Forward, backward, inward, outward

Come and join the chase

Nothing could be drier

Than a jolly caucus raceBackward, forward, outward, inward

Bottom to the top

Never a beginning,

There can never be a stopTo skipping, hopping, tripping fancy free and gay

Started it tomorrow

But will finish yesterday‘Round and ’round and ’round we go

Until forevermore

For once we were behind

But now we find we are be-Foreward, backward, inward, outward…

Wheeee – this is FUN!

Down we go again, giving up 50 points pre-market of yesterday’s gains already – once again punishing anyone who was foolish enough to buy yesterday’s rally. Like the Wall Street Pelican in the cartoon says: "You HAVE to run with the others if you want to get dry." Of course it’s impossible for the participants (the bottom 90%) to get dry as they are not on the rock with a warm fire and simply keep getting soaked – over and over again. But the Wall Street Pelican keeps playing his tune, giving himself a ready supply of dancing fish to snap up whenever he gets hungry.

Of course, for those who miss the subtlety of the caucus race, Disney also puts in the story of the Walrus and the carpenter. "The time has come" the Walrus said, "to speak of many things. Of ships and shoes and ceiling wax and cabbages and kings."

The carpenter reminds me of the Tea Party, enabling their fat-cat (or fat-walrus) allies, only to get screwed over in the end. Walt Disney, don’t forget, had gone bankrupt early in his career and had also got screwed by big business when Universal Studios took control of "Oswald the Lucky Rabbit" – the original Bugs Bunny from Disney. "Alice Comedies" were and earlier work of Disney’s that culminated in the eventual release of Alice In Wonderland, with much of his early sarcasm and frustrations with the system still intact.

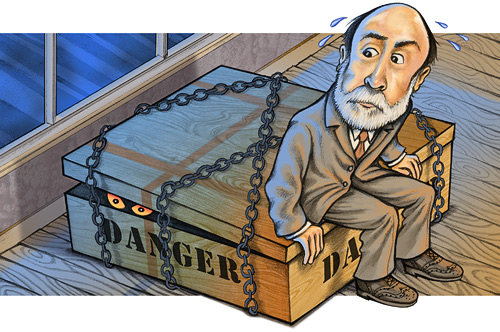

Yesterday, the part of the Walrus was played by Doctor Ben Bernanke, whose Fed Minutes (see my commentary to Members) uses all sorts of fancy language to dance around the fact that this economy is still in the toilet. Callooh! Callay! The Fed may as well be saying as they come up with brand-new ways to avoid saying "RECESSION" and "INFLATION" as that may have been inconvenient, what with the Chairman testifying that such a thing does not exist. "The time has come," Bernanke said, "to talk of many things. Of shoes and ships and sealing wax – of cabbages and kings. And why the sea is boiling hot and whether pigs have wings."

Pigs will apparently have wings long before the real estate market turns around in this country as the most consistent thing about 2011 may have been the Fed’s dreary outlook on both residential and commercial real estate. No one seems to think it’s likely to improve until well into next year and the Fed seems poised to further extend their guarantees of easy money through 2013 at least. The good news is – that puts QE3 squarely on the table and, in my Alert to Members parsing the Fed minutes, I noted:

So one dove was so pissed that he dissented. The question is – how many are "a number of Members" that want more action and how many are "a few others" who feel more action is inappropriate and which ones still have the vote this year? On the whole, my premise of QE3 is intact per these minutes – the data is worse than they thought and it is probably only the price of oil that is keeping them from acting at the moment but another problem in Europe or poor Q4 earnings and they will have no choice. Meanwhile, things need to get worst before the Fed acts is the bottom line.

THAT is the environment we are trading in in 2012 – although the end of the World does seem near, we also see the signs that Deus Ex Machina – in the form of MORE FREE MONEY from the Fed – still may come down from the heavens to save us. Deus Ex Machina is, appropriately: "God out of a machine" and refers to a plot device whereby a seemingly inextricable problem is suddenly and abruptly solved with the contrived and unexpected intervention of some new event, character, ability, or object – pretty much exactly what QE3 is all about – especially for those who already worship money as their God!

Greek poets Horace and Euripides both warned their writing students against the use of the Machine God to solve their plot problems as it was lazy and unsatisfying to the audience but, when push comes to shove in Euripides’ "Alcestis" and Alcestis must give up her life to save here husband – Heracles suddenly shows up and saves her from Death and again, in "Medea," she is spirited away from Jason by the Gods (to cover her double murder). Moral of this story – when it all hits the fan – even the masters will cop out and take the easy crowd-pleaser (likely they had a deadline due and they were out of ideas).

Greek poets Horace and Euripides both warned their writing students against the use of the Machine God to solve their plot problems as it was lazy and unsatisfying to the audience but, when push comes to shove in Euripides’ "Alcestis" and Alcestis must give up her life to save here husband – Heracles suddenly shows up and saves her from Death and again, in "Medea," she is spirited away from Jason by the Gods (to cover her double murder). Moral of this story – when it all hits the fan – even the masters will cop out and take the easy crowd-pleaser (likely they had a deadline due and they were out of ideas).

Clearly the Fed is out of ideas as Operation Twist is a rehash of their (failed) 1961 program but they had to do SOMETHING before going back to the QE well for the third time in 3 years (would have been two years if they hadn’t put it off until now).

While we (brilliantly) sold into the initial excitement yesterday and are very pleased with the downturn this morning – we will also not get carried away on the bear side as the Machine God may be nothing more than an artificial contrivance but we are not in the audience of this particular Global Economic Theater – we are ourselves trapped in the play and I am but a humble member of the chorus and woe unto all of us who do not respect the whims of the Fed!