A statement was issued by Merkel and Sarkozy yesterday.

A statement was issued by Merkel and Sarkozy yesterday.

As translated by the Financial Times, it read:

The President and German Chancellor spoke today by telephone to prepare the European dates in the coming days.

The President and the Chancellor have agreed to provide a comprehensive and ambitious global response to the current crisis in the euro area.

This response will include the following:

– The operational implementation of new forms of intervention EFSF.

– A plan to strengthen the capital of European banks.

– The implementation of the economic governance of the euro area and the strengthening of economic integration.For a lasting solution to the situation in Greece, the Greek authorities will have to make ambitious commitments to address the situation of their economies as part of a new program. Based on the report of the troika and the analysis of debt sustainability Greece, France and Germany call for immediately undertake negotiations with the private sector to reach an agreement for strengthening sustainability.

The President and the Chancellor will meet Saturday night in Brussels ahead of the European Council summit in the euro area on Sunday. France and Germany have agreed that all elements of this ambitious and comprehensive response will be discussed in depth at the summit on Sunday in order to be finally adopted by the Heads of State and Government at a second meeting no later than Wednesday.”

As I said to our Members in Chat (we went bullish on the news, of course) – could they possibly be more clear in their statement? Well, apparently they should have been because the interpretation of this statement, as headlined in the WSJ, was as follows:

Disagreement between Germany and France over virtually every point in a plan to resolve the euro-zone debt crisis forced Merkel and Sarkozy to concede that a summit of EU leaders Sunday won’t produce an agreement.

And that’s what moved the markets yesterday. Fortunately, we have learned to ignore almost everything printed in the Wall Street Journal or any other Murdoch-owned publication and, of course, it goes without saying that if any news is being broadcast on Fox, there’s probably another side to the story that is true.

And that’s what moved the markets yesterday. Fortunately, we have learned to ignore almost everything printed in the Wall Street Journal or any other Murdoch-owned publication and, of course, it goes without saying that if any news is being broadcast on Fox, there’s probably another side to the story that is true.

Still, the Wall Street Journal manages to have not squandered all of the $5Bn worth of integrity Murdoch purchased when he bought the Dow Jones Corporation in 2007 (but, by his own estimates, he’s already used half of it). After all, it took 117 years for the paper founded by Charles Dow and Edward Jones to build that reputation and Murdoch’s only had it for 5 years so far. That has been long enough, according to Joe Nocera, who wrote this summer about how the Journal had become "Fox-ified", beginning with the appointment of Robert Thomson, Murdoch’s London Times Editor and Publisher Leslie Hinton, who ran Rupert’s now-defunct (phone hacking scandal) rag-sheet "News of the World".

Along with the transformation of a great paper into a mediocre one came a change that was both more subtle and more insidious. The political articles grew more and more slanted toward the Republican party line. The Journal sometimes took to using the word “Democrat” as an adjective instead of a noun, a usage favored by the right wing. In her book, “War at The Wall Street Journal,” Sarah Ellison recounts how editors inserted the phrase “assault on business” in an article about corporate taxes under President Obama. The Journal was turned into a propaganda vehicle for its owner’s conservative views. That’s half the definition of Fox-ification.

The other half is that Murdoch’s media outlets must shill for his business interests. With the News of the World scandal, The Journal has now shown itself willing to do that, too.

It’s difficult to ignore the Wall Street Journal. By force of habit we still think it’s the financial paper of record but, time and again, we are reminded that it has degenerated into nothing more than another Conservative rag-sheet with "news" stories that are spun to fit the message of the day. Lately, that message has been that the EU is collapsing and no FACTS to the contrary will be entertained at www.wsj.com.

It’s difficult to ignore the Wall Street Journal. By force of habit we still think it’s the financial paper of record but, time and again, we are reminded that it has degenerated into nothing more than another Conservative rag-sheet with "news" stories that are spun to fit the message of the day. Lately, that message has been that the EU is collapsing and no FACTS to the contrary will be entertained at www.wsj.com.

The corruption of the Journal doesn’t even end in the News Department, just last week it was revealed that the Circulation Department was running a scam to inflate the paper’s circulation by "allowing" groups to purchase copies in bulk for as little at a penny. According to the Guardian, who broke the scandal (happily, I’m sure): "The Guardian found evidence that the Journal had been channelling money through European companies in order to secretly buy thousands of copies of its own paper at a knock-down rate, misleading readers and advertisers about the Journal’s true circulation."

The bizarre scheme included a formal, written contract in which the Journal persuaded one company to co-operate by agreeing to publish articles that promoted its activities, a move which led some staff to accuse the paper’s management of violating journalistic ethics and jeopardising its treasured reputation for editorial quality.

The Journal’s decision to secretly purchase its own papers began with an unusual scheme to boost circulation, known as the Future Leadership Institute. Starting in January 2008 (just months after taking over the paper!), the Journal linked up with European companies who sponsored seminars for university students who were likely to be future leaders. The Journal rewarded the sponsors by publishing their names in a special panel published in the paper. The sponsors paid for that publicity by buying copies of the Journal at a knock-down rate of no more than 5¢ each. Those papers were then distributed to university students. At the bottom line, the sponsors enjoyed a prestigious link to the Journal, and the Journal boosted its circulation figures.

In early 2010 the scheme began to run into trouble when the biggest single sponsor, a Dutch company called Executive Learning Partnership, ELP, threatened to back out. ELP alone were responsible for 16% of the Journal’s European circulation, sponsoring 12,000 copies a day for which they were paying only 1¢ per copy. For the 259 publishing days in a year, they were sponsoring 3.1m copies at a cost to them of €31,080 (£27,200). They complained that the publicity they were receiving was not enough return on their investment.

The alleged fraud did not end there, of course, what followed was a series of deals and subsequent cover-ups that involved more and more of the Journal’s top officials with back-door deals and money transfers and all kinds of stuff that will make a great movie one day and is well-detailed in the Guardian article. If you haven’t heard about this massive scandal here in America – it’s just an indication of how intimidated the US MSM is by Mr. Murdoch.

The alleged fraud did not end there, of course, what followed was a series of deals and subsequent cover-ups that involved more and more of the Journal’s top officials with back-door deals and money transfers and all kinds of stuff that will make a great movie one day and is well-detailed in the Guardian article. If you haven’t heard about this massive scandal here in America – it’s just an indication of how intimidated the US MSM is by Mr. Murdoch.

What’s important for us, as investors, to be aware of is WHERE we are getting our news and this article comes after weeks of looking into what has investors running so scared on Europe when it is, in fact, so easy to fix (or at least kick down the road a year or two). Three weeks ago, as we went bullish off the bottom, I challenged our Members to find positive stories on the EU and they were few and far between. Since then, I have noticed that – not all, but most roads lead to Rupert and I wonder if this is some sort of attempt to shake up Europe, simply to divert attention away from his various scandals or maybe it just sells more papers (as the Spanish-American War did for Hearst) – in which case Uncle Rupert is simply practicing a modern variation of Yellow Journalism.

The problem is that Murdoch, like Hearst, has the reach and clout to MAKE his news true. Hearst started a war to sell papers – does anyone doubt that Murdoch won’t cross a few lines to do the same? We spoke about trusting the media at our Las Vegas conference last week and had we trusted the Journal’s interpretation of the Merkozy statement, we couldn’t have made the right call in Member Chat, at 12:21, when I called a bottom and we went long on the Nasdaq with the QQQ Oct $57 calls at .15 (now .22, up 46%) and the DIA Oct $115 calls at .45 (now .83, up 84%).

It’s not enough just to read the news, you have to think about your sources and the motivations of your sources. As we learned with our EU news exercise, sometimes you have to go far and wide to find a contrary opinion but, when everyone has the same opinion – THAT’s when you should be most worried. We’ve been looking on the bright side of Europe since early September, when I ran a series of posts illustrating how small Greece was in the grand scheme of things. On September 6th, I suggested a trade idea of selling 1 EWG (the Germany ETF) Oct $18 put for $1 and buying 2 Oct $18/19 bull call spreads for .65 each, which was net .30 on the spread. EWG is at $20 so, barring some catastrophe – that trade will be up 566% as options expire today – turning $300 (10 sold contracts, 20 bought) into $2,000 in 6 weeks. THAT is how we use the news to make profits in the market!

To some extent, we are doing what Mr. Murdoch does – we are selling FEAR – in the form of options premiums. When we sell the EWG Oct $18 puts for $1, someone is paying us to promise to buy their German ETF from them for $18 (which is a net $17 entry for us) because they have been intimidated into believing that it may be worth far less than that, even though the price of the ETF at the time was $18.50. We were able to effectively enter a position on EWG that was 10% below the current price and we take advantage of these negative news cycles because we are FUNDAMENTAL traders and know how to look beyond the current PRICE of a security and determine our own long-term VALUE.

Because we felt that $19 was a fair VALUE for EWG, we added the aggressive bullish positions and leveraged that Dollar we collected on each contract into tremendous gains. What was our risk? Owning EWG for a net of $18.15 per share – we had no fear of that because, no matter what panic took hold of the market over the next 6 weeks to influence the PRICE of the ETF – we had already determined it’s VALUE was $19 to us and we would be willing to wait as long as it took for the markets to calm down and make the same, rational assessment we had made back in September.

Our Fundamental assessment of the EU situation led us to be bullish since the month began (see yesterday’s post and, of course, Stock World Weekly) and this morning, at 7:33, I noted to Members that my interpretation of the EU news was catching on and that it might be a good idea to grab the Russell Futures (/TF) at 700 and the oil Futures (/CL) at $87 as bullish pre-market trades. At 9am, oil is already up $1, which is a gain of $1,000 per contract on the futures and the Russell is slowly but surely making progress at 702.20, up $220 per contract at the moment.

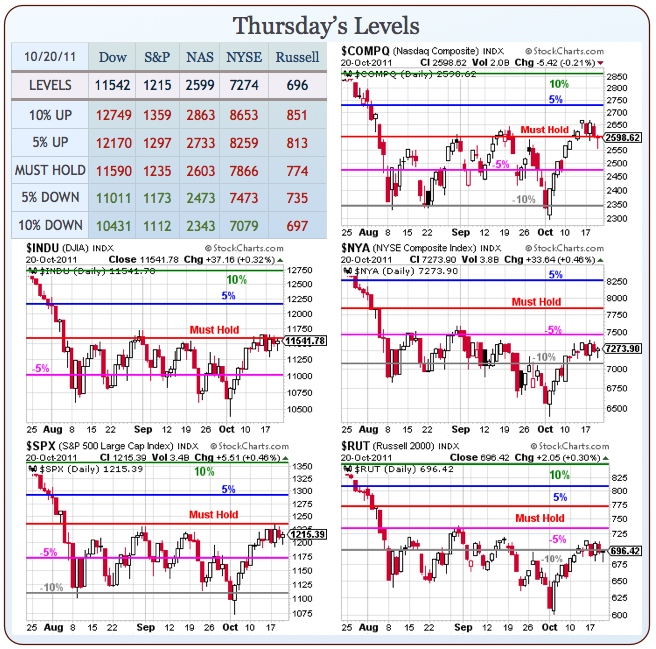

As long as we make enough to pay for our Egg McMuffins, I’m happy with those futures trades. We cashed out out $25,000 Portfolio yesterday as we took advantage of the up and down market swings and we’ll bank that virtual $130,000 (up 420% in 9 months) and take $15,000 of it to start our White Christmas Portfolio next week – hopefully we’ll be over our Must Hold lines and we’ll have a base from which to take some aggressive upside positions so we can get to our goal of $25,000 by Christmas (up 66.6% in honor of Lloyd "the beast" Blankfein).

It’s a long way between now and next Wednesday and, even if the EU is "fixed", if the bailout package is deemed too small, we could be back to square one again. That’s why we opted to move more into cash in our short-term positions (killing the $25KP entirely) as we’d rather be flexible than right but, as you can see from yesterday’s little bullish plays – being in cash doesn’t mean you can’t have a little fun while you wait for clarity!

Have a great weekend,

– Phil