Mmmmmmm, these charts are looking good!

Mmmmmmm, these charts are looking good!

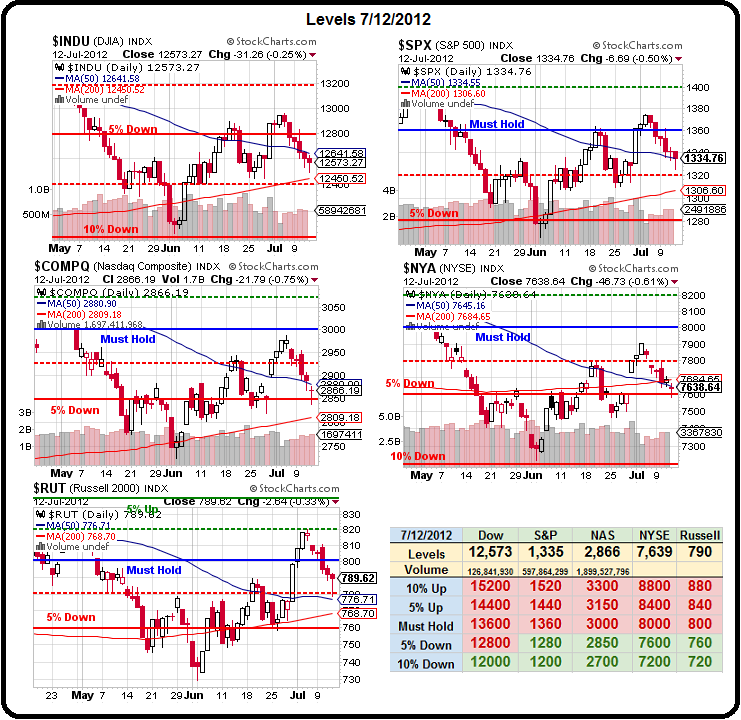

Well, good for those of us who played for those "M" patterns to form last week, anyway. As I said on Monday, when we predicted the exact patten you can clearly see forming on the Big Chart, we had flipped bearish right at the tippy-top last Tuesday, ahead of the July 4th break, because the run-up seemed fake, Fake, FAKE – just more low-volume, manipulated BS on bad news that lead to the anticipation of more QE.

As we expected, this week we got more bad news and still no QE – how could we possibly go up on that?

I also mentioned on Monday that we had taken some bearish plays for this week that were highlighted in Stock World Weekly (page one, in fact), including the SQQQ July $47s, which opened Monday at $1.85, dropped to $1.55 that day and as low as $1.10 on Tuesday but finished the day yesterday at $4.10 after topping out at $5.25 – up 126% from Monday's open.

The more conservative AMZN Oct $185 puts finished the day at $5.10 yesterday and that's up 34% in 5 days in a market that's down 5% – this is a good way to offset bullish bets, isn't it?

The third trade featured on Stock World Weekly's first page (you can subscribe by clicking here), which I also reiterated in Monday's post, was EDZ, which jumped from $14 to $16.21 this week (up 15.7%) and our more aggressive option play on that was the Aug $14/18 bull call spread at $1.20, selling the Aug $14 puts for $1 for net .,20 on the $4 spread. As of yesterday's close, the Aug $14 puts had dropped to .50 and the bull spread had jumped to $1.60 for net $1.10, up .90 on the .20 cash investment for a 450% gain in a week. That too, can offset quite a bit of a 5% drop in the market without committing very much of your portfolio's cash to a hedge.

That's why we can look at this very ugly chart and say "wheeeeee" – it's fun to have hedges!

That's why we can look at this very ugly chart and say "wheeeeee" – it's fun to have hedges!

We talked all about the "M" patterns and our expectations for the indices on Tuesday and on Wednesday I said we have to wait until the end of next week to see if those 200 dmas hold up but it's possible we'll get that test faster than we expected as 3 of our 5 major indexes have already failed, with only the Dow and the Russell above the line – for now.

We took a bullish poke at SVU (now $2.70) yesterday but that was playing for the over-reaction to their troubles and ABX got cheap enough ($34.50) to dip our toes back into gold but we still like those EDZ hedges (they can still go from $1.10 to $4) to help us sleep over the weekend and, if the Russell can't take back 800 today, a TZA (now $18.50) play could also be a big payer next week.

As you can see from David Fry's SPY chart, we're at a very critical test for the S&P and, after 6 straight days of decline, we certainly expect at least a bounce this morning – anything else would be catastrophic as we're so close to failing our levels on the S&P and the Russell.

JPM's earnings were not as bad as the doom and gloom crowd would have us believe so now it's up to the other Financials in the weeks ahead to prove US Banking isn't the same mess that Europe is. We were long on JPM from the drop and haven't changed our mind about them or our general bullishness on XLF (now $14.50) and, of course, China's GDP came in at 7.6%, down from 8.1% and EXACTLY as we expected yesterday when I said to our Members:

China/Danny – I think their GDP will be whatever they want it to be. Perhaps a hair under 8% to excuse a bit more stimulus without sounding alarming. In reality, the evidience points to a pretty sharp slowdown in China and the longer they keep faking it, the more drastic the correction will be.

So, while we can enjoy a little pop this morning, we'll be lookiing to add some shorts into the weekend – just in case reality happens to stop by and, of course, Cash remains King in this silly market.

Have a great weekend,

– Phil