Yay! Another crisis averted.

Yay! Another crisis averted.

Well until next quarter, at least, when we can begin the "crisis" cycle all over again. As it stands, after much hand wringing yesterday, Greece will get the $11Bn they need to fund their nation for another 3 months. Yes, as I noted yesterday, this is not a typo – Greece needed $11Bn and the global markets gave up $1Tn in value because we weren't sure if they were going to get it on Monday morning.

To meet their budget goals in a declining economy, Greece is being pressure to cut 100,000 public jobs by 2015. With just 11M people in Greece, cutting 100,000 jobs is like asking the US Government to cut 3M jobs – isn't that insane? And by insane, of course, I mean – isn't that the Republican platform? Yes, nothing say "economic recovery" like firing 3M people in this topsy-turvry World.

We expected this, of course, and we got very bullish with our picks yesterday morning and were handsomely rewarded into the close and hope to be even more handsomely rewarded this morning as QE FEVER once again takes over the nation (see November's "POMO Fever" article to review the scam).

Interestingly, my main suggestion for playing QE2 last year was: "We can bet on inflation with our gold plays with potentials for 923%, 309%, 3,900%, 567%, 276% and 46%." Gold was "only" $1,300 last November and I was still enthusiastic about it at the time. Yesterday we shorted it with the GLD Nov $180/174 bear put spread at $3.30, selling $193 calls for $3 for a net .30 trade that bets gold won't hold $2,000 through Thanksgiving.

Also different this year is that we are betting against TLT (also in yesterday's main post) and we got fabulous prices for our short play yesterday as TLT ran all the way up to our goal at $115. As we got a nice sell-off at the open, my morning Alert to Members had trade ideas to go long on Oil Futures (/CL) off the $85 line (now $87, up $2,000 per contract) and we sold some DIA Oct $111 puts for $3.10 in the Income Portfolio, which are already down to $2.70 (up 13%) – simply following our rule of ALWAYS selling into the initial excitement.

At 10:08 we got aggressive with a TNA Oct $41/45 bull call spread at $2, selling the $29 puts for $1.70 for a net .30 spread with 1,233% upside potential if TNA finishes over $45 in 30 days. DIA 9/30 $115.75 calls were bought at $1.05 in the $25KP and those shot up to $1.35 (up 28% in a day) but we decided to be greedy and hold them overnight. HOV got attractive again for a long-term play at $1.23, USO was the subject of a complex and very aggressive spread as they hit $33, AAPL caught our attention on the sell-off and we played them long-term bullish to $500 in 2013 and then we went for TNA again as it was still sexy at 12:14.

At 10:08 we got aggressive with a TNA Oct $41/45 bull call spread at $2, selling the $29 puts for $1.70 for a net .30 spread with 1,233% upside potential if TNA finishes over $45 in 30 days. DIA 9/30 $115.75 calls were bought at $1.05 in the $25KP and those shot up to $1.35 (up 28% in a day) but we decided to be greedy and hold them overnight. HOV got attractive again for a long-term play at $1.23, USO was the subject of a complex and very aggressive spread as they hit $33, AAPL caught our attention on the sell-off and we played them long-term bullish to $500 in 2013 and then we went for TNA again as it was still sexy at 12:14.

We weren't done being bullish at lunch as we found a FAS weekly $13/14 bull call spread for .40 with bullish offsets to make it a free trade that was good enough for the $25KP and we discussed which of our September's Dozen were still playable into the Fed and our last play of the day was adding 10 BCS Oct $10 calls at .85 to our $25,000 Portfolio on the very simple logic that Greece was "fixed" and that should be good for Barclays. See, investing isn't that complicated – you just need to pay attention!

We haven't been this bullish since way back to last Monday, when we also got very aggressive into the sell-off but that was 500 points ago so yesterday was a bit riskier and based less on our chart range and more on the fundamentals – which I maintain are not as bad as we have been led to believe by the MSM, who are controlled by the Banksters who compete with us to bid for equities and want nothing more than to get you to walk away from the auction or, even better – to put your equities up for auction and increase the supply, lowering the price for those few of us who are buying.

Turning a minor incident like Greek debt into a World-shaking economic crisis is BRILLIANT! It's as if a used car salesman convinces you that your lost cigarette lighter will force him to knock 30% off the Blue Book on your trade in. You may think you would never fall for that but what do you think you are falling for when you sell your stocks at 30% off the top because Greece may or may not get a $11Bn loan in a $60,000Bn Global Economy (0.18%). That's right about the equivalent of losing the cigarette lighter in your car….

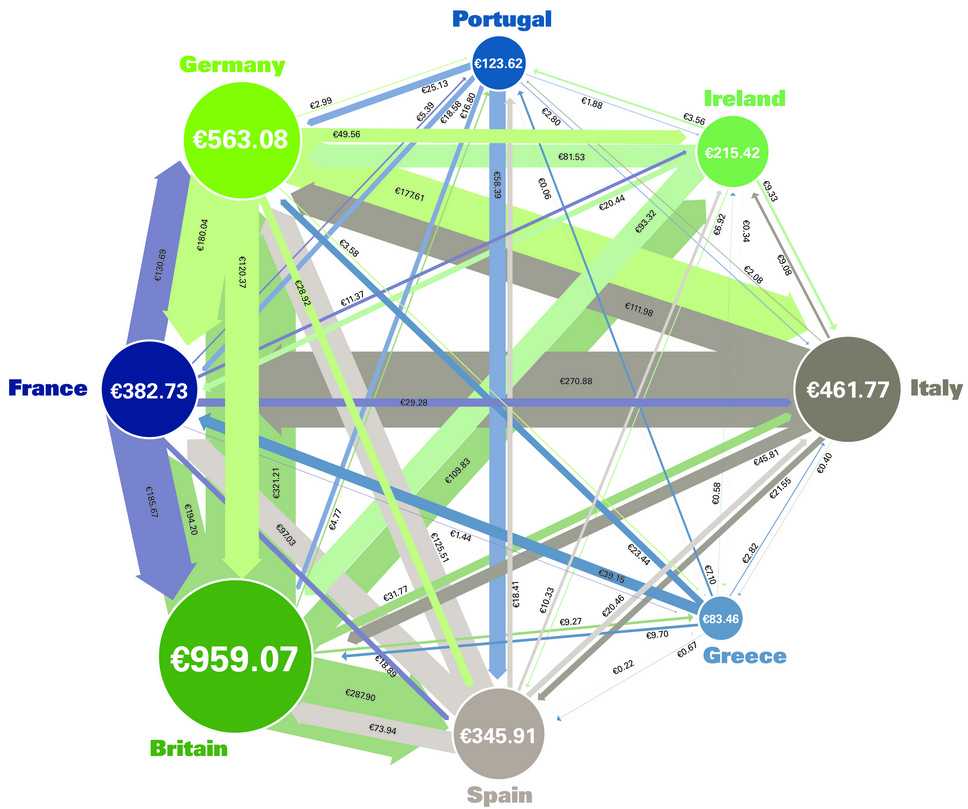

Above is the interlinked debt chart we are used to seeing in the media. The media are controlled, of course, by Big Business and their Financiers and they are all buyers of other businesses. Big Businesses want low borrowing rates to run their businesses and to wipe out their competition, who they ultimately crush or buy out at the lowest possible price. They love a good crisis as they gain market share and get Government to dismantle regulations while labor costs are driven lower and lower as the jobs pool collapses. Financials love it too because the get FREE MONEY from the Government (actually from we, the People in the form of never-ending debt) AND they get to collect massive fees from all the M&A work.

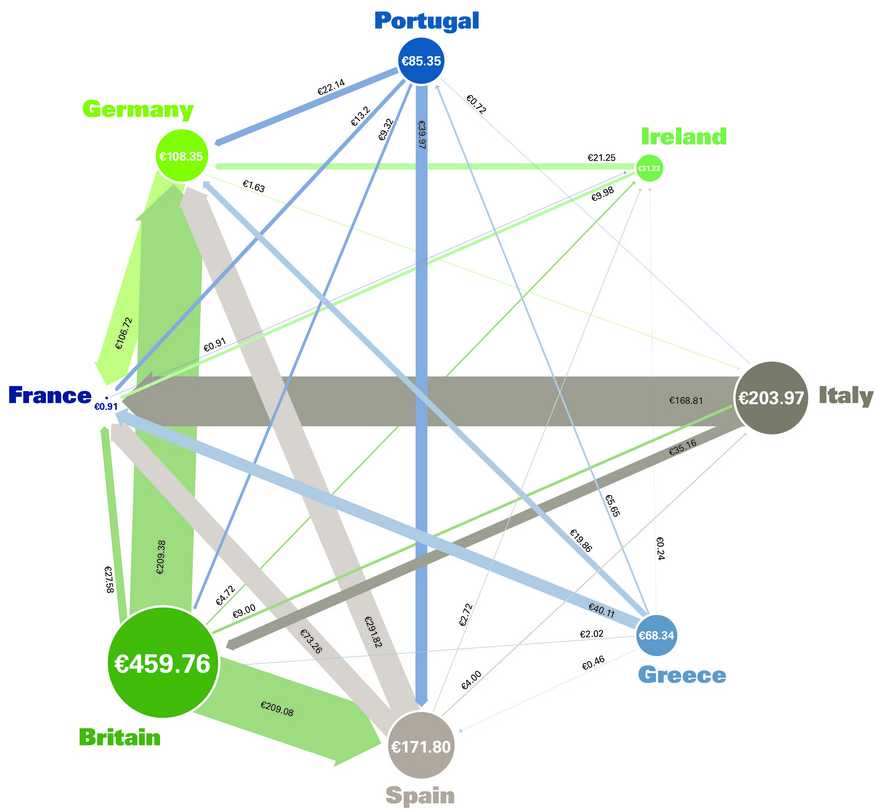

So of course it is in the interest of the MSM to blow this crisis as out of proportion as possible. Even now, at 8:20, on CNBC, Mark Grant and the Gloom and Doom crew are advising their retail sheeple to dump out of equities and buy bonds. Before you do that, however, perhaps we should take a look at the same chart as adjusted by the ESCP Europe Business School in a study that simply cross-cancelled the debt obligations from Nation to Nation – to cut through some of the noise that is present in the standard debt views:

Notice anything different? 64% of the debt is reduced through cross cancellation of interlinked debt, taking total debt from 40.47% of GDP to 14.58%. Even Ireland's debt is reduced from 130% of GDP to just 20% and Frances debt disappears entirely. This is why France is Germany's partner in STRENGTH in the EU. Unlike the American media, who are quick to stereotype and denigrate the French, the people who actually understand the economics of the EU do see the French in a very good position. This is why Americans don't get the relationship between Sarkozy and Merkel – they are grossly misinformed as to what the underlying economics of the situation are.

I don't fault American investors, they have been trained from birth to accept whatever propaganda is broadcast to them through the little boxes they watch all day. Orwell thought the government would have to pass laws to force people to put monitors in every room in the house that are kept on all day – telling people how to think. The reality of America is that the people are so addicted to what was once properly known as the "idiot box" that they feel the need to have TV on their phones – that's very sad…

I don't fault American investors, they have been trained from birth to accept whatever propaganda is broadcast to them through the little boxes they watch all day. Orwell thought the government would have to pass laws to force people to put monitors in every room in the house that are kept on all day – telling people how to think. The reality of America is that the people are so addicted to what was once properly known as the "idiot box" that they feel the need to have TV on their phones – that's very sad…

Of course, the same way we can't take the MSM for granted, we can't just go by one study and decide there is no debt crisis. As pointed out by Lisa Pollack in the Financial Times, "Even if one were to focus on sovereign debt, could the magic compression wand be waved in order to reduce the burden? There are many, many issues one could raise, so let’s just look at a few niggles" citing: Fungibility, Agreeability, Desireability and Opacity – all factors one has to consider before simply cancelling out one debt for another. Still, somewhere between 100% and 36% lies the real debt levels and they quite simply ARE NOT AS BAD AS YOU THINK.

Unfortunately, what you (Investors) think is what drives the markets and the worst thing a fundamental investor can do is get so confident in a conclusion that they are willing to bet against the stampeding mob because that mob will trample you long before you get to be proven right! That's why we continue to ratchet up our technical levels and every day we expect to see signs of strength or we will be happy to commit more of our sidelined cash to the bear side. Our bearish covers yesterday were gold and TLT – for reasons I out lined in the morning post. We also have many, many bear spreads that are neutrally covered by bullish offsets which hedge us for a small break below our -10% lines on the Big Chart.

As I mentioned last week – we are not going to be "bullish" until we break over the rising green channels so, every day, our expectations are raised. At the same time, we're not going to be panicked out of positions by moves down that remain inside the channel UNLESS we make a low again without first making a new high. This is a very dangerous spot because the Nasdaq may top out here and head down before the other indexes get a chance to complete their up cycle so what we NEED to see today and tomorrow is the Nasdaq breaking clearly over the green line and holding it – which would be sort of an invitation for the other indexes to come and join it.

Weakness in the broader (and harder to manipulate) Russell and NYSE is a huge concern. At the moment, we are playing the Russell bullish as a lagger and the the Nasdaq bearish as a leader. We're watching the Dollar on the 77.50 line and over is bearish and under is bullish – what can be simpler than that?

It's going to be a bumpy ride into tomorrow's Fed announcement so let's be careful out there.