Merkel and Hollande had their big meeting.

Merkel and Hollande had their big meeting.

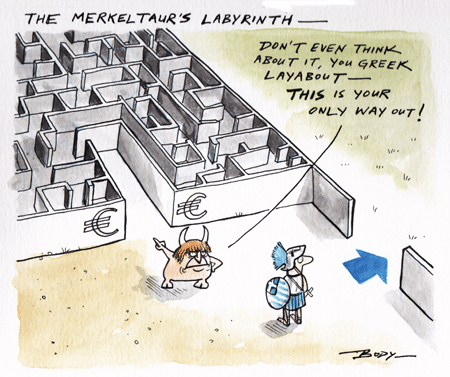

According to Hollande "I want Greece to remain in the eurozone. That's my wish. That's our wish." But he added that "of course Greece must make the necessary efforts for this to happen." That doesn't sound like much of a commitment to me. Merkel wasn't any help, saying: "For me, it's important that we all stand by our commitments, and in particular await the (publication of) the troika report, to then see what the result is, but I will encourage Greece to follow the path of reform, which demands a lot of the Greek people."

SERIOUSLY??? We're right back where we started from. If this is how they are still handling Greece, two years after the fact, do you really think that Spain and Italy will be fixed next month? Greece's continued access to the bailout packages hinges on a favorable report next month from the "troika" of the country's debt inspectors — the European Union, European Central Bank and the International Monetary Fund. If Greece is found to have failed on key economic reforms that are conditions of the bailout loan, vital funds could be halted.

This was not what the EU markets wanted to hear and they are trading off this morning, despite Bill Gross running onto CNBC after the US's pathetic close to assure viewers (and get quotes in ahead of Asia's open) that QE3 is 80% certain. Of course more QE makes the higher-interest bearing notes Gross' $1Tn Funds hold more valuable – so he's far from an objective observer on the subject.

This was not what the EU markets wanted to hear and they are trading off this morning, despite Bill Gross running onto CNBC after the US's pathetic close to assure viewers (and get quotes in ahead of Asia's open) that QE3 is 80% certain. Of course more QE makes the higher-interest bearing notes Gross' $1Tn Funds hold more valuable – so he's far from an objective observer on the subject.

By the way, we were told by the company's PR people that the proper name is not PIMPCO – we apologize for the Freudian slip – especially to America's hard-working pimps, who have never, to the best of our knowledge, callously manipulated the media to misinform the general public in order to personally profit from a financial crisis. Our humblest apologies…

Our hearts also goes out to the once great American Middle Class who, according to the latest report from census data, have suffered a 4.8% decline (adjusted for inflation) in median household income since June of 2009 (you can check where your own income places you right here). That's on top of the 2.6% decline they suffered during the prior 18 months, in the thick of the crash. Household incomes are, in fact, 7.2% below the December 2007 level. According to the report: “Almost every group is worse off than it was three years ago, and some groups had very large declines in income. We’re in an unprecedented period of economic stagnation.”

It should be no surprise then, that mortgage delinquencies are back near record highs, at 10.4% after pulling back from 11.5% in 2009 to 10% last year. For perspective, that's up from an average of less than 2% between 1990 and 1997! Also not surprising is a TERRIBLE Non-Defense Durable Goods number this morning that was NEGATIVE 0.7% on the ex-Transport side vs flat expected.

It should be no surprise then, that mortgage delinquencies are back near record highs, at 10.4% after pulling back from 11.5% in 2009 to 10% last year. For perspective, that's up from an average of less than 2% between 1990 and 1997! Also not surprising is a TERRIBLE Non-Defense Durable Goods number this morning that was NEGATIVE 0.7% on the ex-Transport side vs flat expected.

Even with an 8% rise in Transportation orders thanks to BA beginning to deliver planes, and a 62% jump in Defense Goods, the headline number missed expectations of 3.5%, coming in at 1.6%. The prior ex-Transport number was also revised down from -1.1% to -1.2%. As I asked on Wednesday: "How Many Ways Can We Say Recession?"

Look at the above Durable Goods chart and look at Dave Fry's SPY chart for the last two years – does this make sense? Those Durable Goods numbers are back where they were in the slide of '08 and coming in every bit as steep as we were then yet – as if we've never experienced a downturn before – the market is acting as if we are miles above those levels.

Look at the above Durable Goods chart and look at Dave Fry's SPY chart for the last two years – does this make sense? Those Durable Goods numbers are back where they were in the slide of '08 and coming in every bit as steep as we were then yet – as if we've never experienced a downturn before – the market is acting as if we are miles above those levels.

We DON'T have more people in this country and the people we do have, other than the top 10%, are making 5% less. The Dollars they are earning are also worth less and the Fed printing more money won't make that any better, will it? It doesn't help America to come up with another program to give the top 1% even more money because there's only so many gold-plated toilet seats the Donald can buy in one year and, obviously, it doesn't make up for the 32% drop in Durable Goods orders from the peak – because the average citizen is simply out of money – there's no more to give!

There's no home equity to tap, there are no bonuses at Christmas and no raises and there are no new jobs with better salaries ahead. We are firmly in a decline and the Asterity Nuts in the GOP are ACTUALLY (not a joke) proposing a return to the gold standard in the party's platform. No wonder gold has been flying this week with all the well-connected GOP insiders snapping it up ahead of the convention

GOP spokeswoman, Mary Jo Jacobi (who was Bush's Assistant Secretary of Commerce) said that, in the short term a return to the gold standard would be highly destabilizing, despite it being designed to naturally control government spending. She also conceded that in the short term it may mean more volatility and unemployment, as the central bank wouldn’t be able to vary interest rates in certain situations. Sounds like another winner to me – economic instability, more unemployment and a handcuffed Government – it's the GOP trifecta!

GOP spokeswoman, Mary Jo Jacobi (who was Bush's Assistant Secretary of Commerce) said that, in the short term a return to the gold standard would be highly destabilizing, despite it being designed to naturally control government spending. She also conceded that in the short term it may mean more volatility and unemployment, as the central bank wouldn’t be able to vary interest rates in certain situations. Sounds like another winner to me – economic instability, more unemployment and a handcuffed Government – it's the GOP trifecta!

What lunacy. Click on this link to see what our markets would look like if they had been priced in gold this week. Imagine what would happen if we went on the gold standard!

Is it too late to bring back Herman Cain?

Have a nice weekend,

– Phil