This is frustrating isn't it?

This is frustrating isn't it?

The S&P fell to 1,355 in the Futures, breaking our rule to get bullish as they must hold 1,360 for 2 consecutive days so we're back to watching and waiting now as it's been two full weeks of teasing this line as the index creeps back into the bottom of David Fry's SPY channel.

We thought we were going to fail back at 1,300 but we caught a nice bounce off the bottom at the beginning of the month and flew up another 5.5% since then but now we're almost 10% over the 200 dma on less and less volume and that's one hell of an air pocket below us on the S&P so of course the lack of more free money from the G20 is going to hurt today – the question is – how much?

We discussed the G20 over the weekend, so no need to re-hash it here. Let's take a little time today to delve into the logic of S&P 1,360 and see if we can find some good reasons for it to stick. In his letter to shareholders this weekend, Warren Buffett very plainly says that his entire bullish premise is based on his believe that housing will make a comeback. Jim Bianco had an article on that this weekend noting Homebuilder Optimism has risen for 5 straight months, back to the highest level since May of 2007, at the early stages of the slowdown BUT – let's keep in mind that the sentiment level is 29 and anything below 50 is still NEGATIVE – so we have a long way to go!

We have been playing XRT short, expecting it to have been rejected at $56, like it was last summer prior to a 20% drop. Now XRT is at $58, up 31% from it's October lows and we have to wonder if the situation for Retail has REALLY gotten 31% better than high-volume investors were pricing it AFTER seeing last July's earnings reports or is this another major air bubble that's about to burst?

We have been playing XRT short, expecting it to have been rejected at $56, like it was last summer prior to a 20% drop. Now XRT is at $58, up 31% from it's October lows and we have to wonder if the situation for Retail has REALLY gotten 31% better than high-volume investors were pricing it AFTER seeing last July's earnings reports or is this another major air bubble that's about to burst?

The January Retail Sales Report showed $361Bn in sales and that was up 5.6% from last year's $342Bn. This month we'll see an automatic 3.5% bump as February has an extra day (people fall for that one every 4 years) and we have strong auto sales and the price of gasoline is through the roof so those sales should be stronger too.

But the smart money expects this – that's going to be a "sell on the news" event if ever there was one – the question is: How long until all this "good news" runs its course? Last July, we had earnings for April, May and June and the fact of the matter is that those 3 months had 6.66% BETTER Retail Sales than they did in 2010 and those numbers were up 10% from 2009, when XRT bottomed out at $17.27. We're certainly not expecting/hoping to go back there or even to the 2010 average at $40 but $58 (up 45%) seems like a bit of a stretch as you can't extrapolate consumer spending to keep growing when there are still no jobs and no additional stimulus.

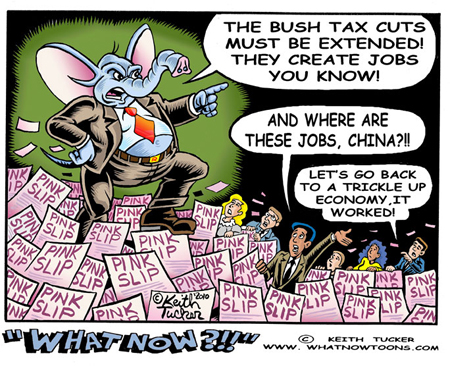

Yes, it's ALL about the stimulus as the G20 has done NOTHING to create jobs – except through the accident of some of their free money "trickling down" from the people they hand it to.

Yes, it's ALL about the stimulus as the G20 has done NOTHING to create jobs – except through the accident of some of their free money "trickling down" from the people they hand it to.

I haven't seen a good breakdown, but we know a lot of retail spending is on-line sales, and that's not poor people. New car sales are up – also not poor people, and eating out is on the rise – again, not poor people. Unfortunately, there is a limit to how much money the CEO with a bonus can spend to make up for all the people he fired to save money to pay for that bonus.

That's an interesting dynamic, by the way because the super-rich USED to buy houses with their extra money and building those houses did create actual jobs. There are no jobs created when a wealthy person decides to buy a more expensive car over a cheaper car and, in fact, since most expensive cars are imports – we actually lose jobs when we lay off American workers to make sure the boss can afford a new Ferrari this year, don't we?

And, of course, that brings us to oil, which is hovering around $109 and we will have to see how the Dollar behaves as both oil and gold have had a big run against the declining Dollar but lack of G20 action (now off until April, most likely) means we're running out of catalysts to further weaken the Dollar and a sell-off in the indexes could send Global investors scurrying back to the relative safety of our currency, engineering a sharp reversal of the current trend.

That's the bear case – the bull case is Iran and more stimulus. We don't have the stimulus but we'll always have Iran (unless they actually bomb someone, then they have about a month). The last time oil was this overbought was last April, also on the recovery/Iran story. We hit $114.83 before collapsing back to $75 but "this time it's different" according to the good folks at CNBC.

That's the bear case – the bull case is Iran and more stimulus. We don't have the stimulus but we'll always have Iran (unless they actually bomb someone, then they have about a month). The last time oil was this overbought was last April, also on the recovery/Iran story. We hit $114.83 before collapsing back to $75 but "this time it's different" according to the good folks at CNBC.

As you can see from Dave Fry's chart on the left, USL, which is smoother than USO as it plays a 12-month strip, is at the top of it's channel and, in a vacuum – I could agree with Dave that we still have room to run but it's not oil, it's gasoline that consumers pay for and we're already back to last April's high at $3.42, which indicates the speculators have overplayed their hand.

Whether they've overplayed their hand or whether they have the cards to show us $114 oil again, we're already at $110 and, more importantly, Brent Crude is already over, not just last year's highs – but over it's all-time high – all on SPECULATION that Iran will disrupt the markets. Have you ever run out to Home Depot to buy a bag of salt because there was going to be a huge snow-storm and then there wasn't one? After a while, you have all the salt you could possibly need – even if that storm does come. Then what happens to the prices?

Imagine what happens with oil, which is much easier to return than salt. As with the GLD fund, which now holds 1,300 Tons of gold, almost double where it was in 2010 and represents over half of a full year's Global gold production – there will be hell to pay when those buyers become sellers.

It's going to be a fun week – let's see what happens!