-starter of a plan rather than sit down and attempt to have constructive negotiations.

As we expected, the continued uncertainty out of Washington is having the perverse effect of panicking people INTO the Dollar, which is the main reason we got so bearish on stocks, copper and oil. We also get oil inventories this morning and Durable Goods at 8:30 along with the Chicago Fed Index so it's going to be a very exciting morning in a day when about 100 companies report earnings as well.

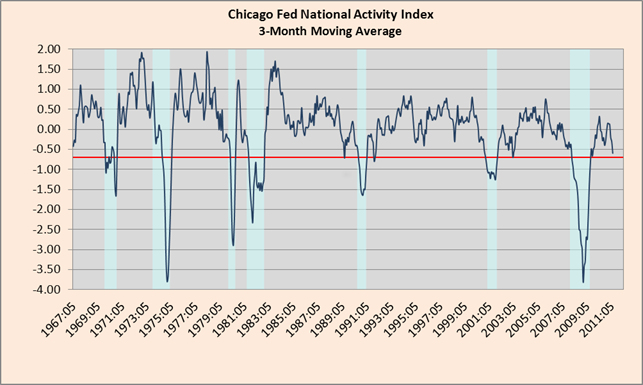

In my Morning Alert to Members this morning (4:40), I warned that "the BOJ could step in at any moment to push the Dollar up, which would not be good for our markets." Lo and behold, at 5:15 there was a huge buy-in on the Dollar that took it from 73.63 all the way back to 73.95 and that knocked the Futures down considerably. Now (8:15), we're at the mercy of the incoming data but the MBA Mortgage Application had a nasty turnaround, falling to -5% this week after showing up 15.5% last week – so a dramatic 20.5% turnaround off last week's strangely bullish number that sparked a BS rally. Also, the Chicago Fed National Activity Index is getting back to SCARY:

There's a lot of red sneaking into the earnings reports now that we're moving out of the Fortune 500 and into companies that don't do a lot of business overseas (where the weak dollar helped boost APPARENT sales). It's 8:30 now and it's certainly no shocker that Durable Goods are down a TERRIBLE 2.1% and that's sending the markets even lower in the Futures – not helped at all by a flat Chicago Midwest Manufacturing Index at 84, which is down 16% from 2007's base level.

Now there's a good guideline. Let's look at this VERY simply. Manufacturing activity is down 16% from 2007 and the Dow was at about 13,500 in 2007 and 84% of 13,500 is 11,340. On the S&P we can take 84% of 1,450 and that gives us 1,218 so lets call that the bottom of our broader range and that's not too far off our 5% lines of 11,590 and 1,235, which makes sense as the Dow is distorted by component changes since 2007 more so than the S&P. It's a pretty simplistic way to look at things but it does make us feel good about picking up a few more long positions once we get back to those 5% lines at the bottom of this little panic sell-off (IF we get that far). Meanwhile – wheeeeeeeeeeee!!!

Now there's a good guideline. Let's look at this VERY simply. Manufacturing activity is down 16% from 2007 and the Dow was at about 13,500 in 2007 and 84% of 13,500 is 11,340. On the S&P we can take 84% of 1,450 and that gives us 1,218 so lets call that the bottom of our broader range and that's not too far off our 5% lines of 11,590 and 1,235, which makes sense as the Dow is distorted by component changes since 2007 more so than the S&P. It's a pretty simplistic way to look at things but it does make us feel good about picking up a few more long positions once we get back to those 5% lines at the bottom of this little panic sell-off (IF we get that far). Meanwhile – wheeeeeeeeeeee!!!

We're watching that 2,809 on the Nasdaq, which is 30 points below yesterday's close (1%) so we expect it to hold today but that's going to be our critical level and Jimmy Cramer is herding his sheeple back into NFLX because his hedge fund buddies aren't done dumping it yet. Cramer's logic for buying NFLX? It's cheap compared to LNKD! No, I'm not kidding – he actually said that with a straight face.

This is starting to look like 2008 in many ways, complete with CNBC giving investors the "all clear" signal to buy stocks, over and over and over again – as they leg lower and lower and lower. Is this time going to be different? As long as Congress and the White House can all sit down like adults and hammer out a truly balanced plan that addresses our long-term debt issues without throwing millions of more people out of work with ill-conceived cut-backs – MAYBE…

Otherwise, let's be careful out there!