Wheeeeee, this is fun!

Wheeeeee, this is fun!

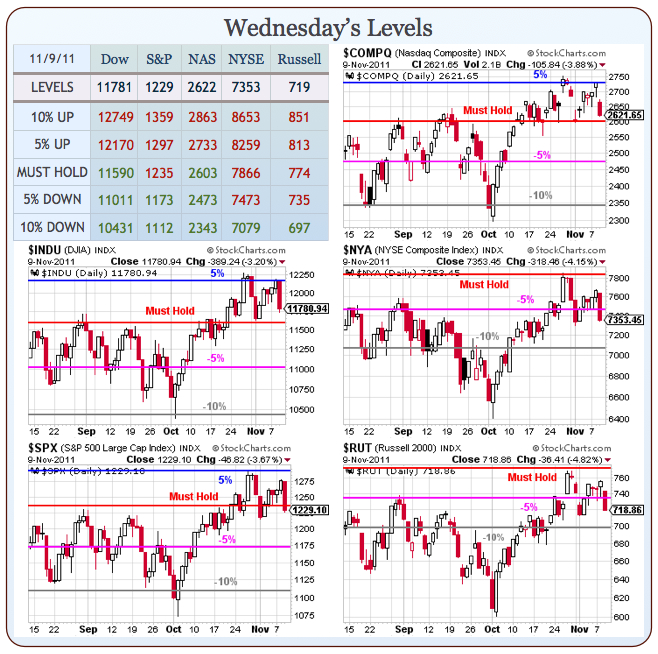

What a ride I am missing this week on my vacation but, on the whole, noting is happening as it looks like we may finish the week about where we begin it, at Dow 12,000. If so, then we can call it a week of good consolidation above our Must Hold line and be happy.

More EU nonsense, of course is driving the markets. David Fry believes that the EU is just stalling,wanting to get the rest of the world, and particularly the U.S., to bail them out. With Bernanke and Geithner in the mix it’s not out of the realm of possibility.

After all, we know the Fed is “owned” by mega-banks (Primary Dealers) and will do their bidding. If these banks have large exposure to euro zone debt they may feel they have to help them out. It would be nice if we could get the rich Arab states to pony-up to help their good customers but they’re just spectators for now.

After all, we know the Fed is “owned” by mega-banks (Primary Dealers) and will do their bidding. If these banks have large exposure to euro zone debt they may feel they have to help them out. It would be nice if we could get the rich Arab states to pony-up to help their good customers but they’re just spectators for now.

Still, we did not break the panic line on the Euro yet ($1.35) but it was tested at 2am, lining up a perfect 3am trade (where the Dollar maxes out into the Asian close) and our futures have been improving ever since (up 1% at 8am).

Nothing has changed other than the deck chairs on the Titanic or, in this case, the leaders of Greece and Italy and Italy has pledged to pass even harsher austerity measures, which is cheering up the markets (ie. the Banksters) and giving us a bounce this morning – until the next panic sets in. As I said to Members yesterday, how close to home does this fire have to spread before we begin to take it seriously. We started with the Arab spring and now France is bordered by crisis on both Southern Fronts and, if France goes, then it’s Germany and the UK and how long can the US pretend that’s not our problem (apparently until at least 2016, according to every single moron who answered that question in yesterday’s Republican’t debate).

To be fair, Ron Paul was on fire but, for some reason, he’s considered unelectable by the GOP, probably because he thinks Big Business is just as evil as Big Government while Mitt Romney tells people he will be the President of the 99% – AND the 1% as well. John Huntsman says we may become Italy if we’re not careful but Italy actually runs a budget SURPLUS outside of their interest payments on debt – the US is not even in the ballpark and our debt to GDP ratio is already higher than Italy’s.

Yesterday’s market-tanking "leak" that Germany and France are seriously discussing a smaller eurozone is so out of whack with the public positions of Merkozy that even eurosceptic Ambrose Evans-Pritchard isn’t buying it. "It can only set off a chain reaction, ultimately engulfing France … the whole eurozone would spiral into a catastrophic Depression."

Forget Europe though, as I said to Members in Chat, the scariest news of the week to me is HSBC taking $1.8Bn of loan impairment charges last quarter as large amounts of customers simply stopped paying their mortgages. That’s $1,800,000,000 in on bank, in one quarter. As I have often said, if the bottom 99% ever want to bring the top 1% in this nation to their knees almost instantly, without a shot being fired – all they have to do is withhold their mortgage payments for one month. That’s like cutting off the oxygen to the Banksters, who collect about $150Bn a month to keep their wheels spinning.

Apparently 650,000 Big Bank clients moved $4.5Bn of their savings accounts to small banks and credit unions in last week’s protest – that stings but it doesn’t wound although, if this is a shade of protests to come from the bottom 99% – that fire from the chart above is going to be spreading a lot faster than people think.