Oh what BS!

Oh what BS!

Still, it’s BS we expected, isn’t it? What did I tell you in Friday Morning’s post? I said: "Our plan for the day (as we’ve been short all week) is to get back to cash for the weekend but I’m sure we’ll find some speculative upside plays (like USO at $37) to play (we already went long on Silver in the Morning Alert to Members)." I followed that up with my 9:40 Morning Alert to Members, where my specific trade ideas for the morning, while the market was plunging, were:

- USO Next week $36 calls are $1.45 so 10 of those in the $25KP with a stop at $1.20.

- TNA Aug $69/73 bull call spread is $2 and you can sell the $51 puts for $1.20 and that’s my favorite index play at the moment. Of course any bullish offset would work but this one is focused on the RUT and betting it won’t drop another 8% by Aug expiration (725).

How’s that for a bottom call? That was right into the panic lows and, at 9:48 I reiterated my call right at the dead bottom, saying to Members: "Volume is not very high – this is a retail panic so far. If you have short positions, strongly consider put tight stops on them (this includes the $25KP and Income Virtual Portfolio) as they put plenty of cash in your pocket and we can always find another layer of shorts if the RUT can’t hold 775."

At 9:50 my trade idea was selling PCLN weekly $545 calls at $3 which expired worthless that day for a 100% gain. At 9:52 we picked up the weekly (that day) QQQ $57 calls at .72 and we had a 100% gain on those by 11. At 9:56 we went short on the VIX with the Aug $19 puts at $1, at 10:16 we even made 5 bullish adjustments to our fairly conservative Income Virtual Portfolio, including selling 50 DIA Aug $116 puts for $110 ($5,500) and we’ll be pulling those right off the table this morning – but I’m getting ahead of myself…

At 9:50 my trade idea was selling PCLN weekly $545 calls at $3 which expired worthless that day for a 100% gain. At 9:52 we picked up the weekly (that day) QQQ $57 calls at .72 and we had a 100% gain on those by 11. At 9:56 we went short on the VIX with the Aug $19 puts at $1, at 10:16 we even made 5 bullish adjustments to our fairly conservative Income Virtual Portfolio, including selling 50 DIA Aug $116 puts for $110 ($5,500) and we’ll be pulling those right off the table this morning – but I’m getting ahead of myself…

At 11:25 we went for a Jan bull call spread on UNG and at 1:20 I put up my last long trade idea of the day, selling YRCW Jan $1 puts for .70 for a .30 net entry on the trucker. At 2:10, with our 2 daily calls already done for 100% gains, I said to Members "Well if you don’t have Disaster Hedges, you sure should get some" and put up 3 trade ideas for 1,000% gains on SQQQ, EDZ and DXD – all of which should still be playable in this morning’s excitement. At the close of trading, I suggested "As a toss, you can always just buy the QQQ Aug $59s for .80 as they were $1.20 yesterday so .50 would have to make you happy" and we should be at goal there (up 60%) at the open as well.

Over the weekend, in Member Chat, we had a great discussion about the Debt situation and who’s to blame (see Paul Krugman’s "The Centrist Cop-Out") and we talked Poverty in America and about Big Business’ destructive influence on our Nation, where my point was very neatly made by example in the Documentary Film "GasLand," which is on HBO this week and is something everyone in America needs to watch before we’re all paying $4 a gallon for water too:

For our Weekend Reading, after going over the potential deals that were on the table I titled the post "Waiting to get Screwed" as pretty much all outcomes will be awful for America – although good for the top 1% and that led to a great discussion in Member Chat under that post as we continued our discussion about Poverty and I added a collection of charts illustrating the tremendous Income Disparity that is now far WORSE than it was during the years that led up to the Great Depression – those rich people thought everything was getting better too!

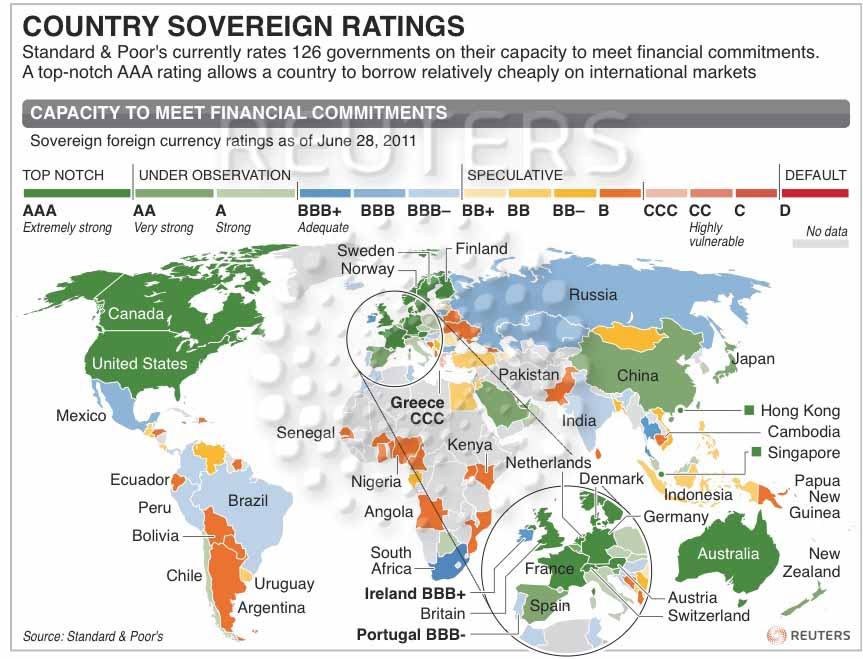

It’s going to be an exciting morning as we got a huge spike in the futures on the "Deal" news and this morning’s Alert to Members went out at 12:50 and, over the course of the morning’s discussions, we are NOT liking the bullish action (futures up 1.5%) so we’ll be cashing in those bullish plays into the morning squeeze and pressing our bearish bets once again because it doesn’t really matter what games our Government plays (and there is no deal until Congress votes, so there is still a huge risk of a shocking sell-off this afternoon) – we still look like idiots and it’s EXTREMELY likely that our Sovereign Rating will be dropped from AAA status for the first time in our nations history:

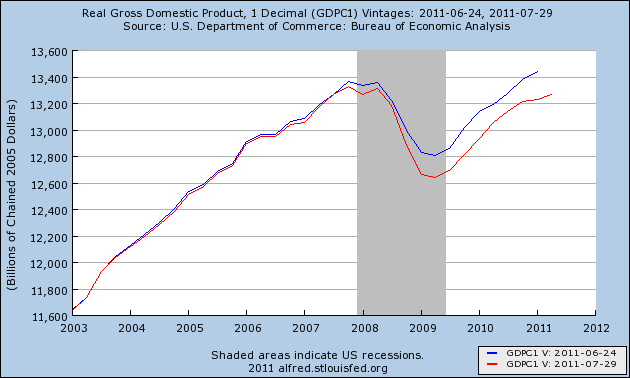

And, of course, all of this is just a huge distraction from our GDP, which is now running at an average of 0.85% for the first half of the year. Keep in mind that our Government told us that GDP was 1.9% for Q1 3 months ago on Friday they said "Oops, did we say 1.9% – turns out it was actually 0.4%." While no one should be shocked that our Government would fudge figures, 375% upside exaggerations to one of our most critical pieces of economic data is – hmm, what’s the word — CRIMINAL!

Are you freakin’ kidding us? How can you possibly MISS by 375%. Are people being fired? Is there an investigation? No, of course not because that would mean that it wouldn’t ultimately come out that the people being fired were only following orders to fudge data and mislead – not just the American people, who are used to being dupes of the Government and the Mainstream Media, but the International Investing Community should be VERY PISSED OFF that they were misled into investing in this country under very false pretenses. You hear pundits on TV all the time telling you that you can’t trust numbers out of China but did China every revise their GDP from 10% to 2% – THAT’s how much of a discrepancy our GDP was!

Are you freakin’ kidding us? How can you possibly MISS by 375%. Are people being fired? Is there an investigation? No, of course not because that would mean that it wouldn’t ultimately come out that the people being fired were only following orders to fudge data and mislead – not just the American people, who are used to being dupes of the Government and the Mainstream Media, but the International Investing Community should be VERY PISSED OFF that they were misled into investing in this country under very false pretenses. You hear pundits on TV all the time telling you that you can’t trust numbers out of China but did China every revise their GDP from 10% to 2% – THAT’s how much of a discrepancy our GDP was!

See the red line on the above chart? THAT’s the true line while the blue line is the lie they’ve been telling us until Friday. Lucky for them the ridiculous Debt Ceiling story is all the media is focused on or people may ask questions like how can the World’s largest economy not have a clue in the World how it’s performing for almost two years and who is it that’s responsible for misrepresenting the GDP of the United States of America by a factor of 4.75 to 1? Where is the outrage? What the Hell is wrong with your people? And I include my fellow Financial "Journalists" here as Woodward and Bernstein must be rolling over in their beds (they’re not dead so the phrase loses some of it’s impact).

Enough of my outrage over the Government because Jim Cramer has the nerve to show his face on CNBC and THAT is an OUTRAGE! He’s not even apologizing for cheer-leading the alarmists last week with advice on Friday to his Mad Money viewers that was SO HORRIBLY BAD that CNBC redacted the video clip of the show from their recap site. Why does Cramer annoy me so much? Because, when I’m out and about in the World (we both live in North Jersey), I am constantly being told "But Cramer says…" As I mentioned, my take on Friday’s posturing was 100% opposite Cramer’s – a view I like to call "rational" and it’s very hard to defend rational when your opponent isn’t. Maybe if I walked around with a sound effect board (is there an App for that?).

Enough of my outrage over the Government because Jim Cramer has the nerve to show his face on CNBC and THAT is an OUTRAGE! He’s not even apologizing for cheer-leading the alarmists last week with advice on Friday to his Mad Money viewers that was SO HORRIBLY BAD that CNBC redacted the video clip of the show from their recap site. Why does Cramer annoy me so much? Because, when I’m out and about in the World (we both live in North Jersey), I am constantly being told "But Cramer says…" As I mentioned, my take on Friday’s posturing was 100% opposite Cramer’s – a view I like to call "rational" and it’s very hard to defend rational when your opponent isn’t. Maybe if I walked around with a sound effect board (is there an App for that?).

So this morning, Cramer is back to BUYBUYBUY and, amazingly, acting as if he expected this all the time after he stampeded his sheeple out of stocks at the bottom last week! What am I saying this morning? As I just posted in Member Chat – SELLSELLSELL! Not all of it at once but let’s take half our bullish profits off the table and set reasonable stops on the other half and let’s add to Friday’s disaster hedges and we’ll even take some speculative short-term downside plays because "good" news is already priced into the morning pop but the Obama/Reid deal still has to get past the lunatics in the House and that’s a coin flip at best.

EVEN If we do get a deal today – what does it fix? We’re still in debt, our GDP is far worse than expected, unemployment is still out of control and NOW – we are CUTTING Government spending. That is just BAT-SHIT CRAZY! Austerity is not growth. Again, look at the chart above – our $15Tn GDP is actually $13.3Tn, that’s 10% less than the benchmark both the Dumbocrats and the Republican’ts are using to base their income projections for the next decade. A $15Tn economy that is growing is the number they are using to project jobs and exports etc. and it’s already off by 10% and SHRINKING! This is lunacy folks – DO NOT GET SUCKED IN!

And have a lovely week!

– Phil