I found this chart interesting from the Economist:

I found this chart interesting from the Economist:

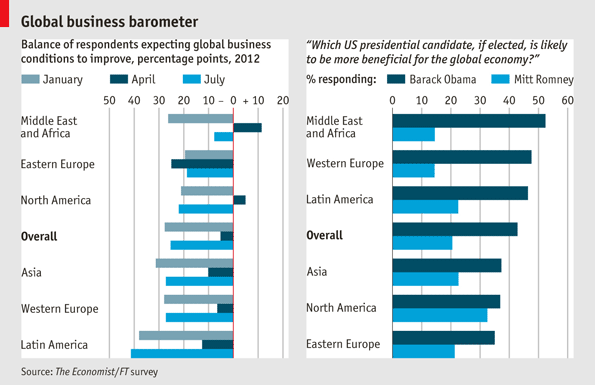

It shows, pretty CLEARLY that GLOBAL business sentiment has worsened sharply, according to the latest Economist/FT survey of over 1,500 senior executives. The balance of respondents who think the world economy will improve over those who think it will worsen fell from minus 5 percentage points in April to minus 25 in July.

Overall, 42% of executives now reckon business conditions will worsen. Most predicted, unsurprisingly, that Europe's biggest problem will be economic uncertainty. More than 60% believe economic conditions in the euro area will get worse in the next six months. The outlook for North America is more optimistic, though with a presidential election in November that could change. Barack Obama leads Mitt Romney in every region, and by 22 percentage points overall, on the question of which candidate would be better for the world economy. An Obama presidency is also considered better for business, with strongest support coming from those in government, education and health care, pharmaceuticals and biotechnology.

I did a lot of reading this weekend – looking for something to get bullish about but, other than the expectation of more stimulus (BECAUSE things are so bad) – I just can't find it. Even if we were to get enthusiastic about some sort of additional ECB stimulus AND QE3 – is that going to be enough to take us past America's fiscal cliff in 135 days or is 135 days just so far in the future that people simply are not going to worry about it? Clearly 135 days can seem like an eternity in a market where the average stock is held for 22 seconds.

I did a lot of reading this weekend – looking for something to get bullish about but, other than the expectation of more stimulus (BECAUSE things are so bad) – I just can't find it. Even if we were to get enthusiastic about some sort of additional ECB stimulus AND QE3 – is that going to be enough to take us past America's fiscal cliff in 135 days or is 135 days just so far in the future that people simply are not going to worry about it? Clearly 135 days can seem like an eternity in a market where the average stock is held for 22 seconds.

As you can see from Dave Fry's SPY chart, the volume has simply gone away in this rally and Barry Ritholtz wrote an article in the WaPo this weekend asking "Where has the Mom and Pop Retail Investor Gone?" When you consider that about 90% of the volume we do see is nothing more than HFT systems trading with each other (hence the 22 second average hold), then we may well wonder where the institutional investor is as well.

While $8.87Tn is on deposit in US banks, only $7.11Tn is on loan. That gap of $1.77Tn represents a 15% expansion since May. The only thing banks are doing with their money (which they get at 0.25% from the Fed and not much more from depositors) is buying TBills and the Banksters bought $136.4Bn of them THIS YEAR, more than double the $62.6Bn they bought in all of 2011. When you wonder what idiots are buying US debt at these ridiculously low prices – just go down and say hello to your local bank manager. “Bank deposits continue to explode and in turn they continue to buy Treasuries as the economy loses momentum, inflation is trending down, Europe continues to hang over our heads and political uncertainty reigns” said Michael Mata, a money manager in Atlanta.

And of course people are plowing money into the banks, despite the abysmal returns – you have one party telling you that we need to raise taxes to cover SS and Medicare or they will fail and another party that wants to simply stop funding the programs to save money – either way, the Middle Class is screwed and the Democrats are too scared to clearly articulate a plan that truly targets tax increases on the top 1% people AND CORPORATIONS because, although it would easily rebalance the budget without further devastating the Middle Class – it might cut down on campaign contributions.

And of course people are plowing money into the banks, despite the abysmal returns – you have one party telling you that we need to raise taxes to cover SS and Medicare or they will fail and another party that wants to simply stop funding the programs to save money – either way, the Middle Class is screwed and the Democrats are too scared to clearly articulate a plan that truly targets tax increases on the top 1% people AND CORPORATIONS because, although it would easily rebalance the budget without further devastating the Middle Class – it might cut down on campaign contributions.

So Americans in general are cutting back their personal debt from an average of 150% of personal income in 2008 to about 125% this year while credit limits have dropped from 210% to 175% (one of the reasons we like shorting MA and V at these levels). Despite the unwillingness of our Government to admit we're in a Global Recession – the people are moving towards a Depression mentality and we may be changing an entire generation's attitude towards borrowing (bad) and investing in the stock market (also bad).

This useful chart by Shadow Trader shows money pouring out of most equities since April (as the above sentiment turned worse) and it's easy to understand why defensive Telco and Utilities have held up – that's normal but Tech has been the risk asset of choice so far while CLEARLY, money has been flying out of other sectors.

This useful chart by Shadow Trader shows money pouring out of most equities since April (as the above sentiment turned worse) and it's easy to understand why defensive Telco and Utilities have held up – that's normal but Tech has been the risk asset of choice so far while CLEARLY, money has been flying out of other sectors.

What then, is holding up the market other than smoke and mirrors?

Again, we can go back to our usual car-lot model where we have 100 identical VW Beetles and we bought them for $20,000 and we're selling them for $25,000 – hoping to make a $500,000 profit. If we sell 10 cars for $30,000 to wealthy speculators, who are betting that the Government will begin a stimulus program that will create a huge demand for cars then the chart would indicate that we have 90 cars left that are now worth $30,000 each ($2.7M) – even though we only actually sold 10 for $300,000.

In order to realize that additional $500,000 over time, we have to now assume that 90 more people are willing to buy my cars for $30,000 and even that won't please the speculators, who expect some kind of profit for themselves above $30,000. But what if the reality is that the Mom and Pop retail customers, who weren't even buying VWs for $25K (all speculators) are not even slightly interested at $30,000? Well, one of our speculators may decide to goose demand buy buying another car or two and jacking the price up to $33,000 but will that bring Mom and Pop off the sideline or simply put the prices more out of reach.

In order to realize that additional $500,000 over time, we have to now assume that 90 more people are willing to buy my cars for $30,000 and even that won't please the speculators, who expect some kind of profit for themselves above $30,000. But what if the reality is that the Mom and Pop retail customers, who weren't even buying VWs for $25K (all speculators) are not even slightly interested at $30,000? Well, one of our speculators may decide to goose demand buy buying another car or two and jacking the price up to $33,000 but will that bring Mom and Pop off the sideline or simply put the prices more out of reach.

Surely it may bring in a couple of new idiot speculators (there's on born every minute) and maybe I sell a total of 5 more cars and the last one sells for $35,000. Now my chart looks incredible because I've sold 15 cars and collected about $450,000 and the last car sold for $35,000 so it looks like the market cap of my remaining 85 cars is $2.975M. Isn't that incredible?!? Now all I have to do is get those other 85 people to buy my cars for $35,000, which is 75% more than I paid.

So I wait. And I wait and I wait. On paper I may be way ahead so I may wait longer than I should and hold my asking price at $35,000 but, after a while, the cash flow dries up and I still have my $2M loan to service and my store has no volume as Mom and Pop just drive right past my "VWs for $35,000" sign without even looking. So, I eventually begin to drop my prices until I find buyers and, if my prices fall back below $30,000 – I then may have to compete with my original speculators – who decide to sell before their investment turns sour.

That's the danger of a low-volume rally, 90% of the stock has never been transacted at these prices – it's a speculative illusion based on the expectation of future events that may never come to pass. It's a $60Tn global stock market that's gone up $18Tn since June. Where is this money coming from? If you thought the behavior of the VW speculators was silly – what about the people who are paying top dollar for stocks right now?

That's the danger of a low-volume rally, 90% of the stock has never been transacted at these prices – it's a speculative illusion based on the expectation of future events that may never come to pass. It's a $60Tn global stock market that's gone up $18Tn since June. Where is this money coming from? If you thought the behavior of the VW speculators was silly – what about the people who are paying top dollar for stocks right now?

Sure speculators and Trade-Bots have plenty of money and they can trade the same 10% of the stock back and forth with each other all day long but God help them all if they actually want to sell those inflated shares to someone else because THERE LITERALLY IS NOT ENOUGH MONEY IN THE WORLD TO SUPPORT THESE PRICES.

Over the short-run – sure, any rich fool can be convinced to part with his money and be the proud owner of a $35,000 VW Beetle that retailed for $25,000 in June. It went up to $35,000 in 2 months so surely it will be worth $45,000 by October is the logic of the rich because he also has $45,000 or $55,000 – these are just "entry points" to the top 1% and they tend to forget where money actually comes from. Money comes from the consumers, who are still 70% of our GDP and they simply CAN NOT AFFORD a $45,000 VW or a $35,000 one, for that matter. However, as Keynes used to say: "The market can stay irrational longer than you or I can remain solvent" which means, in the short run – PRICES (not value) can go anywhere.

Over the long run, however, there's just so many VW Beetles a rich guy is going to be willing to keep in his garage gathering dust – especially when the glove compartment is stuffed with AMZN shares he bought for $240!

Be careful out there!