Europe is FIXED (again)!

Europe is FIXED (again)!

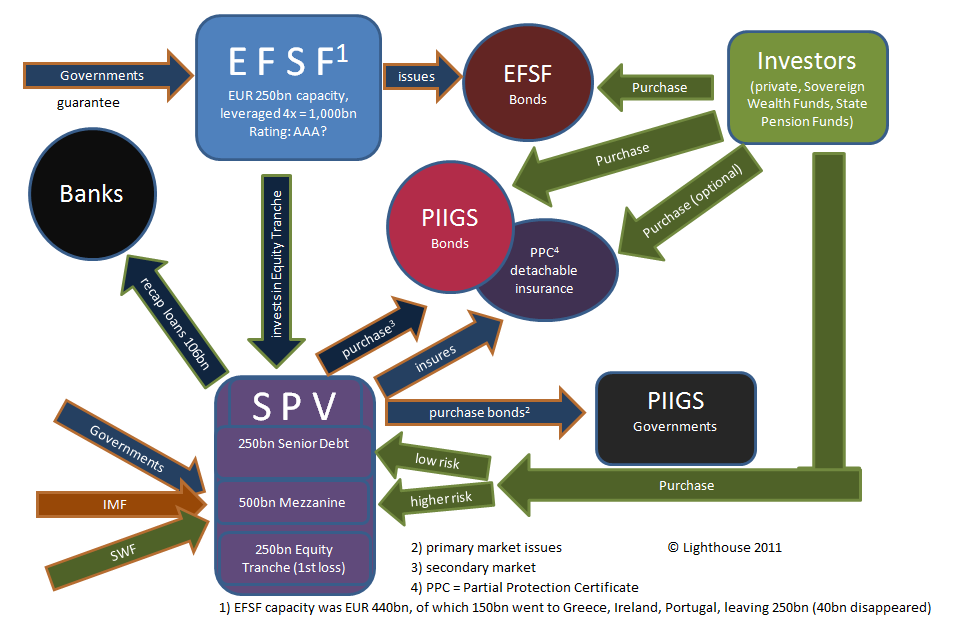

While we are, of course, thrilled (again) – the final solution that Germany has come up with this time for some reason reminds me of a Rube Goldberg machine – with way too many moving parts that all have to work together perfectly in order to get something (a bailout) that you could have gotten from a sane person in one step (borrow/lend money at low rates).

The European Union and the euro area have done much over the past 18 months to improve economic governance and adopt new measures in response to the sovereign debt crisis. However, market tensions in the euro area have increased, and we need to step up our efforts to address the current challenges. Today we agreed to move towards a stronger economic union. This implies action in two directions:

– a new fiscal compact and strengthened economic policy coordination;

– the development of our stabilisation tools to face short term challenges.

That’s the official statement from the European Council, which goes on to outline 16 intended changes, which boil down to a Declaration of Interdependence except it’s not the people of Europe that this new treaty is meant to protect, but the holders of European debt (PIMCO, et al), who have been asked to give up nothing while being given every possible guarantee that even really atrocious behavior – like lending Greece money at 20% interest – will be rewarded.

Behold the power of bond-holders! Merkel, at first, insisted that the private sector share some of the pain but, less than a year of manipulation later and the Masters of the Universe have brought even Germany to their knees as EVERY OTHER EU NATION insisted that bondholders be made whole – except the UK, who are so disgusted by this new treaty that they have opted out – all 26 other Euro Zone Nations have signed on.

We ended ended our day playing bullish yesterday on the assumption that there would be some sort of agreement reached either today or over the weekend but THIS agreement does nothing to convince me to stay bullish into the weekend so we will be back to cash on this news – as I’m really not sure this ridiculous mechanism will stand up to a weekend of scrutiny.

Fortunately, we picked up our Egg McMuffin money already this morning as I sent out a 4:17 Alert to Members saying: "Dollar was all the way up to 79.20 at 3am and now back at 78.92 and that popped us 100 points on the Dow (/YM) just under 12,000 and playable up off that line, of course but let’s see if we make it first! EU says they have an agreement but no details yet."

Fortunately, we picked up our Egg McMuffin money already this morning as I sent out a 4:17 Alert to Members saying: "Dollar was all the way up to 79.20 at 3am and now back at 78.92 and that popped us 100 points on the Dow (/YM) just under 12,000 and playable up off that line, of course but let’s see if we make it first! EU says they have an agreement but no details yet."

We got a beautiful pop at 5:45 that took us up past 12,050 (up $250 per contract) before falling back to test 12,000 again just after 8 (where it’s playable again on the next cross over that line with very tight stops). Europe is up about 1.25% this morning and I expect us to get move of a pop than this as some of the more bearish bets will be forced to cover (we jumped the gun and covered yesterday).

Had we had a simpler agreement – I’d be all gung-ho for a Santa Rally but, due to the complex nature of the agreement (allowing the Punditocracy to poke it full of holes before the first Euro is placed) and due to the fact that our own Treasury has to hawk off $60Bn worth of debt next week – I’m not longer willing to stay bullish over the weekend. Being bearish is still scary but being bullish is just foolish, I think. If we are rallying again next week, I’m sure we’ll find something to buy off a cash position (short-term trading, long-term we’re still bullish).

Why are we bullish at all? Because the EU has not yet begun to fight. How much have they spent bailing out countries and Banks? Two Trillion? Three? Ha, I say – HA! That is NOTHING compared to our own Fed who, by the figuring of the Levy Economics Institute at Bard College is well over the $29,000,000,000,000 (Trillion) mark in "direct lending, asset purchases and all other assistance." It does not, as Barry Ritholtz points out, include indirect costs such as rising price of goods due to inflation, weak dollar, etc…

Cumulative facility totals, in billions

Source: Federal Reserve

Facility Total Percent of total Term Auction Facility $3,818.41 12.89% Central Bank Liquidity Swaps 10,057.4(1.96) 33.96 Single Tranche Open Market Operation 855 2.89 Terms Securities Lending Facility and Term Options Program 2,005.7 6.77 Bear Stearns Bridge Loan 12.9 0.04 Maiden Lane I 28.82(12.98) 0.10 Primary Dealer Credit Facility 8,950.99 30.22 Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility 217.45 0.73 Commercial Paper Funding Facility 737.07 2.49 Term Asset-Backed Securities Loan Facility 71.09(.794) 0.24 Agency Mortgage-Backed Security Purchase Program 1,850.14(849.26) 6.25 AIG Revolving Credit Facility 140.316 0.47 AIG Securities Borrowing Facility 802.316 2.71 Maiden Lane II 19.5(9.33) 0.07 Maiden Lane III 24.3(18.15) 0.08 AIA/ ALICO 25 0.08 Totals $29,616.4 100.0%

Now THAT’s a bailout! As Barry points out: "Overnight lending, by its definition, is temporary, short term, lower risk, modest impact. It exists to allow slightly over-extended banks to meet their reserve requirements. But rolling overnight lending repeatedly for 3 years is none of those things. And it makes a mockery of these same reserve requirements, and the protective purposes they are supposed to serve.

"The amount of overnight lending reflects how broken our financial system really is. A well capitalized, moderately leverage system does not require this massive liquidity from a central bank — interbank lending should be sufficient. What the data reveals is that the financial sector remains dangerously under-capitalized and overleveraged.

"To pretend these were merely minor overnight loans, rolled over once or twice, is foolish, dangerous nonsense."

Foolish, dangerous nonsense – yep, that about sums up the Global Financial Situation. Why then, are we bullish? Because $29,616,400,000,0000 is A LOT of money and EVENTUALLY some of that money will begin to flow back into our $16Tn economy and, even if the Fed manages to put 90% of the monetary genie back in the bottle after accomplishing it’s task – that’s still a bonus $2.6 Trillion sloshing around at some point. Add that the the $1.5Tn in excess reserves that banks are already sitting on plus the $2Tn in cash sitting on the books of our Corporate Masters and we are preparing for on grand mother of an inflation party – at some point.

Consider that a template for the ECB, the BOJ, BOE and even the PBOC to follow as our Global Leaders all desperately look to pump some life into the Economy (as well as their fading political careers). This is the kind of stuff the Fed can do without you knowing, without Congressional approval – without oversight – other than that of Ron Paul, of course:

As Dr. Paul points out in his smackdown of The Bernank – Americans did, in fact, get poorer in Q3 with the net worth of households dropping $2.4Tn to $57.4T, even as the money supply increased astronomically. That’s over 4% folks – IN A QUARTER! It took us 235 years to amass $60Tn and we blew 4% of it in a quarter?!? Household wealth, or net worth, is the value of assets like homes, bank accounts and stocks, minus debts like mortgages and credit cards. At the same time, as I mentioned above, Corporations are amassing record cash stockpiles — $2.1 trillion at the end of September.

And here’s something for the Occupy Wall Streeters to hang their hat on: working Americans are now getting the smallest slice of the income pie on record. The labor share of Q3 productivity — the amount paid to workers instead of businesses and other income-earning entities — was reported to have fallen to 57.1 cents on the dollar, its lowest level since it was first reported by the Bureau of Labor Statistics in 1947.

And here’s something for the Occupy Wall Streeters to hang their hat on: working Americans are now getting the smallest slice of the income pie on record. The labor share of Q3 productivity — the amount paid to workers instead of businesses and other income-earning entities — was reported to have fallen to 57.1 cents on the dollar, its lowest level since it was first reported by the Bureau of Labor Statistics in 1947.

Meanwhile, the wage slaves continue to shop ’till they drop as Americans are pounding the plastic again, as CardHub.com reports Q3 credit card debt jumped $16.8B, or 154% Y/Y. "The speed at which consumers are garnering new debt in 2011 is unprecedented… the first time in the last two years that a Q1 paydown has been completely eradicated by the end of Q3." CardHub results include charge-offs not counted in the Fed’s consumer credit report.

So, as I said, CASH IS KING into the weekend. Our long-term positions should be well covered and our short-term positions should be non-existent, other than perhaps speculating on a big drop next week into the TBill auctions.

Have a great weekend but my sentiment after reading those reports is more like Merry F’ing Christmas: