To QE or not to QE – that is the question.

To QE or not to QE – that is the question.

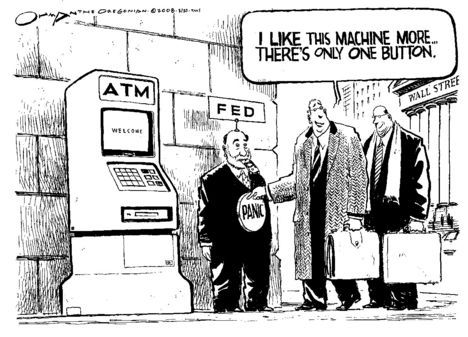

We had a lovely rumor-based rally on Friday as anticipation swells ahead of Bernanke's report to Congress this week. Although the Fed Chairman has said no, non, nyet, nein, etc. in every possible language for months now – as David Fry notes, the "Bad News Bulls" continue to interpret each new bit of negative information as another reason to expect MORE FREE MONEY to rain down from the Fed.

Even at PSW, our sole bulish premise of the last few months has been an expectation of additional bailouts but, so far, they haven't come – so we have gone back to being cashy and cautious in our long-term positions while remaining more bullish over the long-run, where the G20 MUST step in and pump up the economy.

As Dave Fry points out:

As Dave Fry points out:

In the U.S. QE and ZIRP has boosted stock prices ephemerally but has done little to lift employment or the economy. So, does doing the same thing over and over again without success make sense? It does for short-term trading desk and hedge fund profits—that’s all you really need to know. You’ll recall yesterday the NY Fed issued a report stating plainly the result of their recent policies is why the S&P is at 1300 vs 600 where it would be without this help. (By the way, Jamie Dimon is a director of the NY Fed.).

Stocks (led by banks KBE & etc), commodities, and even the euro were strong as this out of the blue rally demonstrates. It’s hard to short when the Fed is hovering above and dangling more hints of QE-crack for the permabulls and HFTs. The only sector to experience some downside was bonds (IEF). Pick any other sector and it was only question of how much they rallied. Most pundits groped for details to explain the rally with comments like: “The confidence number was off some but still way off the bottom” and “…you eventually have to put some money to work” and “…some will point to China as providing more stimulus” and Warren Buffett has been trotted out to the media two days in row talking his book. And, so it goes. This day was reminiscent of the other out of the blue quarter end rally in June.

In Stock World Weekly, we summarized the situation by saying: "Overall, it was a riotous week in the markets ended about flat and righ at resistance. Bad news from China (weakest Q2 GDP since Q1 '09, imports 1/2 of expectations in June), Australia (job losses), Japan (machinery orders off 15%) and at home in America (small business optimism becomes an oxymoron, consumer confidence at 7-month lows, refinances hit 6-month low) have all been taken as signs that QE3 MUST be just around the corner because, after all – how much worse could things get?"

In Stock World Weekly, we summarized the situation by saying: "Overall, it was a riotous week in the markets ended about flat and righ at resistance. Bad news from China (weakest Q2 GDP since Q1 '09, imports 1/2 of expectations in June), Australia (job losses), Japan (machinery orders off 15%) and at home in America (small business optimism becomes an oxymoron, consumer confidence at 7-month lows, refinances hit 6-month low) have all been taken as signs that QE3 MUST be just around the corner because, after all – how much worse could things get?"

Cre PPI, however, remains red-hot at 2.6% year over year – 30% over what many consider the Fed's inflation target of 2%. Our own trade deficit fell $2Bn as exports from the US hit their second highers level EVER and mortgage rates fell to new record lows of 3.3% while the notes we sold ($120Bn last week) had record demand and sold at record low rates.

What is it that we expect the Fed to want to accomplish with more QE? In effect, they have done everything they have set out to do and, in fact, have made the US economy "too hot" and spurred some inflation.

The Fed has upped their balance sheet north of $3 TRILLION Dollars after their first two rounds of Quantitative Easing by creating money to purchase distressed assets from their troubled Member Banks (pretty much all of them) in what will one day be revealed as the World's largest Ponzi scheme when it finally unravels (see David Wessel's In Fed We Trust).

The Fed has upped their balance sheet north of $3 TRILLION Dollars after their first two rounds of Quantitative Easing by creating money to purchase distressed assets from their troubled Member Banks (pretty much all of them) in what will one day be revealed as the World's largest Ponzi scheme when it finally unravels (see David Wessel's In Fed We Trust).

Operation Twist has been a sort of QE 2.5 and have driven down long-term rates but have done nothing to spur demand as broke people can't afford the same home at 4% that they couldn't afford at 6% and, while it may be tempting to throw another $1Tn into an experiment, they are not likely to begin buying at 3% either.

Bernanke is BEGGING Congress to do something and will do so again next week and the anticipation of Bernanke's "Humphrey Hawkins" testimony next week has been giving the bulls something to hang their hats on. Unfortunately, the odds of Congress actually doing anything before the next election are extremely close to zero so we take the last day bounce in the markets with a Lot's wife-sized grain of salt and we remain "Cashy and Cautious" in our short-term trading.

Bernanke is BEGGING Congress to do something and will do so again next week and the anticipation of Bernanke's "Humphrey Hawkins" testimony next week has been giving the bulls something to hang their hats on. Unfortunately, the odds of Congress actually doing anything before the next election are extremely close to zero so we take the last day bounce in the markets with a Lot's wife-sized grain of salt and we remain "Cashy and Cautious" in our short-term trading.

Last week, we had poor Consumer Sentiment numbers (again) and this morning Retail Sales are off 0.5%, much worse than up 0.2% expected by economists (a 350% miss, actually) and ex-Autos the miss by Economorons was 500% at -0.4% vs. +0.1% expected.

More QE is not the answer. Bernanke is right and will be right again this week as he pushes Congress to use their own power to stimulate the economy. Unfortunately, the only sector of the economy that Congress is interested in stimulating at the moment is Campaign Advertising and, of course, PR Attack Ads against each other.

At least the polls show Romney slipping fast with Forbes Real Clear Politics now putting Obama up by 2.4% while Intrade, who has done a better job of calling elections recently than any pollsters – has Obama leading 55.7% to 41.5%. Not even Florida is dumb enough to fall for Romney's BS. Americans are HURTING, they see the World is HURTING and telling them that things will be fine as long as we give tax breaks to the people who aren't hiring them is no longer a working strategy.

At least the polls show Romney slipping fast with Forbes Real Clear Politics now putting Obama up by 2.4% while Intrade, who has done a better job of calling elections recently than any pollsters – has Obama leading 55.7% to 41.5%. Not even Florida is dumb enough to fall for Romney's BS. Americans are HURTING, they see the World is HURTING and telling them that things will be fine as long as we give tax breaks to the people who aren't hiring them is no longer a working strategy.

The Fed and the GOP Congresspeople who will spout off this week all need to get the message – it's the JOBS, you morons! You can't rebuild an economy when 20% of your workforce is unemployed or under-employed. Continuing to give tax breaks to the rich is nothing more than looting the Treasury while Rome is burning and I know the original plan was that our Multi-Nationals and their top 1% owners would all relocate to China and exploit them for 20 years but that plan is failing along with China's economy so it's time to come home and put a little effort into tending this garden or the top 1% will end up starving along with those they exploit.

No consumer spending equals no income. Why does the GOP not get this?

Congrats to all of those who participated in our own effort to stay out of the bottom 99% as SVU catches a GS upgrade this morning and pops 6% with a GS target of $3 (after closing Friday at $2.32). $3 is the new target for our hedged positions.

Speaking of GS – it seems the British Parliament is finally getting around to looking at how GS and their fellow Banksters control the oil markets and manipulate the same way they do LIBOR. After years of trying to get the attention of our own do-nothing Congress, it's good to see a little action from across the pond and I would urge all of our British readers to send their MP's a copy of "Goldman's Global Oil Scam Passes the 50 Madoff Mark," and let them know I will be happy to fly out there and testify.

Speaking of GS – it seems the British Parliament is finally getting around to looking at how GS and their fellow Banksters control the oil markets and manipulate the same way they do LIBOR. After years of trying to get the attention of our own do-nothing Congress, it's good to see a little action from across the pond and I would urge all of our British readers to send their MP's a copy of "Goldman's Global Oil Scam Passes the 50 Madoff Mark," and let them know I will be happy to fly out there and testify.

Perhaps we can get Lloyd Blanfien to explain why Goldman Sachs is now the largest supplier of crude to Alon in California and why they are also their largest buyer of refined products? JPM this month agreed to supply crude to, and purchase fuels from, the biggest refinery on the US east coast as the refinery was sold to a joint venture of Carlyle Group and former owner Sunoco.

Morgan Stanley and JPMorgan are also lobbying regulators to carve out “forward” commodity contracts for future delivery of stock from the so-called “Volcker rule”, which bans banks from proprietary trading. In a letter in February, Morgan Stanley warned that restricting banks’ ability to compete in commodities would force customers to turn to “trading houses, energy merchant companies, oil companies with trading desks, or other types of traders”.

Seriously America – are we just going to sit back and let this happen too?