Thanks Mr. Market – it's been a great year.

Thanks Mr. Market – it's been a great year.

We're up from 1,275 to 1,363 on the S&P and that's 7% and, for those playing the upside since October's 1,074 low – it's been a fantastic 27% run in 4 months so we have nothing to complain about in 2012, do we? Of course the US markets gained $10Tn in value in 120 days – that kind of stuff happens all the time and is nothing to be concerned about. I'm sure the net $20Bn that flowed into the markets during that time period had many, many babies to fill up the empty space – or at least that's how Rick Santorum explained it to me.

Fortunately, with over 80% of the trading in the market being conducted by HFT Bots that bring the average hold time for ALL positions (including your long-term retirement fund) down to an average of 22 seconds – we don't need any actual money – or even human participation to have a nice-looking market rally. While "Drill Baby, Drill" may be the rallying cry of the GOP, their Super Pac contributors in the Financial Sector prefer "Churn Baby, Churn" as Billions of shares are traded in the stock market every day that are held for less time than it takes you to read the word "held".

This post is a bookend, in a way, to my September 30th's "TGIF – Closing a 12% Down Quarter," which followed our bullish prediction the previous day's "Thrill-Ride Thursday – Finding Bottom" where my comment on why we were taking bullish positions in the middle of a catastrophic collapse was:

This post is a bookend, in a way, to my September 30th's "TGIF – Closing a 12% Down Quarter," which followed our bullish prediction the previous day's "Thrill-Ride Thursday – Finding Bottom" where my comment on why we were taking bullish positions in the middle of a catastrophic collapse was:

We only fear missing a rally as we may never get another chance at these lows. While it’s possible that we get that 25% decline, we don’t fear that either as we will simply scale an and take net entries that are 40% lower than we are now and, if the markets fall that far and never recover – we’ll be a lot more concerned about stocking the shelter up with ammo than we will be about whether or not our XLF trade is performing well!

At the time, we had been moving into our September's Dozen Portfolio on each dip since the August crash (S&P 1,100) and we did bottom out on October 3rd at 1,074. Just like our bullish February trade ideas – the plan was to add another trade each day we held our lines and we were quite full in time for the October rally, which took us up to 1,292 at the end of that month.

At the time, we had been moving into our September's Dozen Portfolio on each dip since the August crash (S&P 1,100) and we did bottom out on October 3rd at 1,074. Just like our bullish February trade ideas – the plan was to add another trade each day we held our lines and we were quite full in time for the October rally, which took us up to 1,292 at the end of that month.

On October 29th, we closed our out short-term bullish positions as well as our very successful $25,000 Portfolio (all portfolios are virtual) and began an aggressively bullish White Christmas Portfolio that ended up tripling $15,000 by Christmas.

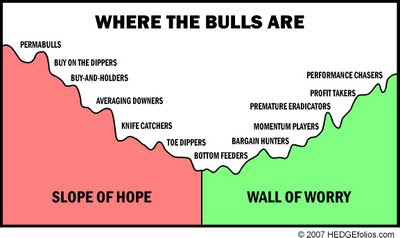

When we began the New Year, we felt 1,275 was a bit toppy for the S&P (up 16% from 1,100) and our new $25,000 Portfolio was aggressively bearish instead. This did not change our long-term bullish stance at all – we still think inflation is an unstoppable force that will drive the market to all-time highs this decade BUT (and it's a big but) that doesn't mean we don't expect a correction or two along the way!

Currently, our $25,000 portfolio is down 40%, to $15,000(ish) as the market has gone up and up and up and up some more for the first two months of the year. While a pessimist may say that's a bad thing, an optimist (a bearish one) would say that we have A LOT of bearish positions we picked up very cheaply now and we are very well positioned to take full advantage of a market catastrophe. If there is no catastrophe – in two more months, with a balance of $5,000 – imagine the size and scope of our bearish positions then!

Of course, if the market continues to roll higher at a pace of 27% every 4 months, our larger, longer-term plays, like our Income Portfolio will be doing ridiculously well and, like any insurance hedge, the cost of our short-term bearish positions should be washed away by the positive performance of our longer positions. In addition to the $25KP, we also have IWM Money and FAS Money Portfolios as well as our $5KP and Lflan's AAPL Portfolio as short-term bullish virtual portfolios to follow but those are all doing fantastically well so there's no need to worry about them at the moment.

Of course, if the market continues to roll higher at a pace of 27% every 4 months, our larger, longer-term plays, like our Income Portfolio will be doing ridiculously well and, like any insurance hedge, the cost of our short-term bearish positions should be washed away by the positive performance of our longer positions. In addition to the $25KP, we also have IWM Money and FAS Money Portfolios as well as our $5KP and Lflan's AAPL Portfolio as short-term bullish virtual portfolios to follow but those are all doing fantastically well so there's no need to worry about them at the moment.

While I do try to get more bullish – it's very hard. On Wednesday I listed 10 more bullish trade ideas as we exhausted our first 20 bullish positions of February with the S&P holding 1,297 all month so we reset the bar at the 1,360 line as both the stop line for our first 20 trades as well as the start line for our next 10 but, so far, we haven't had a full day over the line. That led us to aggressively roll our short-term $25KP bearish bets yesterday and now we will sit and see if this is FINALLY the weekend that reality hits the Global markets.

This morning, as usual, we were able to make our Egg McMuffin money with quick shorts on the Futures in Member Chat (/TF and /CL this morning) but we have certainly learned to take the bearish money and run early and often as no good sell-off goes unpunished these days. Yesterday's stunning reversal was a fine example of both how quickly you can make money betting bearish AND how quickly you can lose it – on the whole, it's a Day Trader's paradise – with a day being re-defined to mean about 30 minutes…

This morning, as usual, we were able to make our Egg McMuffin money with quick shorts on the Futures in Member Chat (/TF and /CL this morning) but we have certainly learned to take the bearish money and run early and often as no good sell-off goes unpunished these days. Yesterday's stunning reversal was a fine example of both how quickly you can make money betting bearish AND how quickly you can lose it – on the whole, it's a Day Trader's paradise – with a day being re-defined to mean about 30 minutes…

CNBC is now (9:06) having their usual morning oil pumping session with Cramer saying $147 is cheap because Maria says Israel is gearing up for war and, of course, Maria MUST know these things because she's in Israel and that makes her the World's foremost authority.

At the same time, the markets are up as if they haven't got a care in the World. Does it make sense to you? Can oil go to $140 on a Gulf War between Israel and Iran with supply disruptions and general chaos and that's going to be GOOD for the Dow and the Russell and the Nasdaq and the S&P? Corporate margins already suck – they are certainly not going to improve as oil climbs 15% this month and, according to Criminal Narrators Boosting Crude – another 25% next month.

Yesterday, CNBC lied to our faces, commenting that refiners in the US were operating at capacity despite the fact that anyone could read the very first paragraph of yesterday's EIA report, where it says in plain English: "Refineries operated at 85.5 percent of their operable capacity last week." So is CNBC lying and purposely misleading the viewing public, fooling people into buying oil on false premises – or are they just pathetically poor fact checkers with little or no editorial oversight as to the veracity of their content? We report – you decide.

Another extremely deceiving bit of data is the headline report itself, which showed a 1.6Mb build in crude oil inventories along with a 600Kb drawdown in gasoline and a 200Kb drawdown in distillates for a net 800,000 barrel build on the week. While that sounds small, you may notice (if you read the report) that last year refineries supplied us with 19,350,000 barrels a day and this year, they cut that back to 18,054,000 per day. That difference of 9.07Mb per week represents 1.14 days of imports, which have also been cut by 1.15Mbd (8Mb/week) to further create the illusion of tight supply in this country. But why stop at shorting the American people 17Mb a week? The US energy cartel has also turned last year's imports of 482,000 barrels a day of Petroleum product to an EXPORT of 870,000 barrels a day for a net outflow of 9.5Mb per week.

That's how the US can consume 19Mb less petroleum per week than we did last year (14%) but the US Energy Cartel can charge us 13% more than they did per gallon consumed. At 18Mbd and 42 gallons per barrel – just that .41 per gallon increase in the price of oil over last year is costing US consumers $9.3Bn per month and you ain't seen nothing yet if Cramer and Company get their way.

I don't want you to protest. I don't want you to riot. I don't want you to write to your Congressman, because I wouldn't know what to tell you to write. I don't know what to do about the depression and the inflation and the Russians and the crime in the street.

All I know is that first, you've got to get mad.

You've gotta say, "I'm a human being, goddammit! My life has value!"

And have a great weekend,

– Phil