The Euro fell below $1.22 for the first time in two years this morning.

The Euro fell below $1.22 for the first time in two years this morning.

Part of this was caused by the decision (or non-decision) by the Bank of Japan to hold-off on their anticipated asset-purchase program. That sent the Yen back to 79.25 to the Dollar (stronger), which itself hit 84 in early trading and took our Futures down over 100 points from yesterday's silly stick-close which, as noted by Dave Fry, was the result of more QE rumors following the release of the Fed minutes at 2 pm.

Of course, all this panic out of stocks and into the Dollar (have I mentioned Cash is King lately?) is just perfect on a day when the US has $13Bn in 30-year notes to peddle (1pm today) and yesterday we had a new record for selling $21Bn of 10-year notes for just 1.459% – that's a NEGATIVE yeild to inflation by any measure.

So now "investors" are PAYING the US to borrow money. That is just fan-friggin'-tastic and hopefully we can refinance our current $16Tn in debt and get paid to borrow the next $16Tn as well. What a way to "fix" an economy, right?

"The markets have been fairly disappointed by central banks' timid policy response," said Ian Stannard, senior currency strategist at Morgan Stanley. "With many questions still surrounding the Greek situation and the German court's decision on the constitutionality of the European Stability Mechanism, we do not see room for the euro to make gains over the next several weeks."

As I said to our Members earlier this morning, panic is certainly in the air and it's a fantastic time to be in cash. We picked up a quick .50 per contract shorting oil Futures (/CL) at $85 as they hit $84.50 and now they just (9am) bounced back to $85 so we get to do it again. We also added USO puts yesterday in Member chat after hearing the awful demand numbers in the inventory report – negative demand in the first two weeks in July, even with record heat is not a good sign at all for the oil industry – or the energy industry in general.

As I said to our Members earlier this morning, panic is certainly in the air and it's a fantastic time to be in cash. We picked up a quick .50 per contract shorting oil Futures (/CL) at $85 as they hit $84.50 and now they just (9am) bounced back to $85 so we get to do it again. We also added USO puts yesterday in Member chat after hearing the awful demand numbers in the inventory report – negative demand in the first two weeks in July, even with record heat is not a good sign at all for the oil industry – or the energy industry in general.

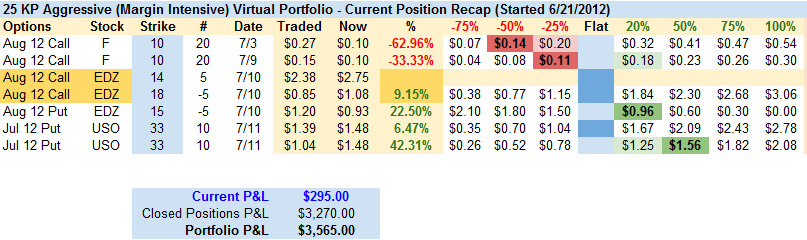

Our bearish stature is already "bearing" fruits as the EDZ hedges we discussed in yesterday's post were added to the $25,000 Portfolio along with the USO and that has already given us a quick, additional $400 profit despite the continued decline in our F position.

We expect another down day today, of course – at least until the 30-year note auction is over at 1pm and then, maybe, we'll get some more QE talk when Fed Governor Williams speaks at 3:40 so these positions are subject to being cashed in as soon as this afternoon – we expect oil to sell off pretty hard after the 10:30 natural gas inventory report.

One trade I want to add to both of our $25KPs (Agressive and non) is SVU. That stock just dropped to $2.80 this morning on some pretty bad news and we're already long on it in several long-term hedged positions from the last time they dipped but today we can pick up the Oct $4 calls for .25 so we're going to add 20 of those ($500) to both of our $25KPs on the possibility there will be a buy-out rumor and, in our $25KPA (above) we can offset that with the sale of 4 Jan $4 puts at $1.65 ($660) so we end up with a $160 credit towards buying 400 shares of SVU for $4 ($1,600) in our worst case and our best case is we get a free ride up on SVU.

As I said back in June when we had the big crash: If you're not going to buy when stocks are low – when are you going to buy?