Spain is "fixed"!

Spain is "fixed"!

Isn't that just great? $125Bn thrown at the banks is bigger (proportionate to GDP) than the US's $760Bn TARP program but, then again, Spain doesn't have the luxury that the US Banksters have of getting an additional multi-Trillion Dollar stealth bailout from the Federal Reserve as they devalue the currency (effectively robbing every man, woman and child in America) in order to give 0% loans to their friends.

Borrow a few Trillion Dollars at 0% and lend it out at 4% for a few years and you too can declare record profits and pay yourself record bonuses for being smart enough to have formed the Federal Reserve to fool the American people into thinking this private banker club was somehow concerned with their interests (see "The Creature from Jekyll Island").

As Monty Python sort of said "scam, scam, scam, scam…" but that's our financial system so no point in complaining about it unless you get paid to – like I do. So $125Bn buys us 12.5 points on the S&P but, unfortunately, that was sort of baked in in Friday as we already popped 10 points so the rally last night seemed overdone, and we were forced to go short on the Futures in Member Chat at 10:18 pm, when I said to Members:

…Anyway, back to the Futures: The RUT should have a rough time at 780 (/TF) and a short there (now 777.20) is realistic as is shorting the S&P (/ES) below 1,340 (now 1,336.75) and the Dow (/YM) does not seem to like 12,650, now 12,644 so – if you want to be bearish off this pop (which does seem a bit overdone), that's the way to go as well as, of course, oil (/CL) if it breaks back below $86 (now $86.03).

Although we went into the weekend bullish (see Stock World Weekly for nice summary of the action), the nice thing about the Futures is you can lock in silly overnight gains with a contrary bet. Oil is already below $85 at 7 am for a nice $1,000 per contract gain and the indexes have given back about 1/3 of their gains too. At the same time as we flipped short on the Futures, our Nikkei (/NKD) long play from Friday morning was up 200 points – good for another $1,000 per contract going the other way and again – the nice thing about playing the Futures is you don't have to wait for the markets to open to take your profits, so you can actually benefit from the BS pre-market shenanigans once in a while.

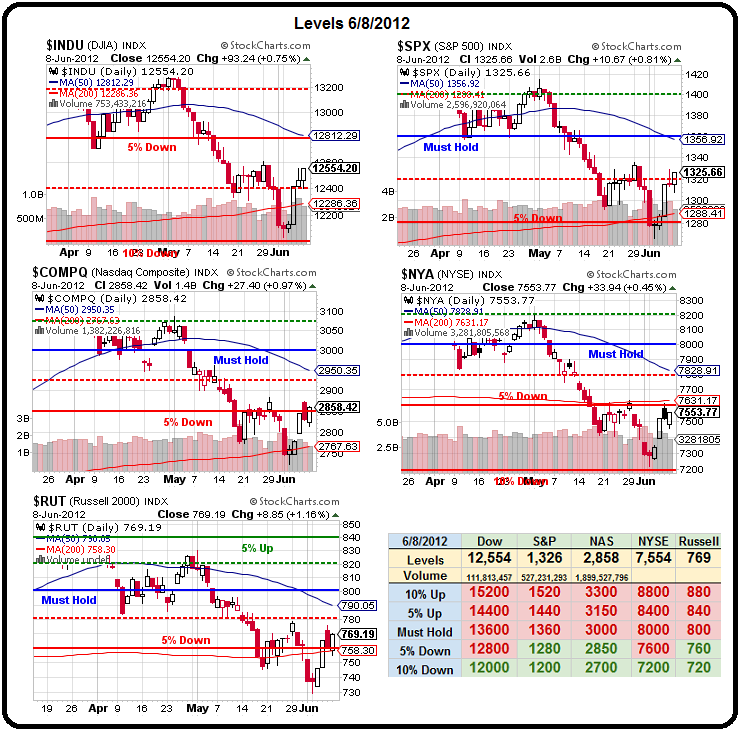

As you can see from the nice Morgan Stanley chart above, Europe is still very much in flux and we are still very much in cash but, as I noted in Friday morning's post – we are happy to be bullish in our very aggressive $25,000 Portfolio which is an aggressive carve-out to a more conservative portfolio, like our virtual $500,000 Income Portfolio – the latest version of which we initiated last week with 10, count 'em, bullish trades last Monday and Tuesday – tagging the bottom (we hope) on the nose.

Providing our levels hold, we have no reason not to be bullish. Clearly the stimulus fairy is alive and well in Europe – Spain was not even given conditions for accepting the latest bail-out and they CLAIM that the only need $44Bn more in bond auctions to keep the lights on through the end of December – isn't that just great???

Providing our levels hold, we have no reason not to be bullish. Clearly the stimulus fairy is alive and well in Europe – Spain was not even given conditions for accepting the latest bail-out and they CLAIM that the only need $44Bn more in bond auctions to keep the lights on through the end of December – isn't that just great???

I am just bursting with sarcastic confidence for Spain and the rest of the EU because now the Spanish banks can buy the Spanish debt with EU money and we can pretend everything is good until next year – when the $125Bn runs out and we suddenly realize Spain is another 10% of their GDP in debt while the money that was lent to Spanish Banksters is all gone – leaving Spanish debt as collateral.

All we need is Jennifer Aniston and Jim Carry cast in the leads and we have the makings of the next great romantic comedy movie!

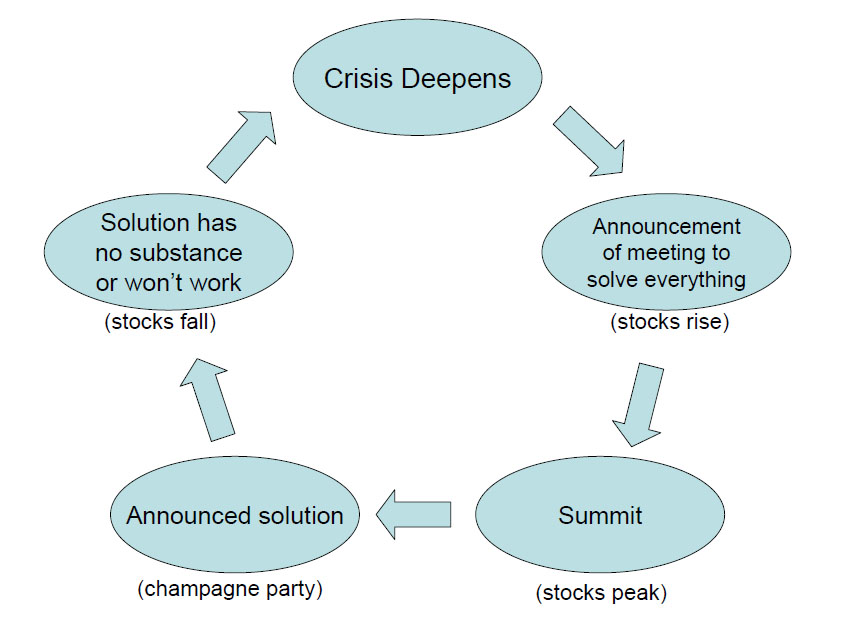

Just like Jim Carry movies, people never get tired of celebrating these endless EU "fixes" but, just like Jim Carry movies – once they are over, you have a Hell of a time trying to explain to someone else why it was funny. Jim Carry and the EU have that certain "je ne sais quoi," which makes you smile for a second and forget your troubles but, at $15 a ticket and another $10 for a popcorn and soda – you still walk out feeling kind of screwed and just a little bit broker – wishing you had just stayed home and waited for it to come on cable instead…

If Spain is Jim Carry then Italy is Steve Carrell and, if that name makes you say "who", then congratulations – you have a life! The difference between Jim Carry and Steve Carrell is that you also regret watching Steve Carrell on cable, but at least you weren't dumb enough to pay to see him in the movies. So far, we haven't been dumb enough to give Italy any money either but it's coming – I have no doubt.

Why bail out Spain if you're not going to bail out Italy and why Italy if not Portugal and why Portugal if not Ireland (again) and why do all those and then ignore France who, along with Germany, will be on the hook for all these bailouts when they start falling apart (which will happen as soon as we stop giving them more money)?

George Soros pointed out last week that EU authorities did not understand the nature of the euro crisis; they thought it is a fiscal problem while it is more of a banking problem and a problem of competitiveness. And they applied the wrong remedy: you cannot reduce the debt burden by shrinking the economy, only by growing your way out of it. The crisis is still growing because of a failure to understand the dynamics of social change; policy measures that could have worked at one point in time were no longer sufficient by the time they were applied. As this morning's market action indicates – we continue to put band-aids on bullet holes the Global economy has suffered major trauma and our "leaders" are still worried about saving the blood transfusion for a rainy day…

In retrospect it is now clear that the main source of trouble is that the member states of the euro have surrendered to the European Central Bank their rights to create fiat money. They did not realize what that entails – and neither did the European authorities. When the euro was introduced the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital; and the central bank accepted all government bonds at its discount window on equal terms. Commercial banks found it advantageous to accumulate the bonds of the weaker euro members in order to earn a few extra basis points.

In retrospect it is now clear that the main source of trouble is that the member states of the euro have surrendered to the European Central Bank their rights to create fiat money. They did not realize what that entails – and neither did the European authorities. When the euro was introduced the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital; and the central bank accepted all government bonds at its discount window on equal terms. Commercial banks found it advantageous to accumulate the bonds of the weaker euro members in order to earn a few extra basis points.

Then came the crash of 2008 which created conditions that were far removed from those prescribed by the Maastricht Treaty. Many governments had to shift bank liabilities on to their own balance sheets and engage in massive deficit spending. These countries found themselves in the position of a third world country that had become heavily indebted in a currency that it did not control. Due to the divergence in economic performance Europe became divided between creditor and debtor countries.

.jpg) It took some time for the financial markets to discover that government bonds which had been considered riskless are subject to speculative attack and may actually default; but when they did, risk premiums rose dramatically. This rendered commercial banks whose balance sheets were loaded with those bonds potentially insolvent. And that constituted the two main components of the problem confronting us today: a sovereign debt crisis and a banking crisis which are closely interlinked.

It took some time for the financial markets to discover that government bonds which had been considered riskless are subject to speculative attack and may actually default; but when they did, risk premiums rose dramatically. This rendered commercial banks whose balance sheets were loaded with those bonds potentially insolvent. And that constituted the two main components of the problem confronting us today: a sovereign debt crisis and a banking crisis which are closely interlinked.

According to Soros: The authorities did not even understand the nature of the problem, let alone see a solution. So they tried to buy time. Usually that works. Financial panics subside and the authorities realize a profit on their intervention. But not this time because the financial problems were reinforced by a process of political disintegration. While the European Union was being created, the leadership was in the forefront of further integration; but after the outbreak of the financial crisis the authorities became wedded to preserving the status quo. This has forced all those who consider the status quo unsustainable or intolerable into an anti-European posture. That is the political dynamic that makes the disintegration of the European Union just as self-reinforcing as its creation has been.

Financial institutions are increasingly reordering their European exposure along national lines just in case the region splits apart. Banks give preference to shedding assets outside their national borders and risk managers try to match assets and liabilities within national borders rather than within the eurozone as a whole. The indirect effect of this asset-liability matching is to reinforce the deleveraging process and to reduce the availability of credit, particularly to the small and medium enterprises which are the main source of employment.

Financial institutions are increasingly reordering their European exposure along national lines just in case the region splits apart. Banks give preference to shedding assets outside their national borders and risk managers try to match assets and liabilities within national borders rather than within the eurozone as a whole. The indirect effect of this asset-liability matching is to reinforce the deleveraging process and to reduce the availability of credit, particularly to the small and medium enterprises which are the main source of employment.

So the crisis is getting ever deeper. The real economy of the eurozone is declining while Germany is still booming. This means that the divergence is getting wider. The political and social dynamics are also working toward disintegration. Public opinion as expressed in recent election results is increasingly opposed to austerity and this trend is likely to grow until the policy is reversed. So something has to give.

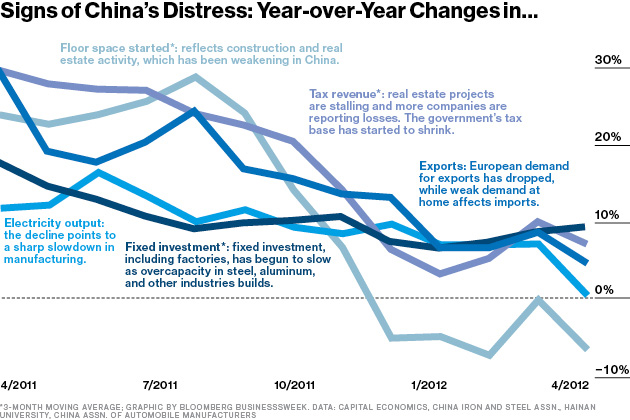

Soros gives the EU 3 months to either take DRASTIC action or it will fall apart through sheer inertia. Voting to keep it together won't help – that's like all the passengers on a plane voting to keep flying after all the engines have blown out – it might make them all feel better but they're still going to crash. The sole consolation for the EU is – at least they're not China:

On Friday morning, I said to Members: "China's data is now expected to be bad so I'm less worried about that (also since it will say whatever they want it to say) than I am about Europe spinning out of control." As we expected, China's data came in better than expected this weekend and that will pretty up the chart above but only within the bounds of that horrific downtrend. The Hang Seng (Hong Kong) popped 2.5% this morning on that "good" news out of China but the Shanghai only rose 1%, to 288 on the Dow Index, which is still down 100 points (25%) since April 2011 but UP 13% from 252 this year.

Of course, PSW Members will do the math and see that 388-252 = 136 and 40% of 136 is 54 plus 252 = 306 so that's our strong bounce and just so happens to be EXACTLY where the Shanghai was rejected last month – what a coincidence!

Of course, PSW Members will do the math and see that 388-252 = 136 and 40% of 136 is 54 plus 252 = 306 so that's our strong bounce and just so happens to be EXACTLY where the Shanghai was rejected last month – what a coincidence!

Our weak bounce line is 278 and that too was just about right on the money (274) on the retrace so we'll be watching China with great interest as it's stuck in the range between the strong and weak bounce but that rapidly falling 200 dma and weakly converging 50 dma is going to make 295 a very tough nut to crack.

Well, that's enough TA for the day – I'm already bored by it. Tomorrow is Technical Tuesday and we'll do some charts then but, for now – it's $10Bn per point on the S&P so, if you want more points, someone needs to come up with more money. G20 meeting is this weekend and then we have a Fed Meeting. China already kicked in a few hundred Billion but we need action in Europe, Japan and the US now or it's going to be a very short-lived rally.

Spain's 10-year is 6.45% this morning – AFTER the bailout and Italy just broke 6% at 6.01% and both Spanish and Italian markets have given back almost all lf their early gains as people who know how to do math wake up and comment on the latest "fix" – and I use that in the most useless and temporary, junkie-applicable form of the word.

We had a nice pop – we were lucky to be bullish – CASH REMAINS KING!