Just waiting for the Jobs report.

Just waiting for the Jobs report.

As David Fry noted yesterday: "The rally is clearly the HFT algos at work and only reviled when markets decline but little mentioned on rallies. Nevertheless these volatile program trades are causing many investors to flee markets as noted in this article. In fact, nearly $200 billion has been withdrawn from equity mutual funds since 2010 according to the ICI (Investment Company Institute). "

We got a little additional rocket fuel at 2pm as Tim Geithner once again said that there is no chance of another Lehman-type even being caused by a default of EU sovereign debt. This is the exact same thing he’s been saying for two months now only this time investors were suddenly in the mood to believe him and some of our beaten-down Financials like MS and BAC took off.

As I mentioned last week to Members and now Doug Kass agrees with me, insurance companies are "stupid cheap" and that’s why we’ve maintained our bullish stance on XLF, still one of my favorite longs. Moody’s downgraded 12 UK Financials this morning but it had little effect on the sector – a pretty good indicator that we may have finally found a bottom. Moody’s also put the hit on 9 Portuguese Banks – they downgraded the whole country last month.

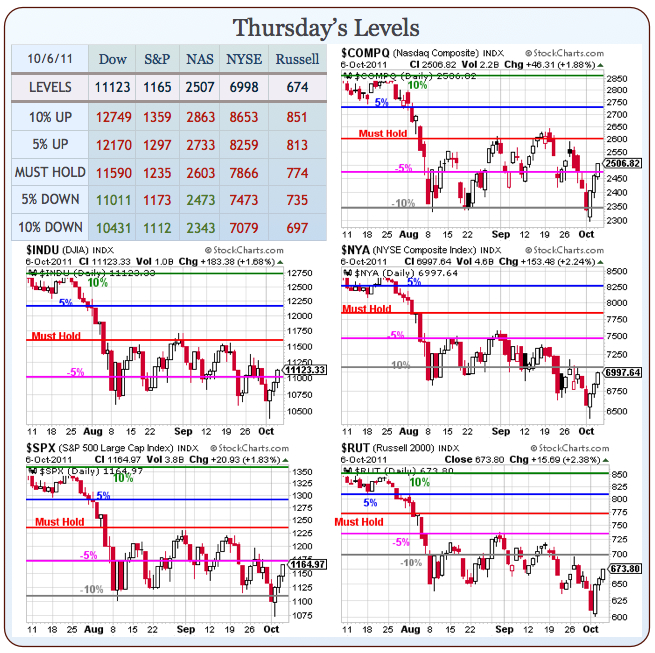

None of that really matters, of course. As you can see from our Big Chart, we are right on track to test the levels we expected for the week but we’re right at the top of our declining range so we got a little more cautious into yesterday’s close – just in case.

None of that really matters, of course. As you can see from our Big Chart, we are right on track to test the levels we expected for the week but we’re right at the top of our declining range so we got a little more cautious into yesterday’s close – just in case.

8:30 Update: Non-Farm Payrolls came in hot at 103,000 AND last month was upgraded from zero to 57,000 and the futures are LOVING IT! Unemployment holds steady at 9.1% and hourly earnings were up 0.2% as private sector jobs were strong at 170,000 added and the subtraction, as the President warned us yesterday – came from a 34,000 reduction in Government jobs. That should hit all of our watch levels and now the game for the day is seeing whether or not we can hold them.

Interest rates are kicking up on signs of economic strength and that’s great for our TLT puts. While gold isn’t getting much of a pop (why should it – no fear?), oil and silver are moving up nicely and we played both of those bullish so – yipeee! I mentioned our TLT trade from Tuesday’s Member chat was still playable on Wednesday morning in the main post and that net $25 spread should pay off the full $1,500 today for a nice 5,900% gain in 2 days – sure beats working!

Theses are the kind of small, leveraged trades that can make very big returns for fundamental investors. What was our risk? That we would end up short 500 shares of TLT at $122. As long as we have the conviction that TLT could not sustain $122 for a long period of time (and I have spent much of the past year going over this logic so I won’t rehash it here) then even if we took a $1, 2 or $3 hit per share if things had gone the other way, we would have been happy to roll the short calls up (in strike) and out (in time) – giving ourselves another month or two to be right.

Theses are the kind of small, leveraged trades that can make very big returns for fundamental investors. What was our risk? That we would end up short 500 shares of TLT at $122. As long as we have the conviction that TLT could not sustain $122 for a long period of time (and I have spent much of the past year going over this logic so I won’t rehash it here) then even if we took a $1, 2 or $3 hit per share if things had gone the other way, we would have been happy to roll the short calls up (in strike) and out (in time) – giving ourselves another month or two to be right.

Also (and this is the hardest thing to teach) patience is key to making these trades. We waited until TLT was over the top of our expected range to pull the trigger and it wasn’t just a technical decision – we felt the move was driven by rumors (of EU demise) that created a fear level (driving people into TBills), that was unsustainable. The Dollar was also at the top of our projected range at 80 so the stars lined up perfectly to make that trade.

You don’t have to trade every day to do well in the markets. What you do have to do is pay attention every day and figure out which relationships you are comfortable following – the ones you understand well – whether it is currencies or companies or countries – whatever it is you understand best is what you should be trading and, if you learn to be PATIENT and wait for the "fat pitch," the very obvious set-ups that make it easy to make a commitment – then you can become a very successful trader.

It’s ironic that we’re going to Vegas for a seminar where the main message is "Don’t gamble with investments!" I look forward to seeing you there tomorrow and, if you are unable to attend – we’ll be doing PSW live from Las Vegas on Monday morning – that should be fun!

Have a great weekend,

– Phil