We have liftoff!

We have liftoff!

Like a rocket that has fired it's stage one boosters, this market is taking off on QE power. At the moment, we have a very dangerous and combustible mix of rumors and minor stimulus – like this morning's 0.25% rate cut by China, which works out to roughly $100Bn in stimulus and is good for 10 points on the S&P.

As I mentioned yesterday, it's about $10Bn per point to buy a move on the S&P and it's now a question of what kind of rally the G20 are prepared to pay for this round. This is the first reduction since the depths of 2008's financial crisis, and follows on the heels of China's banking regulator delaying for a year stricter bank capital rules. Beijing has also been seen fast-tracking previously tied-up infrastructure projects. In another easing move, banks will now be allowed to offer loans at a 20% discount from the benchmark rate, whereas before they were allowed just 10%.

China is in much worse shape the people realize with mountains of iron-ore built up along China's eastern seaboard. The stockpiles hit an all-time high of 120 million tons as steelmakers hold off on orders. Meanwhile, the copper is piled up so high in warehouses that the weight is cracking the floors while "at least" 30 Panamax (biggest that fit through the canal) cargo boats full of coal are floating off China's coast because traders who bought them have been unable to resell them to end-users

China is in much worse shape the people realize with mountains of iron-ore built up along China's eastern seaboard. The stockpiles hit an all-time high of 120 million tons as steelmakers hold off on orders. Meanwhile, the copper is piled up so high in warehouses that the weight is cracking the floors while "at least" 30 Panamax (biggest that fit through the canal) cargo boats full of coal are floating off China's coast because traders who bought them have been unable to resell them to end-users

China’s biggest auto-dealer association said carmakers need to scale back their sales targets or sweeten incentives because the worsening glut of vehicles across the nation’s dealerships is unsustainable. Average inventory carried at Chinese dealerships bloated to a level exceeding two months of sales by the end of May, compared with more than 45 days at the end of April. That’s forcing dealers to deepen discounts and sell cars at a loss to meet mandatory sales targets set by automakers, he said. “Dealers can’t shoulder the burden anymore,” said Luo Lei, whose association is authorized by the central government and represents 2,100 dealership groups. “Their backs are broken.”

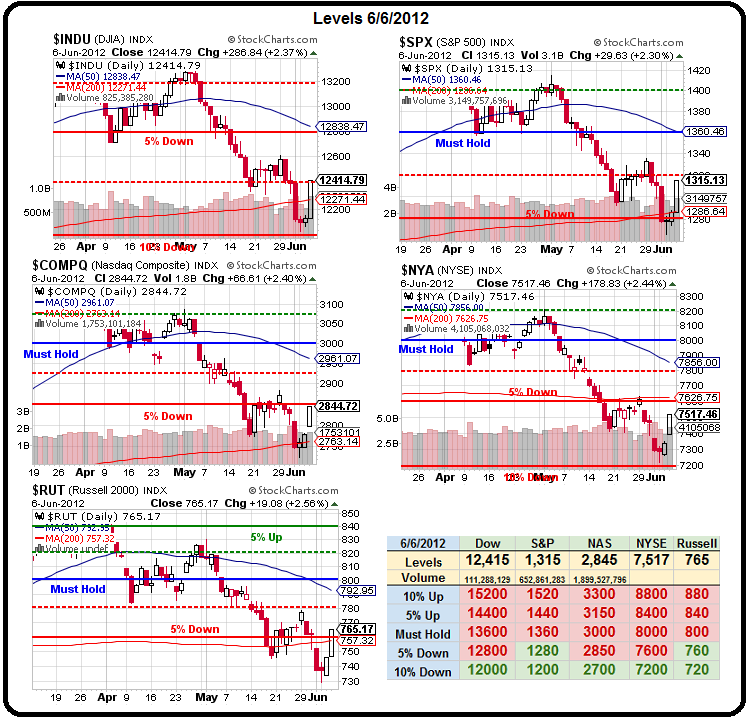

So we have ignition, the thrusters are firing but our payload is VERY HEAVY and we're going to need a lot of fuel to lift this market back into a sustainable orbit. Fortunately, gravity (the Dollar) has gotten lighter as it pulled back from 83.54 on the last day of May, all the way back to 82 this morning – a very nice 2% reduction in gravity that is helping to float the market back to our 5% lines but it's still a very long trip to our "Must Hold" levels, which now represent roughly a 50% retrace of the drop – which is EXACTLY what they were predicted to do all year.

So we have ignition, the thrusters are firing but our payload is VERY HEAVY and we're going to need a lot of fuel to lift this market back into a sustainable orbit. Fortunately, gravity (the Dollar) has gotten lighter as it pulled back from 83.54 on the last day of May, all the way back to 82 this morning – a very nice 2% reduction in gravity that is helping to float the market back to our 5% lines but it's still a very long trip to our "Must Hold" levels, which now represent roughly a 50% retrace of the drop – which is EXACTLY what they were predicted to do all year.

But charts do not matter today, all that matters today is whether or not Uncle Ben and the Fed are ready to fire those stage two booster or whether we suffer a critical failure around 10 am, when and if the Fed Chairman fails to ignite the appropriate level of market excitement and we may fall gently back to our lows as we once again shift our focus to the G20 or we may blow up, along with the bullish expectations that have driven the market for the past two days – in which case, I don't know if the G20 will have enough fuel to pull us out of the tailspin that a lack of Fed action is likely to put us in.

As planned, we took some bullish money and ran yesterday and prepared a few bearish hedges – just in case Bernanke fails us this morning and we need to pull the rip cord. At the moment, we have been lucky enough to call a top and we are "poking" at what we HOPE (not a valid investing strategy) is a bottom but the SOLE premise to our bullish plays is that Uncle Ben and the other Central Banksters will save us with MORE FREE MONEY.

As planned, we took some bullish money and ran yesterday and prepared a few bearish hedges – just in case Bernanke fails us this morning and we need to pull the rip cord. At the moment, we have been lucky enough to call a top and we are "poking" at what we HOPE (not a valid investing strategy) is a bottom but the SOLE premise to our bullish plays is that Uncle Ben and the other Central Banksters will save us with MORE FREE MONEY.

Even if we are "saved" – it won't do crap to fix the overall global situation which will, one day, either blow up in our faces or dissolve in a massive wave of hyper-inflation. It's a terrible time to trade the markets but your investment "advisers" won't tell you that because they don't get paid when you are in cash and the TV people won't tell you that because they want your eyeballs glued to the screen instead of staring at bikinis on the beach and the newsletter people won't tell you because they want your ad and subscription dollars but I'm telling you because I think it's more important for you to preserve wealth now and we can all play the markets later.

What we're doing in this current environment is gambling – not investing. Sure we can make a ton of money gambling when we're right but we can also lose it when we're wrong and the Global cross-currents of the moment make right and wrong a coin flip on any given day.

If you are a great day trader, a great hedger, a great cash manager – then GREAT – it's fun to play a choppy, crazy market but, if you are just a guy trying to invest some money – this is a very dangerous time to be doing so. If we get MORE FREE MONEY from the Fed at 10am – it will be a great time to invest but between now (9am) and then (60 minutes) – who can say?

Be careful out there!