Here we go again!

Here we go again!

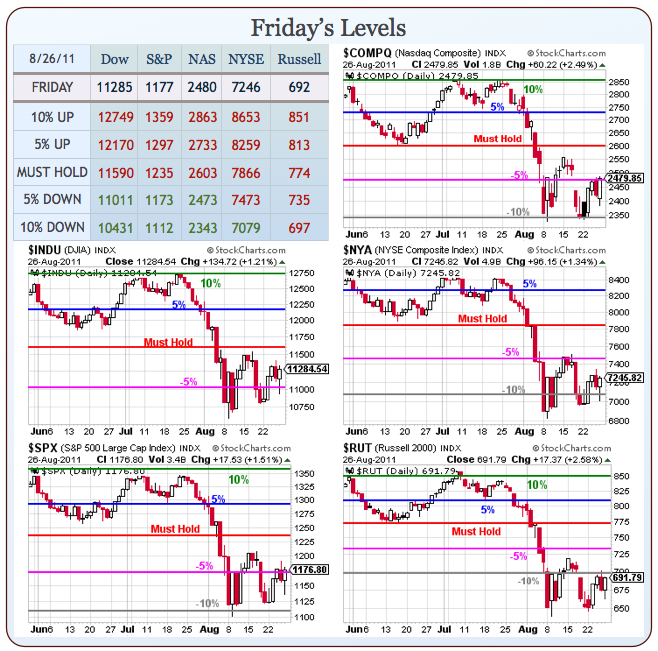

We got ALL the good news we’re likely to get for the month and the next Fed Meeting is not until Sept 20th and the proposed jobs-creating "infrastructure bank" still far from reality – it’s now up to the Bulls to show us the money and move our indices back over those Must Hold lines (which, of course, MUST hold) and back to at least the 5% marks over the next 2 weeks. Let’s not forget that those 5% lines are STILL 10% below the average analyst forecast for the year’s close (1,350 on the S&P).

I said to Members this weekend, as I laid out a new September’s Dozen list, that we still need to confirm that this 4-8% recovery zone we are in is more than just the bounce we EXPECTED to get after a 20% drop in our indexes.

If you think of the movement as a bouncing ball (or dead cat!), then you can clearly see that NOT making it back over the middle of that W formation quickly would only serve to indicate that our pattern is still trending down with bounces that are getting weaker and – if that is all we can muster after Uncle Ben begins to warm up the FREE MONEY machine – then we are in DEEP TROUBLE!

But I have faith! Just as I had faith last year when I put up our aggressive September’s Dozen list under very similar conditions and they were wildly successful so this year, perhaps it’s a bit of wishful thinking, but we’re jumping the gun and locking in a few aggressive plays before September even begins. We are not SURE that we’re not too early so we remain cautious but we’d hate to miss a party so we can put a little of our sideline cash to work but with tight stops in case the market decides to be less aggressive than we are.

But I have faith! Just as I had faith last year when I put up our aggressive September’s Dozen list under very similar conditions and they were wildly successful so this year, perhaps it’s a bit of wishful thinking, but we’re jumping the gun and locking in a few aggressive plays before September even begins. We are not SURE that we’re not too early so we remain cautious but we’d hate to miss a party so we can put a little of our sideline cash to work but with tight stops in case the market decides to be less aggressive than we are.

Until now, we have been concentrating on very short-term directional trade ideas with quick in and out profits and very long-term, well-hedged buy/write trade ideas, where we have a solid, built-in, 20% downside protection (see "How to Buy a Stock for a 15-20% Discount") based on my premise that the "worst case" for the Global GDP really isn’t that bad.

Nonetheless, we still have a very long way to go before we get back on a healthy path. Last week, global markets recovered an average of 1.63% but that comes after 3 weeks where they lost approximately 15% – far from impressive so far:

Looking at the above chart and especially considering the fact that the DAX fell 12.89% the week of August 5th – we are going to have to see some SPECTACULAR Global gains in the next couple of weeks before we even begin to call it a recovery. As I said last week (see Stock World Weekly for a great summary of last week’s events), the US Consumer is "not dead yet" and this morning we’re seeing an 0.8% increase in Personal Spending for July (0.3% MORE than expected), coupled with a 0.3% increase in Personal Income (0.1% less than expected), proving once again that – if you give the American Consumer one Dollar – they will promptly go out and spend at least two!

It’s going to be a busy data week and we are now of a mindset to ignore bad June and July Data like tomorrow’s June Pending Home Sales Report and the June Case-Shiller 20-City Index, which we know is going to suck and we will pin our hopes on the 10am August Consumer Confidence Index holding the 50 line – which would still be down almost 20% from July’s 59.5 level. If we can get past that set tomorrow, it’s all about employment for the rest of the week with Challenger Job Cuts on Wednesday along with ADP (also the Aug Chicago PMI and July Factory Orders).

It’s going to be a busy data week and we are now of a mindset to ignore bad June and July Data like tomorrow’s June Pending Home Sales Report and the June Case-Shiller 20-City Index, which we know is going to suck and we will pin our hopes on the 10am August Consumer Confidence Index holding the 50 line – which would still be down almost 20% from July’s 59.5 level. If we can get past that set tomorrow, it’s all about employment for the rest of the week with Challenger Job Cuts on Wednesday along with ADP (also the Aug Chicago PMI and July Factory Orders).

Thursday we get the usual 400,000 pink slips handed out for the week along with Q2 Productivity, August ISM and Auto Sales all leading up to Friday’s August Non-Farm Payrolls Report, where an anemic 100,000 Jobs are expected to be produced – down from July’s 154,000.

We do not need spectacular data to push the markets higher at this point. The last few weeks have priced in a Global Recession as most stocks have dropped below 2010’s trading range so, very simply, if it turns out that, perhaps, companies WILL end up making more money in 2011 and 2012 than they did in 2010 – ESPECIALLY considering the Dollar is almost 10% LOWER than it was in 2010 – then stocks are pretty much underpriced at the moment.

What are we looking for in "bargain" stocks? Well, they have to be making AT LEAST 10% more than they did last year, otherwise they are not keeping up with inflation. They have to be growing and we STRONGLY prefer that they not be getting most of their business from overseas as that would mean they’ve been taking advantage of the weak Dollar and will suffer when it bounces (IF it bounces). We expect a lot of infrastructure stimulus in the US despite the objections of Congress and, of course, we expect MORE FREE MONEY from the Fed to be officially announced in late September.

What are we looking for in "bargain" stocks? Well, they have to be making AT LEAST 10% more than they did last year, otherwise they are not keeping up with inflation. They have to be growing and we STRONGLY prefer that they not be getting most of their business from overseas as that would mean they’ve been taking advantage of the weak Dollar and will suffer when it bounces (IF it bounces). We expect a lot of infrastructure stimulus in the US despite the objections of Congress and, of course, we expect MORE FREE MONEY from the Fed to be officially announced in late September.

Europe is NOT fixed and may get worse. Trichet said nothing substantive this weekend, Merkel is fighting an uphill battle even in her own country while Greece gets even worse, with 2-year notes trading at 46% last week. Don’t look to Asia for help either as rice prices are projected to rise 22% this year and it was rice that finally sent the Emerging Markets off a cliff in 2008. Don’t look to China for help either as the PBOC is attempting to cool inflation by raising reserve requirements – a move that is expected to drain $140Bn of liquidity over the next 6 months.

So what is a Global investor going to do with their money? You can give it to Japan and get 1% back, give it to the US and get less than 2% back, give it to the EU and maybe never get it back… Timid investors can (and are) buying commodities in record amounts but should they be putting all of their money into gold at almost $2,000 an ounce or oil that is piling up around the planet due to lack of demand at $87.50 a barrel (20% more than last year).

That leaves Asian equities (the CEO of Sino-Forest finally resigned on fraud allegations – we’ll see who’s next!), digging through the rubble to find something still standing in the EU or…. good old, reliable US Equities, many of which are trading back at their 2009 panic lows. We don’t need prosperity – we just need for the World not to end – and that’s a bet we’re willing to make!