Our long nightmare (3 days) of uncertainty are over and now we are certain we may have some more QE some time in the future if certain things happen. Don't you feel better? The markets sure do, with Europe and the US Futures completely reversing yesterday's losses (see Dave Fry's chart). I had said yesterday that, if we were not down 2% at the end of the Day, it would be a surprising show of strength and we never went lower than 1.5% on our indices and finished the day down less than 1% – proving once again that some of the people CAN be fooled all of the time. My comment yesterday was:

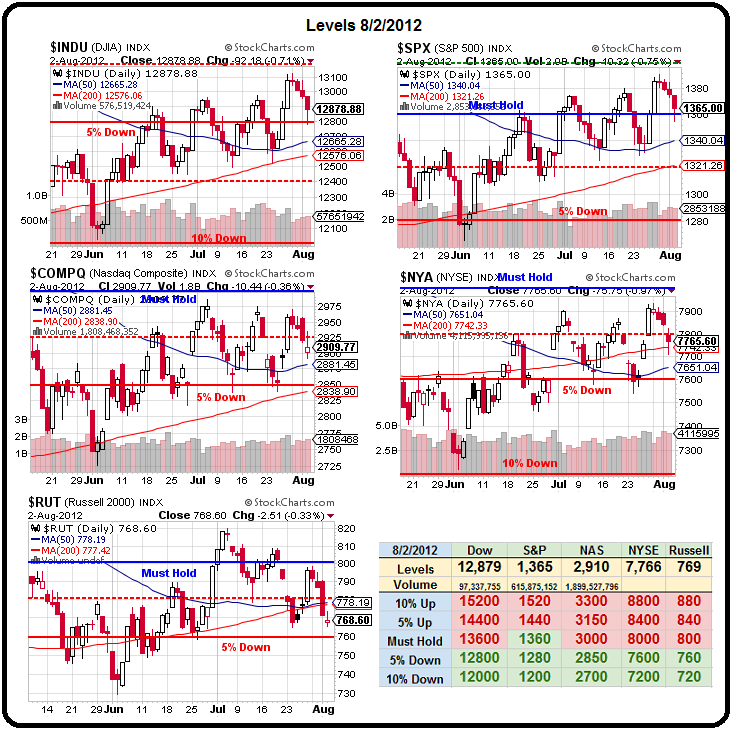

With a 200-point dump in the Dow Futures to 12,800 (12,850 in the regular index), we'll be looking for a bounce to 12,840 as "weak" and 12,880 as "strong" but we're not impressed at all until we're back over 12,900 (50% retrace), which should be 12,950 in the regular session. Without doing all the math, that will be 1,370 on the S&P, 2,900 on the Nasdaq, 7,800 on the NYSE and 770 on the Russell. I don't think we'll be making those but you never know what those crazy Trade Bots will do once they turn the markets on.

Since the market IS controlled by robots (something Knight Capital did a good job of highlighting this week), it should come as no surprise to you that our indexes finished at Dow 12,878 (off by 2), S&P 1,365 (off by 5), Nasdaq 2,909 (9 over), NYSE 7,765 (35 off) and Russell 765 (down 5) – that's a pretty good call for 8:30 am yesterday!

Since the market IS controlled by robots (something Knight Capital did a good job of highlighting this week), it should come as no surprise to you that our indexes finished at Dow 12,878 (off by 2), S&P 1,365 (off by 5), Nasdaq 2,909 (9 over), NYSE 7,765 (35 off) and Russell 765 (down 5) – that's a pretty good call for 8:30 am yesterday!

As we discussed in Member Chat the other day, the moves made by our indexes between our 5% lines don't matter – all we're doing here is messing about within our ranges so far – wake us up when we break one way or another. In order for us to get more bullish, we'll need to see those "Must Hold" levels turn green – and that's Dow 13,600, Nasdaq 3,000, NYSE 8,000 and Russell 800 to join the S&P, which is over it's 1,360 goal but has been alone there since May other than brief flirtation by the Russell over 800 in early July.

We pointed out yesterday that small business is really taking it on the chin as Big Business presses their advantages in a rough economy and puts a lot of pressure on their profits. The net effect of this can clearly be seen by the way the Russell chart is deteriorating compared to our other majors. At the moment, they are the only index in a real downtrend, which puts a lot of pressure on them to break back over 780 to confirm a rally or the Russell will become an anchor that drags down the rest of the market.

Don't forget that it's the Big Boys who report in the first half or earnings season but, now that we're heading into August – it's all about the small caps – no more market-moving pops on big beats – just good old-fashioned earnings next week with DIS a notable exception on Tuesday.

We finished our day with an aggressively bullish call on FAS, selling the weekly $85 puts for $1.40 in a a couple of our portfolios, which was right at $85 at the time – those are looking good to expire worthless for nice 100% gains in 24-hours. In general, we took or bearish money and ran by noon (as planned) and took a couple of bullish pokes but our heart wasn't in it because the Fundamental picture is really not that good.

Despite very good jobs numbers today (Payroll up 163,000 – if you're not picky about how they got the number), the bottom line is Global PMI is down 6%. That's 6% on a $60Tn Global Economy, which could indicate a $3.6Tn drop in overall GDP and that means $3.6Tn less available for Corporate Revenues (not a direct relationship) and we are seeing that in strings of revenue misses this quarter. Profits are holding up because most companies are still in cost-cutting mode and, of course, massive share buy-backs reduce the number of shares and make profits per share seem higher – even when actual profits are not. Barry Ritholtz makes a good point on the Non-Farm Payrolls:

Despite very good jobs numbers today (Payroll up 163,000 – if you're not picky about how they got the number), the bottom line is Global PMI is down 6%. That's 6% on a $60Tn Global Economy, which could indicate a $3.6Tn drop in overall GDP and that means $3.6Tn less available for Corporate Revenues (not a direct relationship) and we are seeing that in strings of revenue misses this quarter. Profits are holding up because most companies are still in cost-cutting mode and, of course, massive share buy-backs reduce the number of shares and make profits per share seem higher – even when actual profits are not. Barry Ritholtz makes a good point on the Non-Farm Payrolls:

To put this into context, the total Labor Pool is about ~150 million people. Each month, some ~4 million folks leave their job, and another ~4 million people start new jobs. The net difference between the people leaving and people coming into the new jobs is the monthly NFP.

So the ENTIRE 163,000 jobs added represents just 2% of the 8M jobs that roll over for the month and 0.1% of the Labor Pool itself. The survey has a 4% margin of error – as evidenced by the DOWNWARD adjustment to last month to 64,000 from 80,000 reported (20%) – so let's not get too excited by a 2% gain just yet. In fact, the actual Labor Force Participation rate declined 0.1% to 63.7% and the Employment to Population ratio fell 0.2% to 58.4% so there are, in fact, less people working – we just don't consider them unemployed anymore – aren't statistics great?

That certainly didn't stop the Futures from making new highs on the news with AAPL popping to $612 (up 1%) and goosing the Nasdaq 35 points over the critical 2,560 line in the Futures (/NQ), the S&P is right behind at 1,377 – up 15 points from yesterday's close – all this is based on the premise that each new worker runs out and buys a new IPhone with their first paycheck, of course. This is why they want to put AAPL in the Dow – the poor Dow is only up 1% so far but it looks like oil (/CL) will make another run at $90 (now $88.50, up from $87.50) and that gooses the Dow via XOM and CVX, who can add a quick 50 points to the Dow's open by themselves.

That certainly didn't stop the Futures from making new highs on the news with AAPL popping to $612 (up 1%) and goosing the Nasdaq 35 points over the critical 2,560 line in the Futures (/NQ), the S&P is right behind at 1,377 – up 15 points from yesterday's close – all this is based on the premise that each new worker runs out and buys a new IPhone with their first paycheck, of course. This is why they want to put AAPL in the Dow – the poor Dow is only up 1% so far but it looks like oil (/CL) will make another run at $90 (now $88.50, up from $87.50) and that gooses the Dow via XOM and CVX, who can add a quick 50 points to the Dow's open by themselves.

I wish I had some good news to back up this rally, but I don't – it's complete nonsense. It's a good chance to get back into the same shorts we cashed in yesterday and nothing more. There's no $3.6Tn worth of stimulus coming – especially with jobs looking good, which keeps our Fed from acting. They didn't feel it was necessary to do anything about 80,000 jobs (now 64,000) last month – why on Earth would they change their stance when we have 163,000 added this month?

Mohamed El-Erian called recent declines in purchasing manager indexes in Europe and Asia “frightening” and said the world economy is suffering its severest slowdown since the global recession ended in 2009. Pimco predicts global growth of 2.25 percent over the next 12 months. That’s down from the 3.9 percent in 2011 and 5.3 percent in 2010 recorded by the IMF. The world economy contracted 0.6 percent in 2009. “This is a serious, synchronized slowdown,” El-Erian said in an interview today. The global slowdown is weighing on the U.S. at a time when its economy is already struggling, El-Erian said. He sees U.S. growth of 1.5 percent over the next 12 months, dangerously close to what may be considered “stall speed,” and puts the odds of an American recession at roughly 25 to 33 percent. “While a recession is not my baseline forecast, it certainly is a serious risk,” said El-Erian, whose firm manages the world’s largest bond fund. No wonder the market is racing off to new highs, right?

Corn is now up 60% and is a much bigger danger to the Global Economy than the Euro is, according to Bloomberg. Rising food prices limit how much central bankers can cut interest rates to safeguard growth. More troubling would be the potential setback to poverty-reduction programs for decades to come. The last food crisis began amid the 2008-2009 crash of the U.S. economy. In the second half of 2010 alone, according to the World Bank, some 44 million people were pushed back below the extreme poverty line, defined as those living on $1.25 a day or less. Asia is home to the bulk of those who spend between 60 percent and 80 percent of their paltry incomes on food.

This morning, we are ignoring and soaring – hopefully we'll test those Must Hold Levels again as they give us a good stop line for making aggressively bearish bets (if the rally is real – they should not provide much resistance, right?) – stay tuned in Member Chat for all the fun!

Have a great weekend,

– Phil