Here we go again!

Here we go again!

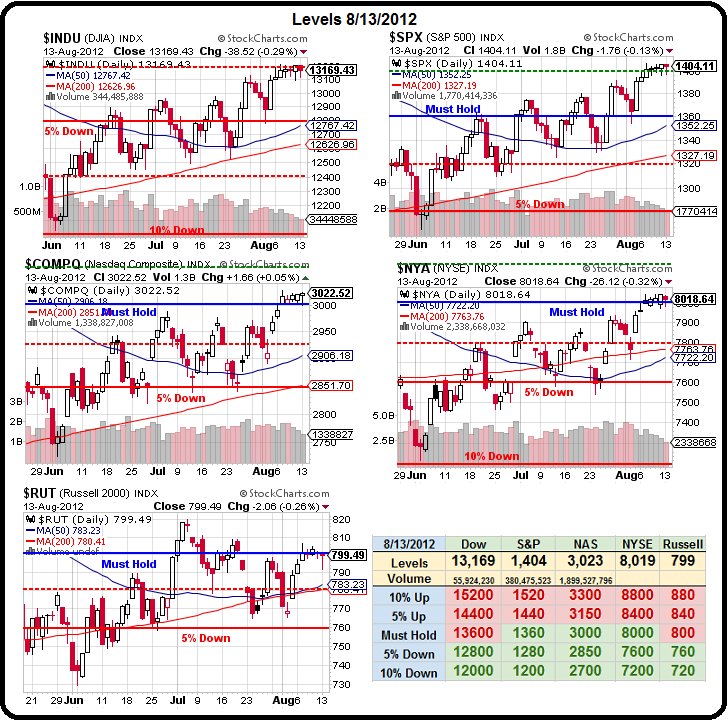

Last Tuesday we also had a big run-up in the Futures and I was skeptical, writing "Through the Roof or Smashed into a Thousand Pieces." Two stocks we did like that morning were SBUX and ABX – and both did quite well this past week but we have generally turned more bearish since then as we languish along the top of our range (see Big Chart).

Yesterday, we adjusted our breakout levels to account for the weaker Dollar to Dow 13,464, S&P 1,428, Nasdaq 3,060, NYSE 8,160 and Russell 816. If we do manage to break over 3 of these 5 lines and hold them for a day – it will be time to switch off our brains and run with the bulls. Since we are currently about 2/3 bearish – that means we'll need a few aggressive upside hedges to protect our bear positions – from Central Banksters printing money or MSM pundits promising the same….

Making money in a bull market is pretty easy. My top trade remains FAS, which is a 3x bullish tracking index of XLF. We are already long Financials in our FAS Money Portfolio but, as a new trade, you can play XLF to move up to $16.50 (up 10%), which should roughly give us a 30% increase in FAS (now $93) to $120 and that means that the Oct $105/115 bull call spread at $2 could return 500% at $10. That's a nice, simple trade with no margin requirement too.

If you do have spare margin, you can sell any put from our Twice in a Lifetime list (mentioned in yesterday's post). One trade idea we added more recently was selling BBY 2014 $18 puts for $3.25, which is a net $14.75 entry on BBY (now $19.50) and what we really like about selling BBY is that buy-out offer on the table – if that goes through and it's over $15 (supposedly $25), then the short puts cancel like an early Christmas gift. You can apply that cash to 1x or 2x the bull spread – if you buy 2x the spreads for $4 and sell 1x the puts for $3.25, then you are in $20 worth of FAS bullish spreads for net .75 with a 2,566% potential upside to the cash (there is about $5 of margin on the short puts).

Another put I like selling is SHLD, who Barron's says can double to $100 a share. We don't care if it doubles, we'll be happy if it just holds $32.50 (now $54.36) and we can keep $8 for selling the 2014 $32.50 puts (yes, really!) for a net entry at $24.50, less than 1/2 the current price. I like that one so much, we're going to add 10 short puts to our virtual Income Portfolio and "risk" owning 1,000 shares for net $24,500 while collecting $8,000 up front.

OK, so we have one trade that can make 2,566% if XLF takes off (pretty much a given if we actually get more QE). Where else can we apply some leverage? How about Japan? I've mentioned EWJ before (last week, in fact), and the Sept $9 calls are up slightly (22%, on track for our predicted 100% gain in 38 more days) at .33 for the week but, for a QE/Stimulus/Irrational Exuberance trade – we want to go a bit further out. The Jan $9 calls are .53 and we can sell on short BBY 2014 $18 put for $3.25, buy 6 of the EWJ Jan $9 calls for $3.18 and still have a net entry on BBY at just $17.93, which is 8% lower than the current price (which is 25% below the offer that's hanging out there). If the Nikkei ETF makes it back to this year's high of $10.67 (last winter it was $11.28), then 6 of those calls will be worth $10.02, which is a pretty nice gain off an initial 0.07 net credit.

I know you probably want a gold trade but I won't do that. Gold is total BS at $1,600. Silver at $28 – maybe, copper at $3.35 I wouldn't mind owning for 10 years but not gold, thank you. I looked at FCX but it doesn't give a good pop and it can really get trashed in a sell-off so, for our last bullish trade idea (oh, that sounds ominous!) – how about a simple index play?

I know you probably want a gold trade but I won't do that. Gold is total BS at $1,600. Silver at $28 – maybe, copper at $3.35 I wouldn't mind owning for 10 years but not gold, thank you. I looked at FCX but it doesn't give a good pop and it can really get trashed in a sell-off so, for our last bullish trade idea (oh, that sounds ominous!) – how about a simple index play?

The Russell (see Dave Fry's IWM chart) topped out at 860 last year and that's 7.5% higher than it is now and TNA is a 3x Ultra-ETF for the Russell at $53.50. 3 x 7.5% is 22.5% and 122.5% x $53.50 is $65 so that's our target for a bull run.

Now we find a time-frame and, if we aren't rallying by October I would be in cash anyway so let's say the Oct $55/61 bull call spread at $2.50 is a nice, potential 140% gainer on it's own and, aside from the above offsetting bullish plays, we can bet that TNA doesn't fall below $42 (a 21.5% drop so RUT 745ish) and sell the Oct $42 puts for $1.90 and then we have a net .60 cost on the $6 spread and that's a lovely 900% upside potential if the Russell climbs 7.5% back to 860 – obviously, if we don't get QE and the Russell fails to hold 790 – it's going to be prudent to cut our losses there!

Does this mean I'm flipping bullish? Noooooooooo, not at all. SHOW ME THE LEVELS – and then we can talk. But, we had a big recovery yesterday and, although I still think it's BS – it's BS that's working for a whole week now so, as I said, we have to prepare to STOP THINKING and get more bullish. Stop thinking about the drought, stop thinking about Unemployment, Housing, Iran, Gas Prices, Inflation, the Deficit, China slowing Down, the Euro breaking apart, etc. This is the "wall of worry" the bulls say the market climbs and, gosh darn it, they were right in 2008 weren't they – we ignored a lot of the same things for months and months – until we didn't.

But that's what our levels are for. Once we are over them, they also tell us when to turn our brains back on and go short again but, until we break back under 3 of 5 (and we raise our stops along the way, of course) we can have lots of fun running with the bulls.

Until we make our levels – these are just hedges for our bearish positions. This morning we got a cumulative -0.2% GDP out of Europe and that's following a 0% print in Q1. It takes two consecutive negative quarters to be officially considered a Recession so, please, let's not it a recession yet. Although Germany held Europe up with a 0.3% GDP, that too was down from 0.5% in Q1 but the forward-looking ZEW Indicator fell from a terrible -19.6 in July to a HORRIBLE -23.5 in August for the fourth consecutive monthly decline. Current conditions also fell 10% to 18.2 for July and, if I understand this quarter thing correctly, July is a month in Q3 and August is a month is Q3 and July is worse than June and August (in progress) is expected to be worse than July so I'm going to go out on a pretty sturdy limb here and say – RECESSION!!!

And a Recession is, of course, TERRIBLE, which means, of course, it must be GREAT NEWS for the market since it brings on the QE Fairy. So – if we're going to be investing against this data – we all need to practice saying "I do believe in fairies, I do, I do!" It looks like Germany's top 1% may get a visit from the tax fairy as opposition leaders (who may become majority leaders soon if conditions deteriorate further) are calling for a 1% annual tax on ALL wealth and assets over $2.5M. That's right, if you have $100M in assets, they want $1M – each year (well, just $990,000 next year if you only have the $99M left..). This proposal is expected to raise an additional $14.25Bn a year as a tax on $1.4 Trillion in wealth from the top – now THAT's trickling down!

Of course that's nothing compared to the 10% one-time tax proposed on all wealth exceeding $310,00, which would raise a cool $285Bn, or 9% of GDP. Now, put yourself in a top 10% German's position and see how generous you feel about funding Greek, Spanish and Italian debt while you're figuring out which car to sell so you can send the Government and extra $30,000 this year!

Of course that's nothing compared to the 10% one-time tax proposed on all wealth exceeding $310,00, which would raise a cool $285Bn, or 9% of GDP. Now, put yourself in a top 10% German's position and see how generous you feel about funding Greek, Spanish and Italian debt while you're figuring out which car to sell so you can send the Government and extra $30,000 this year!

What's great about the US is – we don't have to do any of that stuff. In fact, with the Romney Tax Plan, everyone earning over $200,000 gets a tax CUT and the suckers who earn less than $200,000 (no one we know) pay 1.2% MORE to cover it. What could be simpler than that? What sense does it make for our top 10% to pay $1.44Tn in additional taxes to balance the budget when we can have the bottom 90% pay it, not balance the budget and just give it to us? Now THAT's a plan we can all get behind, right? You silly Europeans do everything backwards!

Our plan in Member Chat this morning was to short the Russell Futures at 802.50 (/TF) and the Nasdaq at 2,732.50 (/NQ) and this opening pop should give us both. Oil is almost at $94 and that's our normal shorting target (/CL) so it's going to be a very interesting morning as we press those bear bets right into the top of the range but today we plan to remember to go long at the EU close (11:30) as that's been a pretty reliable bottom each day.