I keep re-using this post as the comments under it are very important.

We have been exploring various options for trying to see if there is a way to structure a Berkshire-like company in the 21st Century. What I would like to accomplish this week is getting ALL interested Members to fill out Craig's survey (you need a GMail account to log in) – because, no matter what we end up finding, it would be great to quantify the incredible knowledge and experience of our Member base – who knows when or how this information will be useful in the future?

The idea is to be able to say that these 5 or 6 people in a certain region have knowledge of a certain sector and would be good contacts when opportunities arise in their area. Just read through the comments in the post below to get an idea of how amazing this group is! Not only do we have top notch people in almost any field but those same people are the types that have the opportunities to bring to others. I know that at least once a week, someone presents me with a business problem that can easily be solved by just finding the right people with time to commit to the project – many of us are retired or have a decent amount of free time – what could be more perfect than to have opportunities dropped in our laps?

So PLEASE fill out the survey, add your comments below (I promise to catch up this weekend) and, by the end of this month, we expect to have some major announcements – providing we have enough interested parties to make it work, of course.

Malsg had a great comment as to structure, and LVModa made a great point about getting involved with private companies. For those of you who don't remember, LV hosted our PSW Conference in Las Vegas last year and I got to spend time with him – his background is great for this – as are many others who have offered to work on this project. Please check out the comments below and consider this the last, last chance to make your own before this train leaves the station.

Thanks,

– Phil

====================================================================================

"Build a better mousetrap, and the World will beat a path to your door."

Of course we know that's not entirely true – even if you build a better mousetrap, if you don't secure the patents and fail to develop adequate production, marketing and distribution systems or fail to adequately control your costs – the World can be a very unforgiving place.

Even if you do all those things right, you're only as good as your last quarter in the even more unforgiving stock market as the good people at RIMM can surely attest. While there is a lot of money to be made betting on the daily and monthly swings of the market – Warren Buffett has shown us that buy and hold still has a place in this World and, in fact, outperforms all the noise over time.

I'm not going to make this a post about Berkhshire – you can read my February post "Warren Buffett's Secret to Making 100% a Year" and you'll quickly get the gist of how much I like Warren and his company. Since 1965, each Dollar invested originally in Berkshire stock has grown 490,409% vs 6,262% for the S&P 500 – an outperformance of 77 TIMES in 45 years – average more than 2x the S&P average each year and then left to the miracles of compounding!

It all boils down to 2 key elements – Cash Flow and PATIENT Money. In Buffett's third year, he underperformed the S&P by 20% and as recently as 2009 (by 6.7%) and 2010 (2.1%) and this year (about 10% so far) and that's in large part because Buffett has been deploying his cash to take long-term positions – despite the fact that he's 81. Why? Because that's the opportunity of the moment!

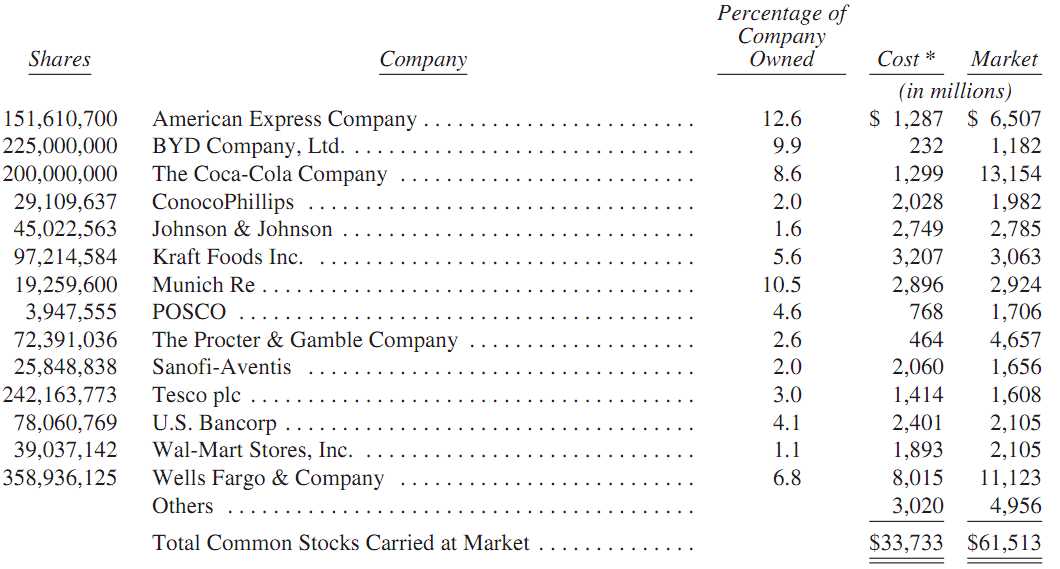

You may think Berkshire is diversified but it really isn't. As of last year, 45% of their money was in Financials and 43% in Consumer Staples – Warren Buffett would fail Jim Cramer's "are you diversified" test!

You may think Berkshire is diversified but it really isn't. As of last year, 45% of their money was in Financials and 43% in Consumer Staples – Warren Buffett would fail Jim Cramer's "are you diversified" test!

Also, very few people realize that Buffett's first purchase, the Berkshire Hathaway textile manufacturing company – was actually a failure – a mistake Buffett himself has said cost him roughly $200Bn had the money been put to better use at the time.

While some people may say that and you can roll your eyes, the fact is that Buffett is using the formula of the money squandered buying Berkshire's stock against the actual returns of his own company since that first year. The entire Berkhshire Hathaway textile business shut down in 1985 with zero remaining value and, as of last year, Berkshire Hathaway (in name only) held ZERO Technology shares, ZERO Utilities, ZERO Materials shares, and ZERO Telco shares with only 1.2% of the portfolio in Industrials. Clearly manufacturing left a bad taste in Buffett's mouth.

So, what's to stop us from doing the same thing? Can we create a company, in today's investing environment, that lays the foundation for the kind of long-term future growth in the 21st century that Berkshire has enjoyed in the second half of the 20th century? I think it may be an ideal time to put something together because, if we have the cash – there are many, many fine companies that are undervalued – both public and private.

So, what's to stop us from doing the same thing? Can we create a company, in today's investing environment, that lays the foundation for the kind of long-term future growth in the 21st century that Berkshire has enjoyed in the second half of the 20th century? I think it may be an ideal time to put something together because, if we have the cash – there are many, many fine companies that are undervalued – both public and private.

As a group, we certainly have the talent to put something together and we also have the money – the question is, do we have the will?

Let's use this post, which I will flesh out with an outline of what we need and what we have to build a better Berkshire, to pool (and list) our talents and ideas for investing and we'll see if we have enough interest and ability to move this project past the drawing board.

As many of you know, I used to have a real estate data company called Accu-Search, which I sold back in 2004. Now that my non-compete has expired and I see a huge opportunity to get back into that business as it provides excellent cash-flow with great growth potential (our 1999 investors made 10x back) and I see many, many opportunities to buy title insurance companies as well as other data companies, at what is HOPEFULLY the bottom of the Real Estate cycle (being at the top of the cycle is why I sold Accu-Search, albeit a little early). That's my little field of expertise – what's yours?

That's probably my biggest criticism of Buffett – that he holds things TOO long. While I love the long-term hold of cash-producing businesses – they still have times when they are over and under-valued. Buffett is the master of buying the under-valued, but he rarely sells the over-valued. Imagine how much better his returns would be if he followed our philosophy of taking the money and running when the markets get over-bought!

Can we build a better Berkshire? I don't see why not. We have a template that's been successful for almost 60 years to emulate. I know, for example, that the second time around I will be able to skip 10 years of mistakes in building a data company – there's a reason VC's like to work with "serial entrepreneurs" – if you've been there and done that, you are simply less likely to waste time going down blind alleys.

As Warren Buffet, who has $50Bn says – If I knew then what I know now, I'd have $250Bn!