Looks like we picked the wrong week to get bullish.

Looks like we picked the wrong week to get bullish.

Good golly what a mess! After Obama blew his jobs speech on the 8th and the market dropped a quick 5%, we thought SURELY the Fed can’t be so stupid as to make the same mistake and disappoint the markets with an inadequate stimulus – especially after such a big build-up of our expectations.

Well, SURPRISE – what we got, as I told Members yesterday, was the VERY LEAST the Fed could do. Nothing would have been kinder because, had they done nothing – then at least we could have held onto the hope that they would do SOMETHING at some point. By doing something and that something being almost nothing – all hope is lost.

We lost all hope at 2:27, when the Fed released their statement and my immediate note to Members was: "Killing short-term bullish plays including buying back DIA short puts in Income Portfolio!" That same minute, my next comment in Member Chat was: "Game on for SQQQ plays and on any hedge with a bullish offset – stopping out the offset until we settle down is a good plan!" and, at 2:38, I put up an annotated view of the Fed statement and added the following conclusion in an Alert to our Members:

This is not terrible if seen as a first step but it’s a disappointment and now we will face the wrath of the markets. If you don’t have enough hedges then perhaps (in addition to our long-put list) and today and yesterday’s hedges:

- DIA Oct $108 puts at $2.20.

- DXD Oct $18/21 bull call spread at $1.05

- SQQQ Oct $22/25 bull call spread at $1, selling $20 puts for $1.20.

Needless to say, those trades are all doing quite well this morning and, having been able to follow through with our plan to flip bearish on a poor Fed statement, we were then able to spend the last hour of the day doing a little bottom-fishing – picking up some speculative upside plays in case we bounce with the goal of getting neutral into the close because, in the end – it’s all up to the interpretation of the Fed and, of course, the ECB’s next step.

Needless to say, those trades are all doing quite well this morning and, having been able to follow through with our plan to flip bearish on a poor Fed statement, we were then able to spend the last hour of the day doing a little bottom-fishing – picking up some speculative upside plays in case we bounce with the goal of getting neutral into the close because, in the end – it’s all up to the interpretation of the Fed and, of course, the ECB’s next step.

I mentioned the Long Put list and we were tracking that in part two of our Range Trading post, so you can see them all there but a couple of plays that are ahead of expectations already are FCX Jan $37.50 puts at $2.40, now $5.45 (up 127%) and NFLX Jan $120 puts at $3.95, now $18.85 (up 377%). Those, of course, come off the table and we switch horses (if we need covers) to put plays like BIDU, CMG, DECK or QQQ that got cheaper since we first identified them. On the whole, we are still much stronger than we were back on August 23rd, when we used the long puts to cover the possibility of a breakdown below our 10% lines.

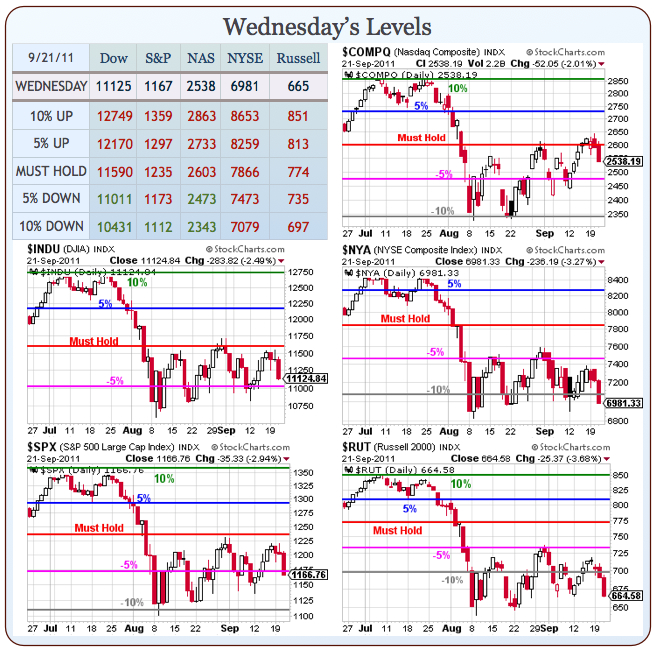

We do the Range Trading reviews because we as STILL right inside our trading range and the best way to find a new play today is to look for the trades that worked last time we were in the same place. Looking at our Big Chart, we’re simply back to where we were at the beginning of the month, on the way to retesting those lows. If the NYSE and the Russell break down below those lines today – this will be a fine example of the meaning of the phrase: "Uncharted Territory!"

We do the Range Trading reviews because we as STILL right inside our trading range and the best way to find a new play today is to look for the trades that worked last time we were in the same place. Looking at our Big Chart, we’re simply back to where we were at the beginning of the month, on the way to retesting those lows. If the NYSE and the Russell break down below those lines today – this will be a fine example of the meaning of the phrase: "Uncharted Territory!"

Still, we look back at the trades of early September and what worked well? We had SDS weekly calls that gained 217%, GLD Oct $160 puts that are cheaper now but made a quick 20% at the time (GLD is one of our major hedges), we shorted Oil Futures (/CL) at $88.50, we had the EDZ Oct $19/23 bull call spread for $1, selling the $17 puts for $1.15 for a net .15 credit on the $4 spread (that one is doing well), we grabbed a TZA next weekly bull call spread that made 1,100%, a QID bull call spread was ruined because we offset it with short Sept $25 puts on HPQ (much better now) and we shorted the Russell Futures (/TF) off the 700 line and the Nasdaq Futures (/NQ) off the 2,200 mark (where they are right now again!) for massive gains.

One trade that didn’t work at all was TLT puts. Those lost 85%, our only losing contract that day that wasn’t an offset to a winning trade. Did we learn our lesson? Sadly, no, we were still shorting TLT yesterday and will again today as they hit our max target of $122. We took a brief shot at shorting them yesterday but wisely stopped out. Today we will probably give it another shot but cautiously, as the EU is trading down 5% ahead of the US open. I will repeat what I wrote in the Range Trading post about balancing your positions as it’s very important today (as we did yesterday):

That is KEY when playing volatile markets. FIRST makes sure you have an adequate hedge, in case you are wrong, THEN you can start balancing out your expected downside profits with some bullish speculation.

That’s going to be the game plan today. We’re looking to hold those early September lows but now that we have no Fed support, it will be a lot less surprising to see those supports fail now than it would have been in September so we’re not as likely to play for the bounce until AFTER we see the bounce in place. Cashy and Cautious is the plan once again and it’s fine to take a few pokes as positions but BALANCE is the word of the day. In fact, in yesterday’s morning Alert to Members, our trade idea for the morning was to buy the QQQ weekly $57 calls for .45 AND the $56 puts for .40 on the expectation we’d get a $1+ move one way or the other. The $56 puts hit $1.05 yesterday for a nice 35% gain on the first day but they should be much better this morning and we can take them off the table and whatever the $57 calls make on a bounce (if any) is just a bonus.

We may have had a chance to recover but our friends in Congress once again are threatening to shut down our Government on the 30th. Remember when the Dems wanted a long-term fix and the Reps said it would be fine to just re-vote in September and the Dems caved before our Government collapsed? Well, here we go again as the simple (in theory) continuing resolution to keep our Government operating after September 30th was soundly struck down by the House last night. Since they are all on vacation next week – they have 48 hours before we’re back to that crisis again – and isn’t this just perfect timing to wreck the economy and make Obama look bad (worse)?

We may have had a chance to recover but our friends in Congress once again are threatening to shut down our Government on the 30th. Remember when the Dems wanted a long-term fix and the Reps said it would be fine to just re-vote in September and the Dems caved before our Government collapsed? Well, here we go again as the simple (in theory) continuing resolution to keep our Government operating after September 30th was soundly struck down by the House last night. Since they are all on vacation next week – they have 48 hours before we’re back to that crisis again – and isn’t this just perfect timing to wreck the economy and make Obama look bad (worse)?

I know a lot of people are disgusted by this and like to say "throw the bums out" as if they are all bums but we do have a 2-party system in this country and you do need to pick one to run it. Back in August, I identified the Republican Party as the single biggest threat to this Nation’s future and it’s fine if you disagree with me and many people (including me) said the Democrats are no better in many respects but I will close today with a good example of why I am a Democrat and why I still do have hope for this nation’s future – because if we can find one good woman to lead us – we can find others as well. But it’s up to us to make the effort to find them and help them succeed because the opposition is entrenched and it is strong and we’re going to have to fight to take back this country: