Do or DIE today!

Do or DIE today!

We already went long in Member Chat last night, picking up Russell (/TF) futures off the 630 line but they stopped us out at 660 (up $3,000 per contract) so we switched horses to Oil (/CL) Futures at $80 in my morning Alert to Members and that’s already at $81.25, which is up $1,250 per contract. Our third play this morning was shorting gold (/YG) at $1,765 and that one is also a quick score, with gold backing down below $1,755 already but gold is just $33.20 per dollar per contract so up $332 on that one, which is why we usually don’t play it – too boring!

Pre-market trading has been the only time it’s been safe to be bullish for the past couple of weeks as we’ve suffered the most relentless sell-off since 2008. As I said in yesterday’s post, we expect the Fed to take action this afternoon (not just make nice noises) – anything less than that will be a disappointment – possibly a catastrophic one, so we’ve left our well-hedged hedges but we cashed out our directional short plays on yesterday’s dip. As I said in last night’s Member Chat:

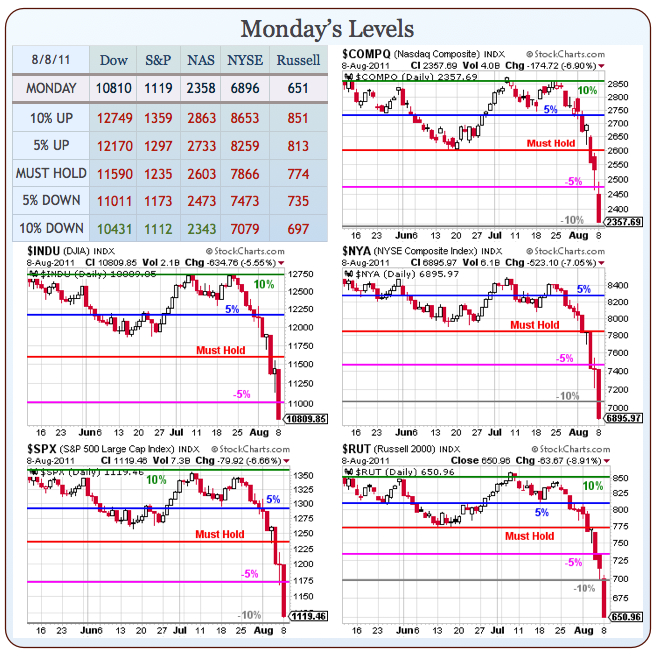

It’s (the market drop) not extraordinary until/unless we break those -10% levels on our new chart. Otherwise, it’s a 20% pullback off a 100% run-up and that is very ordinary, although this is coming a bit sharply… There is nothing wrong with cashing out and waiting for clarity but, as I said above – we’re SUPPOSED to have a 20% pullback after a 100% run in the markets. I’m sorry this time was not different and that we didn’t go to the moon just because the charts looked good but this is reality. We were up on thin volume and now we are down on heavy volume, pretty much right after we were told that there would be no more heavy volume.

As you can see from the extended Big Chart, we’re just down 20% from the top, which was 100% off the bottom so we have one of those neat little Fibonacci retracements that we PLANNED ON in February, when our top was projected to be, at most, 1,440 on the S&P (1,364 was our best day) and our 50% retracement line was (drum roll please) – 1,122. Where did we finish yesterday? 1,119! Not bad for a 6-month old projection. IF we break down here, our last support before Hell is 1,014 but let’s not think about that as it’s sad. So all the recent action has done is proven to us that, without Quantitative Easing, we are simply back in the TOP HALF of the range that we had defined way back in the Spring of 2009:

Note that the bottom of our current Big Chart is simply the middle of our Fibonacci Zone, where we EXPECT to have some good support. Hopefully Uncle Ben will wave his magic wand and money will once again rain down from the skies and all will be well as the Emperor is once again clothed in the very finest invisible garments (and I hope you watched yesterday’s clip as it completely explains our economy) and all of the people will once again marvel at our "wonderful" economy and the beautiful sheeple will once again stampede into the Stock Market Slaughterhouse for the next fleecing.

As Doug Short points out in our Chart School section at PSW, the Fed has nowhere to go with the Funds Rate (unless they are going to start paying people to borrow money) and I pointed out to Members in Chat last night that there was a Fed Meeting last August 10th and the statement made no mention of QE2 and the markets dropped like a rock THE NEXT DAY. 2 weeks later (as noted on chart), Bernanke capitulated.

As Doug Short points out in our Chart School section at PSW, the Fed has nowhere to go with the Funds Rate (unless they are going to start paying people to borrow money) and I pointed out to Members in Chat last night that there was a Fed Meeting last August 10th and the statement made no mention of QE2 and the markets dropped like a rock THE NEXT DAY. 2 weeks later (as noted on chart), Bernanke capitulated.

HOPEFULLY (not a valid strategy!) Ben has learned his lesson from last year and is not willing to risk another 10% sell-off due to his dithering. Keep in mind my prediction of last Tuesday was that we would have a 20% drop and, when the woman on TV introduced me with that prediction, I was very quick to clarify that I meant 20% FROM THE TOP, not from where we were last Tuesday, already 7% down.

So it’s hold up or shut up day for me. This is where we expect to make a stand but, unfortunately, it’s all up to the actions of "The Bernank", who has proven himself less than competent so far in forestalling crisis after crisis. This time better be different or we will soon be looking like London – with crowds turning their anger on banks, businesses, government buildings etc. As the announcer says about the looters: "They don’t really care what they take – they just want to cause as much damage as possible." Kind of like Congress!