Will the GDP be bad enough to be good?

Will the GDP be bad enough to be good?

As I said yesterday, bad news is now good news as Bernanke promised to crank up the presses if the economy stumbles and yesterday we had terrible jobs numbers and an absolutely awful Kansas City Fed Manufacturing Survey and Eurozone Economic Confidence continued to decline and that was capped off with an S&P downgrade of Spain.

RALLY TIME – of course! The markets broke right over our 50% lines, forcing us to add a few bullish positions for purely technical reasons while we wait and see when or if the madness will end.

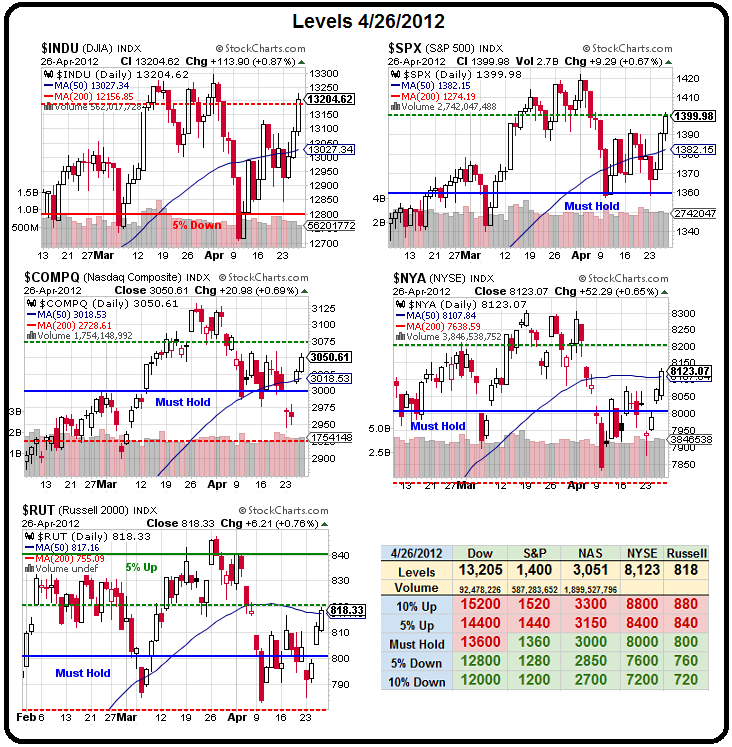

We've already had a few hours of extensive conversation about the economic situation in Member Chat so let's just focus on how we can play the next half of the retrace back to our highs at Dow 13,300, S&P 1,420, Nas 3,200, NYSE 8,300 and Russell 850. We'll still be watching those 50% lines (see yesterday's post for levels and chart) but it was easy money this morning grabbing Nikkei Futures (/NKD) off the 9,500 line in Member Chat and already (8:23) the index is back to 9,550 and, at $5 per point per contract – the Egg McMuffins are paid for.

The BOJ dropped 10,000,000,000,000 Yen on the economy this morning, expanding their asset purchase program to 40Tn Yen and it DISAPPOINTED the market and the Nikkei fell from 9,700 to 9,500 but we were up nice and early and, since the other Global Indexes seemed happy enough to ignore Spain's double downgrade (in fact, Spain is up 1% this morning on the bad news), we figured it would only be a matter of time before the Nikkei futures came off the floor to join them.

The BOJ dropped 10,000,000,000,000 Yen on the economy this morning, expanding their asset purchase program to 40Tn Yen and it DISAPPOINTED the market and the Nikkei fell from 9,700 to 9,500 but we were up nice and early and, since the other Global Indexes seemed happy enough to ignore Spain's double downgrade (in fact, Spain is up 1% this morning on the bad news), we figured it would only be a matter of time before the Nikkei futures came off the floor to join them.

As you can see from David Fry's charts, the Nikkei has been tracking the S&P very closely and the divergence was a bit silly. What's actually silly is the way the S&P is going but we'll take the quick 50 points and run ahead of the GDP, where we HOPE the markets get a cold slap in the face from a GDP report that I predicted would be a miss from 2.9% expectations.

8:30 Update: 2.2%! That is TERRIBLE!!! Not just a little terrible but TERRIBLE!!! Business investment is crashing, structures are down 12%, Government spending down another 3%… Damn, there is NOTHING good in this report. What a delusional market we have rallying against this data. Still, now the question is – is this news so bad it will be GOOD? Will 2.2% GDP be anemic enough to spur Ben into action just 2 days after he told us the economy is improving and inflation is under control and unemployment is going down and gas prices are only temporarily high?

ROFL! Did people really believe that crap? Oh yeah, that's right, I put up this image as a warning on Wednesday but what do we know with our silly Fundamental view of the market? Of course, part of the reality we have to embrace is that there are, in fact, many, many suckers in this World and it's one thing to be ahead of the curve but quite another to fight the tide. Our general strategy this week has been to make quick money off our bullish momentum plays and use that money to press our bearish bets.

ROFL! Did people really believe that crap? Oh yeah, that's right, I put up this image as a warning on Wednesday but what do we know with our silly Fundamental view of the market? Of course, part of the reality we have to embrace is that there are, in fact, many, many suckers in this World and it's one thing to be ahead of the curve but quite another to fight the tide. Our general strategy this week has been to make quick money off our bullish momentum plays and use that money to press our bearish bets.

This is a good system as we end up with some huge bearish bets right at the top of a market but only IF it ever normalizes.

This is a good system as we end up with some huge bearish bets right at the top of a market but only IF it ever normalizes.

Otherwise we're treading water like idiots and missing the rally. The strategy is based on the belief that EVENTUALLY the fundamentals will catch up with the market and price discovery will occur and the huge drop we catch will more than make up for the rally we missed.

As you can see from our Big Chart, the Dow is back near the top of our expected trading range and that's why it became our focus short while the Russell has been lagging (along with the Financials) and those became or focus longs.

Due to the crazy move in the Nasdaq yesterday, we also added a nice SQQQ (ultra-bearish Nasadaq) spread that will pay back 333% in our small portfolios if the ETF simply holds $11 through options expiration. If you're not going to take advantage of cheap leverage like that when the market is running to the top of the range – when will you make your plays? You can't buy low and sell high unless you are actually willing to buy when things are low and sell when they are high – our Big Chart is a very useful guide for tracking those trading ranges and – if the range breaks – we stop out and wait for the next one. This is not a complicated strategy, folks….

Due to the crazy move in the Nasdaq yesterday, we also added a nice SQQQ (ultra-bearish Nasadaq) spread that will pay back 333% in our small portfolios if the ETF simply holds $11 through options expiration. If you're not going to take advantage of cheap leverage like that when the market is running to the top of the range – when will you make your plays? You can't buy low and sell high unless you are actually willing to buy when things are low and sell when they are high – our Big Chart is a very useful guide for tracking those trading ranges and – if the range breaks – we stop out and wait for the next one. This is not a complicated strategy, folks….

Still we must fear the Fed so we went long on BAC ($8.27) as well as TNA ($59), also in our two small, virtual portfolios as we wanted to make sure all of our bases were covered. While we expected a miss in GDP (not a 24% miss, though), we also expected exactly the reaction we're getting from the markets which is – EVEN MORE BULLISH! – as the Dollar dives to 78.75, down almost 1% off it's morning highs as everyone is rushing in to bet on MORE FREE MONEY from the Fed.

So we'll ride this wave while it lasts but we KNOW there are plenty of rocks ahead so look for us to bail early and get back on the bear track. Our Big Chart lines are slightly higher than our 50% levels so we'll now be using 3 of 5 of those to determine when to flip the switch back to bear.

The Euro shot up to $1.325 and the Pound is at $1.625 and the Yen is all the way down to 80.60 so they should be buying Dollars but the Swiss Franc is down to 1.201 to the Euro and that means they'll be cranking up the presses to buy Euros which my 10-year old daughter yesterday commented was stupid, because they gave away their strategy. Maybe the SNB needs a take your daughter to work day to straighten them out!

The Euro shot up to $1.325 and the Pound is at $1.625 and the Yen is all the way down to 80.60 so they should be buying Dollars but the Swiss Franc is down to 1.201 to the Euro and that means they'll be cranking up the presses to buy Euros which my 10-year old daughter yesterday commented was stupid, because they gave away their strategy. Maybe the SNB needs a take your daughter to work day to straighten them out!

My daughter also said yesterday that, based on her first lesson in identifying MACD and RSI patterns, that the indexes looked a couple of days from a big sell-off, which means what we have now is likely to be the blow-off top. In Carny speak, the Blow Off is the rush of customers out of an exhibition after the big finish – last Friday we jammed to ELP as we took our bearish profits off the table and prepared for the big show this week: "Come inside, the show's about to start, guaranteed to blow your head apart…" I mentioned some of our bullish trade ideas in that morning's post – here's a detailed look at one of our bullish trade ideas from Thursday's Member Chat (when we were getting towards the bottom of our range):

Bullish/Samz – See above CHK but, shorter-term, I like selling FAS May $80 puts for $1.45 as that's down 21% which is down 7% on XLF ($15.30) to $14.23 and that's a reasonable place to go long on XLF since we love them at $13.50 anyway. Using that base, you can grab the TNA May $50/55 bull call spread at $3.20 for net $1.75 on the $5 spread that's 110% in the money (TNA now $55.85) so you can't lose unless TNA drops 10%, which is 3.3% back on the RUT, which is 772.8 and 775 was our target anyway. If you only want a HEDGE, just in case the RUT breaks 3.3% up, then it only costs $2.40 for the TNA $55/60 bull call spread and then your insurance cost is net .95 but you can see why I'd rather spend the extra .80 to have $5 better position, I'm sure…

As of yesterday's close, the FAS May $80 puts were .45 (up 68%) and the TNA May $50/55 bull call spread is already at $4 for net $3.55 off the net $1.75 entry so up 102% in a week is not a bad way to hedge a bull run. We just added a similar trade in yesterday's chat and that let's us put very tight stops on this layer so we can get right out with no regrets. Even playing the straight $2.40 (and option we also used yesterday), the straight bull call spread is up 66.6% in a week – and that's a number that makes Lloyd Blankfein very happy!

As of yesterday's close, the FAS May $80 puts were .45 (up 68%) and the TNA May $50/55 bull call spread is already at $4 for net $3.55 off the net $1.75 entry so up 102% in a week is not a bad way to hedge a bull run. We just added a similar trade in yesterday's chat and that let's us put very tight stops on this layer so we can get right out with no regrets. Even playing the straight $2.40 (and option we also used yesterday), the straight bull call spread is up 66.6% in a week – and that's a number that makes Lloyd Blankfein very happy!

As I said, our longer-term strategy is to take SOME of the profits from these aggressive upside momentum plays and put them into longer-term bearish positions – like PCLN July $600 puts at $8. It's not that we think PCLN will drop $150 but the July $650 puts are $16 so it's reasonable to assume that a $50 pullback in PCLN, back to $700, will give us a 100% gain on the July $600s. If it only ends up being 50% – we'll take it!

We'll be taking some of the money and running this morning on the bull side because this market is simply ridiculous. If we're wrong on Monday morning and the market isn't down 200 points – then we'll rethink our bearish positions and add more bullish ones but, at some point, you do need to put your foot down and stop the madness!

Have a great weekend,

– Phil