When is the last time you turned $100,000 into $100Bn?

How about $100M? $10M? No? Why is that, do you think? It's because, by the time you invest in a public company, the original investors have already made 10 times, 100 times, even 1,000 times their original investment. This is why Investment Banks but a lot more effort into competing to win the next big IPO than they do into deciding what stock to buy. Don't get me wrong, you can make a very nice return on stocks – but never the kind of returns you can get from backing a winning start-up.

Yes, 9 out of 10 small businesses fail and not to many of those become huge winners but that is exactly why I have such high hopes – as we discussed in our original Build a Berkshire post – for our being able to beat those odds. Just like any good Venture Capital operation – we are chock full of experts in various fields within our group, we have the makings of the kind of team that can identify and nurture good investment opportunities and help turn them into great companies.

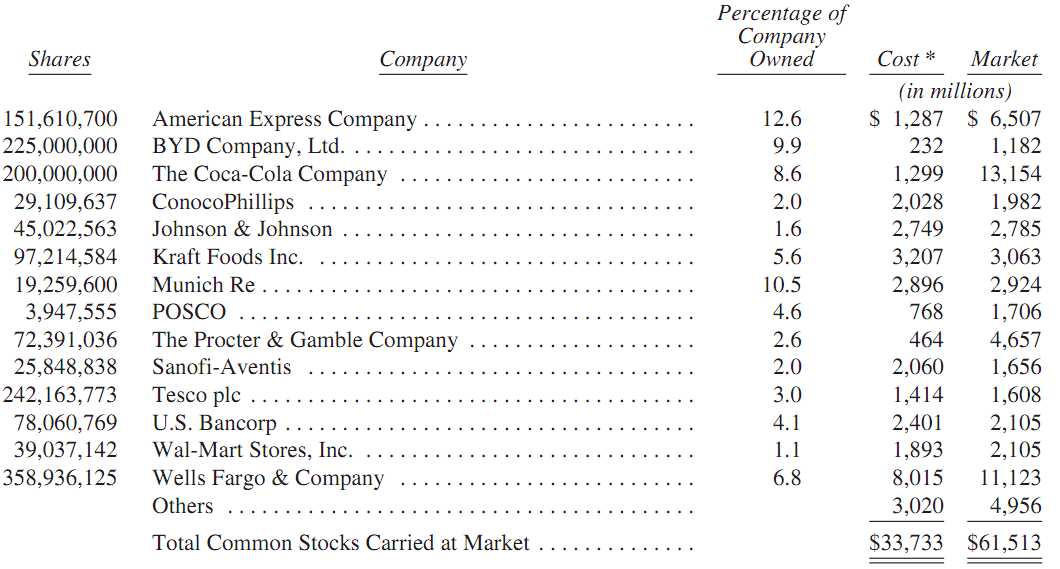

My one criticism of Warren Buffett is that he tends to hold his companies too long. Warren is not willing to cash out and move on to the next thing. Part of that is legitimate – when you are cashing out $13Bn worth of KO stock – what exactly is a better place to put your money? But, as we have pretty clearly demonstrated over the past couple of months at PSW – Cash is indeed King if you time it right and we're not in danger of running into Warren Buffett's problem in the near future.

What we need to do is think about how best to deploy cash over the long, medium and short hauls, building the kind of company that can seize market opportunities when they present themselves while, at the same time, building a foundation that will stand the test of time and generate the cash flows for years and decades to come.

While we have had some very good discussions regarding structure, etc, it is unfortunate that current securities regulations do not allow us to do what Warren Buffett did in 1962, which was borrow money from people he knew – getting investors big and small to take stock in his holding company (about $7M), which bought Berkshire stock ($11.50 a share at the time) until they gained a controlling interest in the company. As Buffett himself notes – that is what is now call a hedge fund.

Now, as it turned out, Berkshire Hathaway, the shirt-making company, was a terrible investment and always struggled until it was finally shut down and written off in 1985 and Warren Buffett kept the name to remind him of his vanity in putting too many eggs in his first basket – a mistake he estimates cost him $200Bn over the past 45 years, based on having used that early cash on his 2nd through 1,000th investments – rather than on his first!

Buffett's second business is one that is near and dear to my heart – insurance. What people don't understand about the insurance business is that it only SEEMS like a low-margin proposition but what happens with insurance companies is you build massive cash reserves over time and you are able to, in turn, invest those cash reserves and then only pay tax on the profits while the reserves remain "reserved".

Buffett's second business is one that is near and dear to my heart – insurance. What people don't understand about the insurance business is that it only SEEMS like a low-margin proposition but what happens with insurance companies is you build massive cash reserves over time and you are able to, in turn, invest those cash reserves and then only pay tax on the profits while the reserves remain "reserved".

That's why a company like FNF, which I unsuccessfully tried to buy (the whole thing, not the stock) in 2008 for $8 ($1.6Bn) can have $1Bn in cash and $5Bn in Long-Term Investments against just $1Tn in debt can have just a $4.2Bn valuation at $19.43 (and pays a 3% dividend!). What they have on the books is "Deferred Long-Term Liability Charges" which are, essentially, the reserves they are required to keep to offset potential insurance claims. When you are in a nice scam of a business like Title Insurance – the likelihood of digging into that claim fund is extremely remote.

When we first started discussing the BBBW back in December, I was in the process of getting back into Title business myself. I had thought it would be an opportunity for all but by the time we went back and forth we had already secured funding and moved forward. It's an incredible business with endless opportunities and makes for a great cash cow – especially for those with the patience to buy low and sell high and, currently, the real estate market is still at a low.

Meanwhile, other business opportunities have been presented to me (they are almost every day) that I liked including a concierge service for hospitals (hospitals get paid, in part, based on patient satisfaction and people who are suddenly hospitalized often need things taken care of for them), capturing vacation properties for time-shares (the real money is in running a rental/management service after the fact!), a few restaurant opportunities, an iced tea company, crepe stands at concert venues and several things I can't talk about in public but also like a lot.

At the same time as this was going on, we saw CHK drop to $13.32 (where I was literally foaming at the mouth to buy it), HOV $1.52, FTR $3, SVU $4, WFR $1.44, etc. – so plenty of things to do with idle cash while we wait for other opportunities to come along. Of course, none of these names are a shock to our Members, they are all companies that come up on list after list of value stocks we like. I'm like Buffett that way, I tend to like a company and the PRICE of the stock does not change my feelings about it.

At the same time as this was going on, we saw CHK drop to $13.32 (where I was literally foaming at the mouth to buy it), HOV $1.52, FTR $3, SVU $4, WFR $1.44, etc. – so plenty of things to do with idle cash while we wait for other opportunities to come along. Of course, none of these names are a shock to our Members, they are all companies that come up on list after list of value stocks we like. I'm like Buffett that way, I tend to like a company and the PRICE of the stock does not change my feelings about it.

There are lots of hedge funds and Lord knows the World does not need one more but, unfortunately, due to current regulations, that's the structure we're looking at and, of course, there is a huge amount of interest in it among people who responded to the forms that were sent out to people who had registered Those people are going to move forward and start a fund in the near future and that's great (if you did not get anything and are still interested – let Craig and Ron know in comments below and they will be in touch) but it doesn't help the smaller investors.

My thoughts on this is that we can maintain the original structure idea and still involve individuals who are not able to be accredited by letting them participate at the Angel-level with the opportunities we develop. As you know from our original post and comments, we have about 150 people who are all over the country with various fields of expertise. My idea was to structure an organization in which opportunities are brought from an individual Member, to a regional or sector-oriented group (Craig is working on a program that quantifies everyone's various skills) and then moves up to general discussion among the entire group (essentially in a chat forum like we usually use) for comments and then goes to the investment committee.

Once an investment is made, mentors will be assigned as needed (possibly board memberships at times) as the project moves forward. In the case of public companies – if we end up owning enough to get access – the same concept applies, whoever is in the region with the right skill set can become a liaison with the company. A structure like that gives us the power and expertise of some of the largest investment Banks in the World – just utilizing the skills of 150 people who usually command 6-figure salaries by itself is good for what – about $30M a year of potential added value?

GS has 32,000 employees who generate $28Bn in revenues so about $1M per employee – surely we are good enough to generate $200,000, right? So it's easy for the accredited investors to realize value in a top-level fund but what about smaller players? Well, it seems to me that they can, individually or in groups, do angel financing on projects that are too small for the main fund or possibly act as bridge financing for projects that are interesting but, for whatever reason, won't be funded immediately.

Also, the laws are evolving and crowd funding has become very, very interesting (and another business I'd like to look into) with Kickstarter, I believe being the most famous. As you can see from the chart on the right, crowd-funding is growing at a huge rate and it's an excellent way for smaller investors (and big ones!) to spread their risk by making micro-investments in a number of companies because, you never know which company will pay 100-1 but if you invest in 100 companies and just one does – then all the 1-1, 2-1, 5-1 and 10-1 payoffs are just bonuses!

That's how venture funds play the game. Of course they like to pretend they have sophisticated systems for picking winners etc. but generally, it's just a matter of giving a little money to a lot of companies with onerous terms so that a single winner can make up for 10 losers. Those who know me know that I don't like that "swinging for the fences" model but the same diversification logic can be used trying to find 3 doubles, one triple and 2 singles out of 10 more conservative investments for an 11-4 payoff ratio and let the occasional home run be a happy accident.

My idea for a model is simple then, regional groups identify an opportunity (usually brought up by one of the groups participants) and those opportunities they find worth move on to discussion by the BBW participants in a running chat (maybe we'll have threads for topics of interest but I'm not a fan of threads) and then the Fund's investment committee looks it over and again it's discussed.

Depending on the rules, perhaps there will be room for participation from smaller investors and perhaps not or perhaps it's not yet ripe for the main fund and then we're back to individual investments, loans or bridge financing as is determined by the Angel groups – a nice symbiotic relationship that will let us cast a wide net around the World for the next big thing. With a little money and a few successes under our belts – we'll find more and more doors opening and more and more opportunity.

That seems like a strategy worth pursuing.