I want to be bullish.

I want to be bullish.

Really I do. Being bullish is much more fun than being bearish. According to Bloomerg: In the midst of the Great Depression, people who bet on stock-market declines were considered unpleasant, unwanted, un-American, un-something. Yet as a New York Times writer noted in February 1932, "The bearish speculator is not often reviled in healthy markets; it is when prices are declining that opprobrium is heaped upon him."

That's not what's happening now. It has become so out of vogue to be bearish now that many fund managers I talk to are insulted that I should question their bullish positions. Being bullish has become the new religion whose Gods are Ben Bernanke, China, the BOJ and the ECB – beings of supreme power who can move the markets with a word and will never, ever let them go down again – all you have to do is BELIEVE!

There are still some heretics out there as put contracts against Europe are at their highest level since the July/August collapse. The iShares MSCI EAFE Index Fund (EFA) is matching its highest levels in the last six months, but a huge put spread dominated its option activity Friday. Options to protect against a 10% drop in the EFA cost 71% more than contracts betting on a 10% gain, according to data compiled by Bloomberg. Put volume jumped to a record on Feb. 24. The ETF has gained 16% since global equities bottomed last year on Oct. 4th.

The May $52/43 bear put spread is the hot trade on EFA (over 100,000 contracts at net $1.14) at the moment although EFA hasn't been at $43 since April 2009. It's an $11M bet that Europe is going down but maybe it's just a hedge on $100M worth of bullish positions – it's hard to tell with these things…

There's still plenty of bad news out there, most notably today that the S&P finally realized Greece has defaulted on it's debt by forcing bondholders to accept 53% less than they were owed (I know – SHOCKING!). What's actually shocking is the reaction this caused by the ECB, who have now "temporarily," but immediately "suspended the eligibility of marketable debt instruments issued or fully guaranteed by the Hellenic Republic for use as collateral in Eurosystem monetary policy operations."

So now they WON'T be taking Greek debt as collateral – at least until March, when new agreements may be in place (if all goes well). Meanwhile, the International Swaps and Derivatives Association’s determinations committee was asked to determine whether the Greek default constitutes an event that will trigger Credit Default Swaps, meant to insure bondholders against default. Hundreds of Billions of Dollars depend on this decision and there will be many winners and losers no matter which way it goes.

Banks, hedge funds and other money managers had bought and sold credit swaps on a net $3.2 billion of Greek obligations as of Feb. 17, according to the Depository Trust & Clearing Corp., which runs a central repository for the market. Credit swaps pay the buyer face value if a borrower fails to meet its obligations, less the value of the defaulted debt.

Back in the US, $1,120,000,000 of Consumer Debt is delinquent (over 2x Greece's total debt) and $824Bn is considered "seriously delinquent" according to a report from the NY Fed. The "improvement" in delinquent debt noted in the report is entirely the result of a $146Bn drop in mortgage debt, much of which was defaulted on so – yay! – I guess. Of course, 2.2% of the outstanding $11.5Tn ($253Bn) "transitioned" into delinquency in Q4 so it's on step forward and two steps back for the consumers in the US economy.

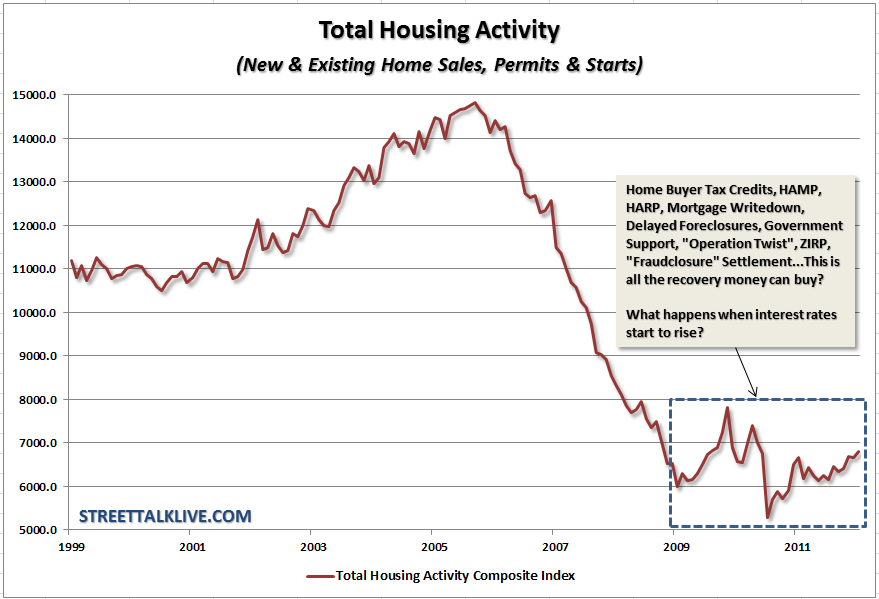

Pragmatic Capitalism had this great composite chart of our housing "recovery" that really puts it in perspective and illustrates a couple of issues the Fed report brings to light like:

Pragmatic Capitalism had this great composite chart of our housing "recovery" that really puts it in perspective and illustrates a couple of issues the Fed report brings to light like:

- Roughly 289,000 individuals had a foreclosure notation added to their credit report in Q4, a 9.5% increase from the third quarter.

- In 2011, mortgage originations totaled $1.55 trillion, the lowest level of originations since 2000

The good news is that Auto loan originations were $289Bn, back to 2007 levels. While a pessimist would conclude that people are simply moving out of homes and moving into cars, an optimist would say – "Hey look – Dow 13,000!" This morning we will alternate shots of Tequila and hitting ourselves in the head with a brick until we are able to adjust our attitude to appropriately focus on the those positives and eliminate those negatives.