‘m not going to talk about it because we already did so extensively in Member Chat. What we will be concerned with is how much of a drag AAPL is on the Nasdaq this morning as the stock makes up 10% of the index. At the moment, AAPL has recovered from a low of $350 in overnight trading (down 7.5%) back to $368 at 8am so little effect so far but what we don’t expect is for AAPL to go up and that’s going to weigh on the Nasdaq, which needs to add 83 points (3.3%) to get back to last week’s highs and give us our W pattern back to last week’s high.

NOW do you see the problem. If 10% of the index is going down or simply frozen, now the other 90% has to gain 3.6% to drag the index back to where it was (2,550). So now we can probably say that the Nasdaq will fail to make our pattern – certainly ahead of Bernanke tomorrow morning.

That means there will be a lot more pressure on the other indexes to perform and we need Dow 11,500, S&P 1,200, Nas 2,550, NYSE 7,500 and RUT 710 JUST to make (in the Dow’s case) an 800-point 40% bounce off the 2,000-point drop. That 40% bounce is essentially the Fibonacci Retracement of 38.2% we EXPECT and, if we stop there – it only serves to confirm a broader downtrend. As we have discussed, we are at a very dangerous inflection point this week and the ONLY thing that is going to turn us higher is some sort of announcement of QE3 – without it, we will be flipping bearish once again (and it’s not like we’re very bullish now!).

We’ll be watching that 2,473 line on the Nasdaq very closely today – considering it’s handicap, just getting over the -5% line will be a small victory. The Russell, of course, MUST get over 697 – we’ve already seen what happens when one of our indexes is two of our 5% levels behind the rest when the NYSE dragged us under and it’s NOT PRETTY!

We’ll be watching that 2,473 line on the Nasdaq very closely today – considering it’s handicap, just getting over the -5% line will be a small victory. The Russell, of course, MUST get over 697 – we’ve already seen what happens when one of our indexes is two of our 5% levels behind the rest when the NYSE dragged us under and it’s NOT PRETTY!

Meanwhile, 416,999 people besides Steve lost their Jobs this week as Unemployment Claims kicked back up 5,000 vs down 3,000 predicted by Economorons.

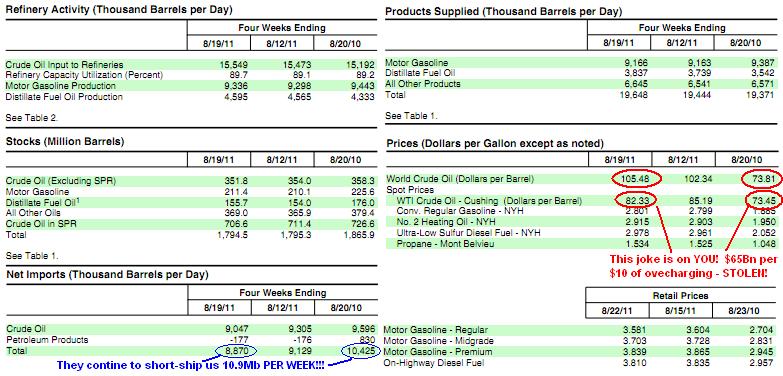

We went short on the Dow Futures (/YM) off the 11,300 line in Member Chat this morning but got stopped out quickly. We took our huge silver winners (short) off the table but remained short on oil after yesterday’s dreadful inventory report as well as the MasterCard Pulse report, which shows US Gasoline Consumption at a 9-year low! American drivers are buying 4.2% less fuel than this time last year, when it was $10 cheaper per barrel.

First of all, I want to draw your attention to the price difference between the country where the President acted to release oil from the SPR and the rest of the World, who were not so lucky as to have a President willing to go over the strenuous objections of the other party, who’s pocket are so stained with oil money that they have become flammable. The rest of the World is paying 28% MORE than we are for oil and we are all paying MUCH more than last year – despite global consumption being down.

All of the World’s leaders need to stand up to these people but we can start right here in the US and investigate as to why we are now being short-shipped 10.9 MILLION barrels of oil in a single week. 4.8Mb were released from the SPR but the crooks at the NYMEX refused shipment (they actually had to actively cancel existing delivery contracts) of so many barrels of oil that our total US inventory declined by 800,000 barrels. This is terrorism folks – this is a direct threat to our national security caused by the actions of traitors operating within the United States of America. If the CTFC refuses to look into this nonsense, perhaps we can call Homeland Security?

All of the World’s leaders need to stand up to these people but we can start right here in the US and investigate as to why we are now being short-shipped 10.9 MILLION barrels of oil in a single week. 4.8Mb were released from the SPR but the crooks at the NYMEX refused shipment (they actually had to actively cancel existing delivery contracts) of so many barrels of oil that our total US inventory declined by 800,000 barrels. This is terrorism folks – this is a direct threat to our national security caused by the actions of traitors operating within the United States of America. If the CTFC refuses to look into this nonsense, perhaps we can call Homeland Security?

Where are the 4.8Mb that were removed from the SPR this week? They were not supposed to be taken out of the country but, instead, the NYMEX traders canceled so many orders for imported barrels that they created an artificial hole for the SPR to fill. Isn’t actively undermining the energy security of this country a crime? It certainly is a moral one, but who ever cares about that these days?

Meanwhile: In yesterday’s post we noted: "The entire financial sector remains much oversold and was ripe for a countertrend move" and in Member chat I suggested the BAC Oct $8/9 bull call spread at .30 as a simple, bullish way to play the financials saying, "BAC – I have been picking JPM trades for a month, if you don’t have them by now, what’s the point. On the other hand, BAC is showing a little backbone finally and looks interesting."

Well that, plus our many other bullish financial plays should work out great this morning as Warren Buffett agrees with me and announces a $5Bn investment in BAC and that should rocket all of our financial plays and may even get our indexes back on track again – that’s how fast and how easily the markets can turn around!

It looks like it’s going to be a VERY interesting day!

.jpg)