My, my – things are getting ugly.

My, my – things are getting ugly.

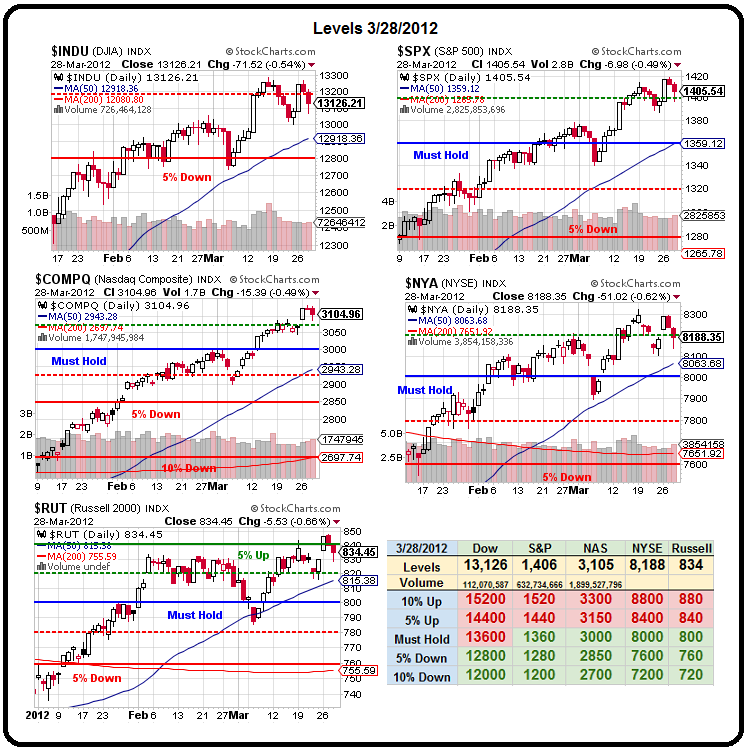

Not too much technical damage on the Big Chart so far but we have critical crosses of our 2.5% lines at S&P 1,400 and Nas 3,075 to watch. I think we'll hold the Nas unless AAPL takes a dive so, despite the 1% drop in Europe this morning (7:30) – I don't think today's the day the music dies.

We have our 3rd estimate of Q4 GDP this morning at 8:30 and I'm not expecting it to be better than the last 3% estimate – probably a bit worse as the data has been downhill since then. Clearly sentiment has turned a bit sour and, as I mentioned in yesterday's post – if this is all we can get out of the markets after our Central Banksters all held a QE revival meeting on Monday with promises of Trillions more free money – then we are pretty screwed.

Speaking of people who are soon to be screwed, oil speculators are about to get their gas handed to them as there are over 570M barrels worth of open contracts at the NYMEX scheduled for delivery in the next 3 months alone and we're already way over any prior level of storage capacity (Bespoke chart).

If Iran doesn't nuke the Strait of Hormuz very soon, this is going to turn ugly for those stuck with oil contracts as October 2013 barrels are still trading under $100 and 2015 contracts are under $90 – indicating no long-term support for all these speculative barrels. Yesterday, another 7M unwanted barrels piled up in inventories as consumers continue to cut back on gasoline they can no longer afford.

When I was on BNN earlier this month, oil was at $107 and my trade idea was to pick up the SCO April $29/33 bull call spread for $2.10, selling the April $30 puts for $1.35 to pay for it on the premise that oil wouldn't go over $110, where we begin to lose more than the net .75 cash and our max gain of $3.25 (433%) came around $105. We're at the halfway mark to April expiration and, with oil at $105, SCO is at $33.63 (our goal) and the April $29 calls are $5 and the $33 calls are $2 and $30 puts are .40 for net $2.60 – up 246% already. That's the way we like to play oil short over the medium term, while we will generally use USO puts and, of course, those fabulous Futures (/CL) to play the shorter-term moves.

Obviously, I was wrong in expecting a big sell-off by the end of March, unless we drop 5% by tomorrow but I still have all the same concerns I had on March 5th, when AAPL was 13% lower ($533) than it is today. We didn't bet against AAPL of course – we love AAPL although, as I mentioned on Tuesday, AAPL is distorting the markets, making things seem much healthier than they are. Still, it wasn't until March 15th, when the S&P finally broke over 1,400, that we initiated our Long Put List (Members Only) and so far, so wrong on some of them but not too painful – as noted by my comment on our PCLN position in yesterday's Member Chat:

We shorted PCLN July $450 puts at $5 on the 15th and they dropped to $3.70 on the 20th and we spent $2.40 to roll them up to the $500 puts at $6.10 and those are now $4.50 and we just decided to move to the $520s this morning, which were $4.90 at the time, so a $1 roll on our $500 puts (11:05) and the $520 puts are already $5.50 so a good roll and our basis is $3.70 + $2.40 + $1 – $7.10 and we're down $1.60 despite the fact that PCLN has moved $70 against us since 3/15.

You HAVE to have conviction to short a bull market but, for value investors, the urge to short becomes irresistible at a certain point. As I detailed yesterday, PCLN has clearly passed that point for us and, the higher they go – the more we want to short them!

8:30 Update: Same old, same old on the GDP at 3%, Price Index also steady at 1.1%. 359,000 people lost their jobs last week and the week before is revised up from the 348K that sparked a rally to 364K, that would have caused a sell-off if accurately reported.

Our Corporate Masters boosted profits by $16.8Bn but that is down considerably from the $32.5Bn they added in Q3. Before we pass the hat again to bail out our beloved Banksters and other oligarchs – note that Production Cash Flow increased by $44.8Bn in Q4, up 25% from Q3 thanks to all that FREE MONEY the Fed is tossing at them. Don't worry though – they sure aren't going to waste it paying their workers!

In fact, Domestic Profits of Financial Corporations shot up $29.9Bn, a 400% increase over Q3's negative $9.1Bn as Operation Twist (twisting you out of your retirement) kicked into high gear. Domestic Profits of Non-Financial Corporations kept pace, up $28.4Bn vs $17.9Bn in Q3. So things were, indeed getting better in America in Q4 – HOWEVER – the Rest of the World component of Corporate Profits DECREASED $41.5Bn, 900% worse than Q3's $5.4Bn increase.

Look, I know I bore a lot of people talking about the price of rice in Bali – BUT THESE THINGS MATTER! Sooner or later, it all catches up to us and our biggest problem is we see these things miles before the MSM (and other investors) catch on and we end up making our bets a bit early but, over time – we do tend to be right more often than not.

Overall, pre-tax Corporate profits FELL $8.3Bn from Q3, when the S&P was at 1,100. Do you think Q1 profits rose 30% to justify the market move or do you think that maybe, just maybe, we are a bit overbought?

Speaking of overbought – Seeking Alpha Reports this morning: "With warm weather about to allow for even higher natural gas inventories, the country's 4Tn cubic foot storage capacity could get hit by mid-August, literally causing the price to go negative as operators like Kinder Morgan (KMI) turn away product. Low prices are at work increasing gas usage, but it may not come in time to prevent red prices this summer." My commentary to Members two weeks ago was:

Nat gas was down 64Bcf and I can't imagine where it was cold last week so I think someone cut production. Nat gas shot up from $2.26 to $2.32 but 64Bcf at the end of winter is nothing to get excited about – I don't even know where they are going to put the gas this summer as we're bottoming about 30% higher than a normal bottom and, with all the shale production – we might blow past the builds of the last two years, which were about 2,200 Bcf and that would put us to 4,600, which is about 800Bcf more than we actually have storage for in the US.

As I said, we may be ahead of the curve as Fundamental investors but, eventually, the rest of the market catches up with us! Unfortunately for the bulls, I have had no reason, since March 5th, to change my 775 target on the Russell – which is now 7% below the current level. I had said end of March back on the 5th and, as I said above, not very likely by tomorrow but most of our short-term bets are bearish and we have 3 more weeks until our April contracts expire so we don't mind if we miss our target by a week or two.

Tomorrow we''ll see just how few of those Corporate Profits found their way into American Workers' Personal Incomes – even though it's the US Consumer that is the only reason there are any Corporate Profits at all. That's as good a cue as any to end this post with a little food for thought – one of my favorite cartoons by Elaine Supkis that sums up the lunacy quite nicely:

Let's be careful out there!