Waiting to cut out the deadwood.

Waiting to clean up the city.

Waiting to follow the worms.

Waiting to put on a black shirt.

Waiting to weed out the weaklings.

Waiting to smash in their windows

And kick in their doors.

Waiting to follow the worms – Pink Floyd

Not a lot to report today, just waiting.

Merkel said this and Hollande said that and Monti said something and Soros, in a great interview in Spiegel (a German magazine), says we're running out of time and blames Germany for the mess of the moment:

There is no question that a breakup of the euro would be very damaging, very costly, both financially and politically. And the biggest loss would be incurred by Germany. Germans have to bear in mind that, effectively, they have suffered practically no losses so far. Transfers have all been in the form of loans, and it is only when the loans are not repaid that real losses will be incurred.

Germany could leave, but it would be incredibly costly. I just read the report of the German Finance Ministry, which estimates the costs of a euro-zone exit in terms of employment and economic activity, both of which are real. Because this is the case, Germany will always do the minimum to preserve the euro. Doing the minimum, though, will perpetuate the situation where the debtor countries in Europe have to pay tremendous premiums to refinance their debt. The result will be a Europe in which Germany is seen as an imperial power that will not be loved and admired by the rest of Europe — but hated and resisted, because it will perceived as an oppressive power.

Germans tend to forget now that the euro was largely a Franco-German creation. No country has benefited more from the euro than Germany, both politically and economically. Therefore what has happened as a result of the introduction of the euro is largely Germany's Schuld — its responsibility.

Soros does not shy away from WWII comparisons and tells Spiegel that Germany has a responsibility, like America did after WWII, of creating something akin to the Marshall Plan to rebuild Europe where the US voluntarily committed funds without asking for anything in return but, in doing so, laid the foundation to make themselves World leaders for the next 50 years by doing something our current generations of politicians seem to be unfamiliar with – ACTUALLY LEADING!

Soros does not shy away from WWII comparisons and tells Spiegel that Germany has a responsibility, like America did after WWII, of creating something akin to the Marshall Plan to rebuild Europe where the US voluntarily committed funds without asking for anything in return but, in doing so, laid the foundation to make themselves World leaders for the next 50 years by doing something our current generations of politicians seem to be unfamiliar with – ACTUALLY LEADING!

Of Angela Merkel, Soros agrees with my chess analogy saying: "She is trapped. Merkel has realized that the euro is not working, but she cannot change the narrative she has created because that narrative has caught the imagination of the German public, and the German public has accepted it. But at the same time, Chancellor Merkel realizes that what is happening is not working, and so she is determined to preserve the euro."

Soros gives Merkel and the EU 48 hours to "fix" things or he firmly believes the crisis will quickly snowball out of control – I can't argue with him there.

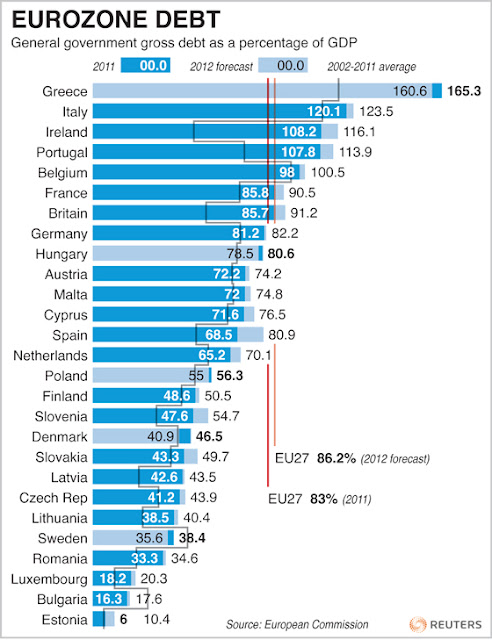

Cyprus needs a bailout and Spain needs a bailout and NEITHER of those countries have a higher debt to GDP ratio than Germany (82.2% BEFORE kicking in more cash to "fix" their neighbors). Spain is Europe's fourth largest economy, which is larger than the other four euro bailout sisters—Greece, Ireland, Portugal and Cyprus–combined. And remember Spain already requested up to €100 billion ($125.7 billion) from EU bailout earlier this month to recapitalize its regional banks reeling from the collapse of its massive real estate bubble.

Germany is, of course, under control compared to the France (90.5%), the UK (91.2%), Portugal (113.9%), Ireland (116.1%), Italy (123.5%) and, of course Greece (165.3%) in debt as a percentage of GDP but, as we discussed in yesterday's morning post, deleveraging is not the answer.

Germany is, of course, under control compared to the France (90.5%), the UK (91.2%), Portugal (113.9%), Ireland (116.1%), Italy (123.5%) and, of course Greece (165.3%) in debt as a percentage of GDP but, as we discussed in yesterday's morning post, deleveraging is not the answer.

In my Monday post (which was "too political" to be published at Seeking Alpha), we talked about the stranglehold the Banksters have on the Global economy and THAT is the only reason austerity is so popular. What is austerity in the end but a sacrifice of the people to pay off all their debts in full, no matter how detrimental it is to their Nation or their way of life?

Austerity maintains the value of the currency that the Banksters get paid back in while inflation destroys it. The average worker has no savings – so what do they care if there's inflation and the cost of food and energy go up 10% a year – as long as they get a 10% raise, it has NO EFFECT on their lives (see Inflation Nation). But, to the Bankers who lent them $200,000 on their $250,000 home – it's a crisis. They get paid back in dollars that only buy $180,000 worth of goods and services while the Bankers have to pay their staff 10% more than last year so they make LESS PROFITS while the workers make MORE MONEY – that cannot be allowed to happen!!!

Certainly not in America, which is why the Bankster party is running a Bankster for President (oops, gonna get censored again!) to make sure they can completely screw over the American people for another 4 years rather than doing something which Obama doesn't have the balls to do either – which is tell these jokers to shove it!

Who are the Jokers? Clowns to the left of us (Congress), jokers to the right (Fed) and here we are – stuck in debt with you… These debts CANNOT be repaid – but that's not looking at the issue correctly – these debts SHOULD NOT BE REPAID! That's right, if I loan money to a company that is poorly run and it files for bankruptcy – the company can restructure and continue and I will end up with a loss and NEXT TIME I will hopefully make better lending decisions. I do not have the right to force all current AND FUTURE employees to take massive pay and benefit cuts until they pay me off in full – that would be ridiculous.

That's austerity!