Wholesale gas prices jumped 5% last night.

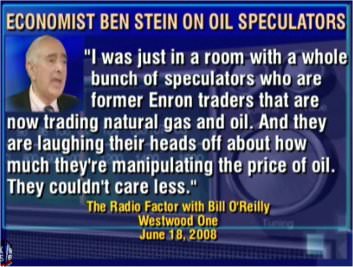

Goldman Sach's head of energy research, David Greely, has been banging the oil drums all month and has helped engineer a 10% rise in crude, costing Americans an extra $10Bn a month at the pumps and in their energy bills (not even including the rise in food and transportation costs) in order to make his masters another Billion on their trades but he's not done there. Now he is celebrating Brent Crude crossing it's 2008 highs of $124 a barrel by recommending long positions on September WTI contracts at $107.50:

Greely's main bullish premise for WTI is that one way or another, as Keystone was meant to do, they will find a way to reverse the flow of oil into Cushing, OK, where we measure our national inventories each week, and begin draining that facility dry at will. This will give the commodity manipulators total control over the price of oil by enabling them to add or subtract millions of barrels of oil each week and, if the Keystone project gets rammed past the White House – millions more can be drained from Cushing at the will of a single company.

It has long been the dream of the US Energy Cartel to force Americans to pay the same ridiculous prices as Europeans for oil, despite the fact that the US produces over 10Mb per day right here at home, more than twice as much as Europe.

It has long been the dream of the US Energy Cartel to force Americans to pay the same ridiculous prices as Europeans for oil, despite the fact that the US produces over 10Mb per day right here at home, more than twice as much as Europe.

Concerns of potential supply disruptions have increased as tensions between Iran and Western nations escalate, Greely said in a report today. Spare production capacity among the members of the Organization of Petroleum Exporting Countries has fallen to “dangerously low” levels at a time that the world’s demand is recovering, Greely said.

“We believe that stronger-than-expected demand against limited inventory and scarce excess production capacity leaves the market vulnerable to price spikes in the near-to-medium term,” Greely wrote. “Oil looks increasingly compelling from the long side both as an outright position and a hedge.”

If this is giving you flashbacks to 2008, when Goldman Sachs stampeded their sheep into $140 oil contracts on the promise that the same conditions would lead to $200 oil – you're half right. The reality is that it's even more asinine now to make these statements than it was then as we had a much more robust economy in 2008 and we had far less production capacity in 2008 and we had far less of an inventory surplus in 2008 but don't let that stop David Greely from destroying America to enrich his masters – just like Arjun Murti, who came out with Goldman's last massive pump job – Greely will soon be a disgraced footnote in investor history while his superiors decide what color Ferrari to buy this year with their bonus money.

If this is giving you flashbacks to 2008, when Goldman Sachs stampeded their sheep into $140 oil contracts on the promise that the same conditions would lead to $200 oil – you're half right. The reality is that it's even more asinine now to make these statements than it was then as we had a much more robust economy in 2008 and we had far less production capacity in 2008 and we had far less of an inventory surplus in 2008 but don't let that stop David Greely from destroying America to enrich his masters – just like Arjun Murti, who came out with Goldman's last massive pump job – Greely will soon be a disgraced footnote in investor history while his superiors decide what color Ferrari to buy this year with their bonus money.

Prior to joining Goldman in 2001, Greely worked as a research economist at the FDIC so he really knows his stuff. I poked holes in Goldman's 2008 call in my article "$200 Oil – Who's Going to Pay For It?" based on purely economic reasons. Not only is the economy weaker now and less able to pay these excess fees but the rest of Greely's premise is nothing but pure and utter BS as well. For one thing, there are 100,000,000 more barrels of oil in storage in the US than there were in 2008, that's 12 days worth of imports in addition to the 204 days of imports we already had. Of the 8.5Mbd we import, 5Mbd comes from Canada and Mexico and Iran isn't going to be cutting off the Gulf of Mexico, are they? Another 2.5Mbd comes from South America and I'm pretty sure Iran doesn't control the Atlantic yet – despite their "surprisingly strong" navy that CNBC keeps featuring – as if they are going to last more than 24 hours against our 5th Fleet, which is deployed in the Gulf.

So, for the 1Mb of oil that we actually import from OPEC, we have a 1,750 day reserve to draw down on in case Iran is able to cut off 100% of the supply. I promise to get concerned sometime around year 3 of the blockade – really I do! If Iran is unable to affect a 3-year blocade of the Straight of Hormuz – total disaster for oil longs as Opec Production is already at 30.9MBd, back to all-time highs and Saudi Arabia alone is putting out 11Mbd, which is the highest level since the Iran-Iraq war, when oil was below $40 a barrel (despite the war and Saddam setting oil fields on fire).

Not only that, but we're already getting a glimpse of demand destruction at $4 per gallon and Kevin Book, Director of Research at ClearView Enerrgy Partners says that, between $4 and $5 per gallon, we can expect to see a 2.5Mbd destruction of demand. That's more oil than Iran produces! As Book points out:

"Most of the world’s elective, GDP-linked petroleum consumers are in the OECD, and most of them are here in the U.S. Most of us are still driving yesterday’s cars at today’s prices without yesterday’s bank accounts and yesterday’s access to credit (to say nothing of yesterday’s home valuations).

OECD demand includes a significant price-driven “shock absorber” in the form of demand compression, but we don't think subsidized economies should be overlooked, either. In subsidized economies, end-users drive almost as much at high prices as they do at low prices, and governments are the ones who get the sticker shock. When that happens , investors shouldn’t forget about the “crumple zone” in global demand that comes from governments pulling back on those subsidies."

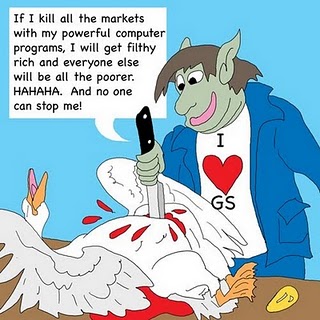

There is already such a glut of supply in North America that a barrel of Canadian crude from the oil sands in Alberta fetches just $63 a barrel and THAT is the trend. This is why GS and the other manipulating bastards that have taken over our country (not to mention most of the "Free" World) are desperately trying to drive people into oil now – they have tens of billions of Dollars worth of contracts to dump before this charade – like the Great Charade of 2008, blows up in their faces and sends them running back to the Government for another bailout. As noted by Al Fin Energy and Robin Mills of Manaar Energy:

There is already such a glut of supply in North America that a barrel of Canadian crude from the oil sands in Alberta fetches just $63 a barrel and THAT is the trend. This is why GS and the other manipulating bastards that have taken over our country (not to mention most of the "Free" World) are desperately trying to drive people into oil now – they have tens of billions of Dollars worth of contracts to dump before this charade – like the Great Charade of 2008, blows up in their faces and sends them running back to the Government for another bailout. As noted by Al Fin Energy and Robin Mills of Manaar Energy:

Oil producers are deathly afraid of oversupply in the oil market — an oil glut. Such a glut is happening in the North American natural gas market, shaking the energy globe from Russia to Iran to Venzuela. Since oil dictatorships derive their political power from energy sales, they cannot afford to tolerate an energy glut. Such a thing is far more a threat to them than contrived and ghoulishly elaborated rumours of "peak oil."

The advent of shale oil and gas production has reversed declining US production, is now spreading globally, and can be commercial at an oil price of just US$30 a barrel. This breakthrough seems completely to have passed by peak-oil advocates. They claim the end of "easy oil", without noting that technology continually makes unconventional oil into conventional.

Peak oil cultists are compelled in their belief — they no longer have a rational choice whether to "believe" or not. They lurch from one doom projection to another, compulsively feeding on a ghoulish doom that can never satisfy their ineffable hunger.

Last year, in June, I laid out a plan for traders to break the backs of the oil speculators and the trades I outlined at the time led to many Billions of Dollars worth of potential profits as oil fell form $114 to $75 despite all of GS's predictions to the contrary. Today we're back at $106.95 in the Futures, which was the spike high of last March – and they were able to keep up the nonsense through the end of April, when both oil and the markets collapsed.

Last year, in June, I laid out a plan for traders to break the backs of the oil speculators and the trades I outlined at the time led to many Billions of Dollars worth of potential profits as oil fell form $114 to $75 despite all of GS's predictions to the contrary. Today we're back at $106.95 in the Futures, which was the spike high of last March – and they were able to keep up the nonsense through the end of April, when both oil and the markets collapsed.

I don't think investors are either rich enough or dumb enough to get screwed like that twice in less than a year but, then again, I often underestimate how many idiots fall for Goldman's crap time after time. Even when Goldman Sachs is harangued on National TV for steering their own clients into "shitty deals," GS seems to always be able to round up another herd of sheep to lead into the next slaughter.

Oil is now up 52% since October and is up 165% since March of 2009 so only a little bit ahead of the trend that takes us to Goldman's promised land of $140 oil again (up 250%) by late Summer. With Global consumption at 86M barrels per day, that's $8.6Bn a day sucked out of the Global economy and $3Tn a year that goes into paying for a commodity that literally goes up in smoke – leaving nothing in its wake but a mountain of debt (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark").

Oil is now up 52% since October and is up 165% since March of 2009 so only a little bit ahead of the trend that takes us to Goldman's promised land of $140 oil again (up 250%) by late Summer. With Global consumption at 86M barrels per day, that's $8.6Bn a day sucked out of the Global economy and $3Tn a year that goes into paying for a commodity that literally goes up in smoke – leaving nothing in its wake but a mountain of debt (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark").

Thank goodness the GOP stopped Al Gore from charging us 10 cents a gallon to funnel into alternate energy research back in 1992 – at the time, they said that 4.3 cents a gallon extra would destroy the US economy (gas was $1.10 a gallon at the time but Gore warned it could go much higher if we didn't take fuel conservation seriously).

We don't know WHEN this oil scam will collapse but we have been shorting oil with the intention of rolling our short plays up (in strike) and out (in time) as prices climb higher – a strategy for which we were richly rewarded in 2008 (after much stress as oil hit $140 before falling back to $40). At this point (over $105), it's now a race on which will collapse first, oil or the economy but one will bring the other down in any event.

So, unfortunately, we will still have to be careful out there – at least until we get the technical signals we've been waiting for.